Reflecting market dynamics with a strategic move, a cunning whale recently deposited a significant amount of Bitcoin (BTC) into Binance and caught the right moment as Bitcoin surpassed the $45,000 threshold. This calculated move demonstrates a sharp understanding of market trends and following a masterful strategy to benefit from the right price points.

A Closer Look at the Whale’s Calculated Deposit Transactions

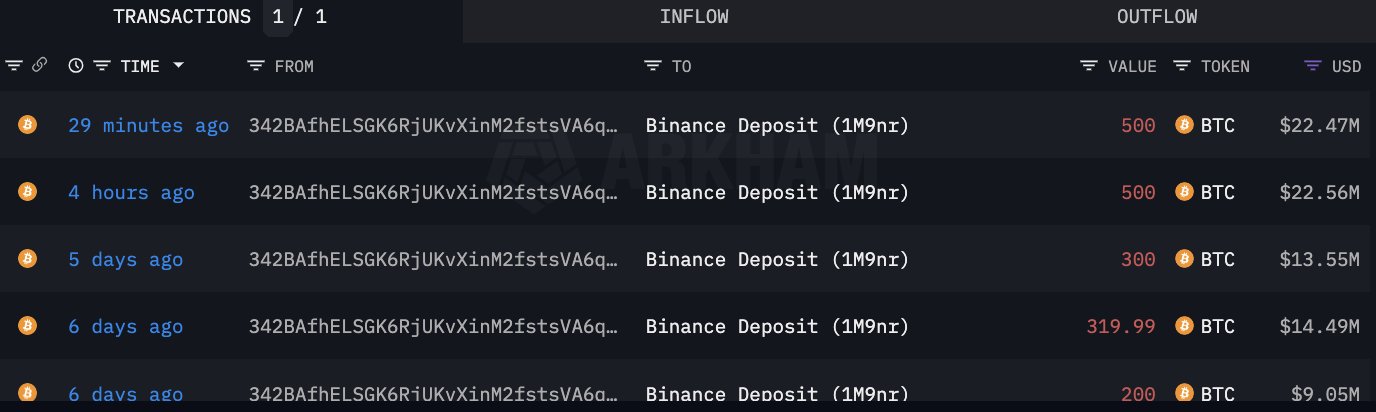

The whale’s recent investment included a significant amount of 1,000 BTC, equivalent to $22.47 million, following Bitcoin’s rise above $45,000. This strategic maneuver showcases the whale’s proactive approach in capitalizing on market movements and optimizing their cryptocurrency portfolio.

In a broader context, the whale’s relationship with Binance extends beyond a single deposit transaction. Over the past two weeks, the whale has orchestrated a series of deposit transactions, accumulating a total of 4,000 BTC worth $178.7 million. The strategic timing of these deposit transactions and benefiting from high prices during each transaction has been noteworthy.

The Whale’s Previous Bitcoin Movements

An analysis of on-chain data provides interesting insights into the whale’s past movements. In June 2022, the whale withdrew 4,000 BTC from HTX and OKX. Notably, these withdrawal transactions were carried out at an average price of around $21,000.

This historical context demonstrates the whale’s foresight in securing Bitcoin at lower values and laying the groundwork for profitable transactions during subsequent deposit and selling phases.

The recent deposit of 1,000 BTC aligns with the whale’s ability to quickly respond to market dynamics, particularly Bitcoin’s rise above $45,000. This timely action reflects a strategy aimed at optimizing gains during bullish phases.

Strategic Accumulation and Insights Over Two Weeks

The cumulative accumulation of 4,000 BTC over a two-week period underscores the whale’s commitment to strategic accumulation. The ability to benefit from high prices during each deposit transaction positions the whale as a selective participant in the cryptocurrency market.

The actions of such strategic players like this whale provide valuable insights for investors navigating the cryptocurrency environment. Understanding the nuances of timing, accumulation, and historical movements can inform investment strategies and risk management practices.