If the current pace continues, the U.S. could announce four-digit additional tariffs on China by the end of the month. Trump has already stated that he plans to impose a 50% additional tax starting April 9. This would mean taxes of around 124% on some items and approximately 104% overall, an unusual situation that the markets may never witness again. What do experts in cryptocurrency say about this scenario?

Where is the Money Going?

Investors are gripped by fear as discussions continue with over 50 countries while Trump seeks to eliminate taxes. Simply removing tariffs may not suffice; he is also demanding the prevention of advantages gained through currency and other factors. During this process, exporters are responding to Trump’s actions, while alternative measures like tax support are being sought. However, wouldn’t tax support for exporters render these tariffs meaningless?

This is likely why we are witnessing one of the most significant economic events since the gold standard. Quinten questioned where the money is going in a recent assessment, stating;

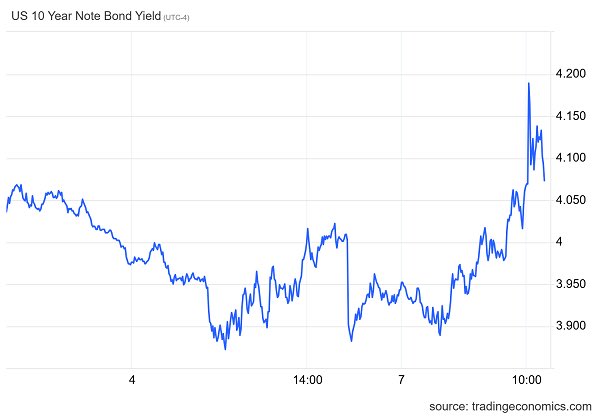

“Typically, when stocks are sold, investors seek safety in government bonds. This ‘flight to safety’ drives bond prices up and yields down.

However, that is not the case right now.

As stock prices fall, bond yields are rising, indicating investors are not turning to bonds. They are pulling money out of everything. When both stocks and bonds are sold simultaneously, it often signals broader financial stress beneath the surface.

And all of this points to an inevitable conclusion: the system is crying out for more liquidity. Central banks will have to respond.”

No statements were made regarding today’s Fed meeting. While expectations for six rate cuts dominate, figures like BlackRock’s CEO believe there is a “zero” chance of such large cuts. We are in a very interesting period, and we will just have to wait and see. Trump appears to be more determined than anticipated, while China seems more aggressive. If we observe China forming an economic coalition with countries outside the U.S., it wouldn’t be surprising.

For now, what should happen is that in this stalled global trade environment, countries should pursue interest rate cuts to stimulate domestic demand. While this article was being prepared, Trump mockingly shared;

“What we’re not talking about is that oil was $76 and now it’s $65. Gas prices will drop…” – Truth Social Account

The Price Where Bitcoin’s Decline Will End

In today’s evaluation, Stockmoney Lizards stated that tariffs are merely an excuse and that Bitcoin  $91,081 is already approaching its technical correction level. They predicted a bottom above $65,000, stating;

$91,081 is already approaching its technical correction level. They predicted a bottom above $65,000, stating;

“Show me the Bitcoin chart, and I will tell you the news. If there were no tariffs, other events would occur. Some war news, inflation… This may not be the end of the correction, but we are definitely approaching the target area. Be patient. Don’t panic.”