It was something eagerly awaited by cryptocurrency investors, and the Spot Bitcoin ETF was approved in January. The SEC realized it could no longer resist and was compelled to grant ETF approvals. Thus, the challenging process was concluded. So, what is the current situation with ETF inflows? Will the rise in cryptocurrencies continue?

Current Status of the Spot Bitcoin ETF

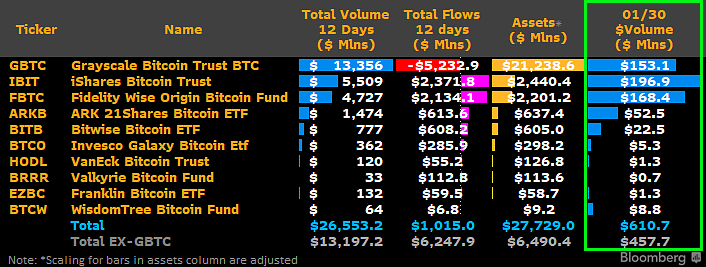

GBTC sales shook the markets along with the spot sales following this month’s ETF approval. Normally, the news of an ETF approval should not have triggered a sell-off event, as the expectation was for institutional reserves to grow with continuous inflows in the medium and long term. Indeed, that’s what happened; although GBTC experienced massive outflows, the inflows into other ETFs were higher, resulting in nearly $800 million in net inflows.

GBTC reserves saw an outflow of $5.2 billion in 12 days. The total asset amount dropped to $21.2 billion. During the same period, only BlackRock and Fidelity ETFs hosted $4.5 billion in inflows. Excluding GBTC, the total reserves of all other spot Bitcoin ETF issuers are close to $6.5 billion. Thus, despite the net GBTC sales of $5.2 billion, the inflows into ETFs excluding GBTC were larger, meaning a significant amount of BTC was withdrawn from the circulating supply.

Spot Bitcoin ETF Predictions

One of the fundamental reasons for Bitcoin’s price recovery from $38,500 was the weakening outflows from GBTC. As inflows into other ETFs continued, investors became less worried about a potential $20 billion sale. What does this $20 billion represent? Of course, the GBTC reserves.

The weakening daily outflow from GBTC and the growing reserves of other ETFs suggest that optimism should increase in the medium and long term. Miners issue 900 BTC daily, and the net daily inflow from just 2 ETFs, Fidelity and BlackRock, is much higher than this.

If ETF inflows continue at this rate after April’s halving, a demand 20 times the daily miner output is expected from just 2 ETF managers. This does not include the demands from MicroStrategy and others. All these factors indicate that we have passed an important milestone on the road to a six-figure Bitcoin price target.

Türkçe

Türkçe Español

Español