Bitcoin  $105,181 is currently trading at $93,800, leaving altcoin traders dissatisfied. As of January 1, 2025, Ethereum

$105,181 is currently trading at $93,800, leaving altcoin traders dissatisfied. As of January 1, 2025, Ethereum  $2,422 remains around $3,300. This article examines the current status of popular cryptocurrencies, identifying which are at buying levels and which altcoins may be overvalued.

$2,422 remains around $3,300. This article examines the current status of popular cryptocurrencies, identifying which are at buying levels and which altcoins may be overvalued.

Insights on APT Coin

APT Coin, which reached a peak of $15, is preparing for the new year. A trader known as Daan Crypto Trades shared updated graphs, indicating potential buying levels in case of deeper dips.

“APT is forming an important pattern near the Golden Fibonacci retracement level and the Daily 200MA. It resembles many external charts. Since the lows in August and the elections, there has been a good run, but it is now testing these levels and trying to create a higher low.”

Should sales continue, we may witness new lows between $6.67 and $4.3. As the holiday season ends, an upward movement in Bitcoin’s price could stabilize the market.

Which Altcoins Are at Buying Levels?

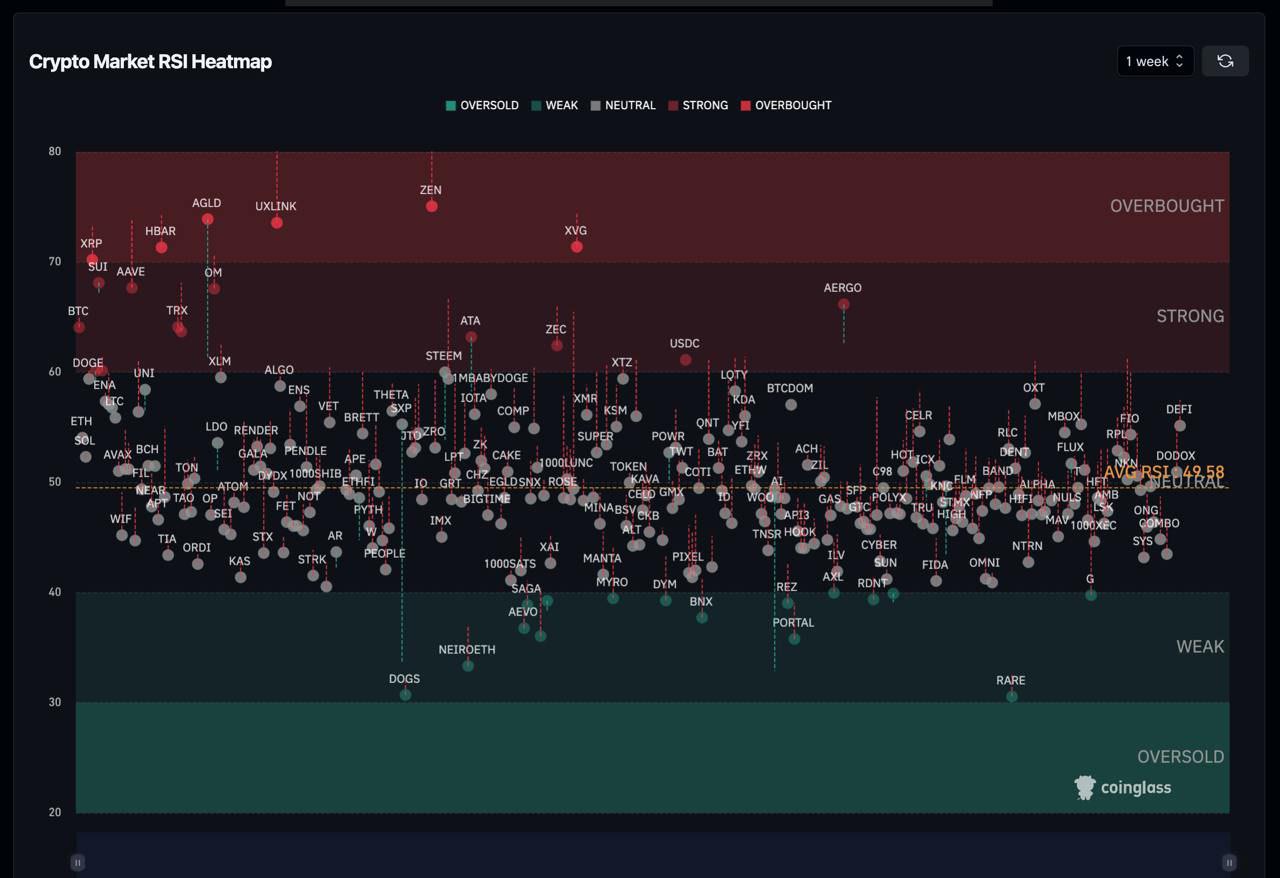

The RSI indicator measures demand in cryptocurrencies. If the RSI is in the overbought region, a correction is expected for the related cryptos. Today, we will monitor the current RSI statuses for around 100 cryptocurrencies.

Altcoins such as HBAR, XRP, AGLD, and ZEN Coin are in the overbought zone. It’s important to note that if the trend is a strong upward one, prices may continue to rise even if the RSI is in overbought territory.

However, not every altcoin in the oversold region presents a buying opportunity. For instance, DOGS Coin continues to weaken due to decreased interest in Telegram altcoins and dissatisfaction during the DOGS airdrop period, suggesting prolonged trading at lower levels.

Altcoins clustered below the 50 level may be nearing the end of their corrections. Cryptocurrencies like TAO, WIIF, and TIA suffered significantly during the recent Bitcoin downturn. Many are now anticipating Bitcoin to rebound to six-figure levels, expecting to recover quickly from their lows.

Bitcoin remains below $94,000, and excitement around the January 20 handover event is anticipated to impact the markets.

Türkçe

Türkçe Español

Español