After Trump won the elections and officially took office, American voters began to track the status of promises made. Major announcements were made at the Bitcoin  $105,345 conference, notably by Senator Lummis, who shared a critical legislative proposal concerning the Federal Reserve.

$105,345 conference, notably by Senator Lummis, who shared a critical legislative proposal concerning the Federal Reserve.

Fed to Accumulate Bitcoin

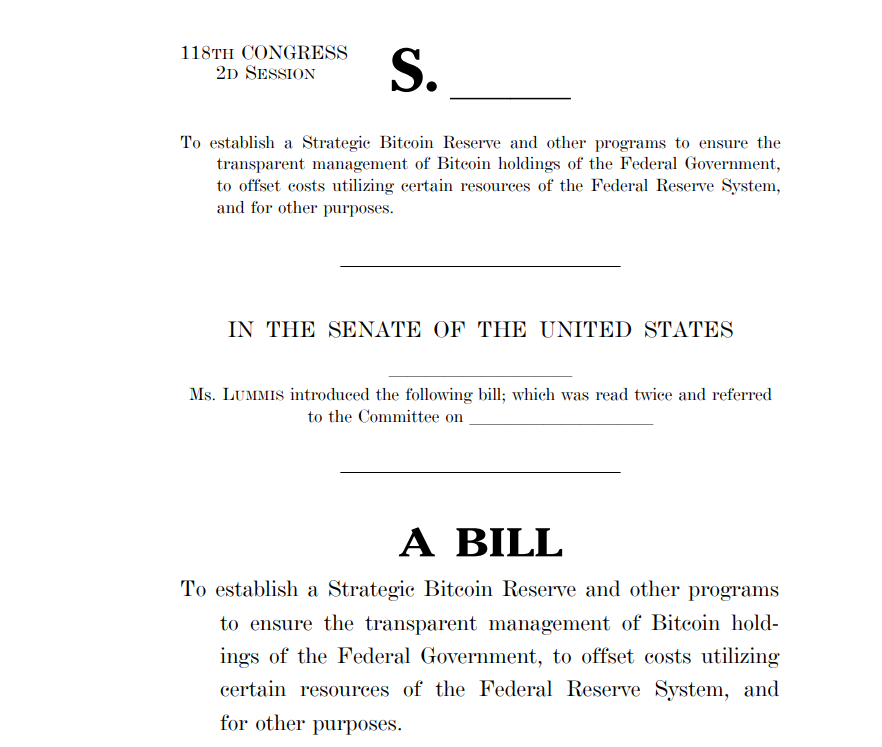

U.S. Senator Cynthia Lummis introduced a proposal for a strategic Bitcoin reserve this year. She emphasized the need for the Fed to accumulate BTC to strengthen the dollar and pay off national debt. The full name of the bill is the “Innovative Investment for National Competitiveness Enhancement Act,” commonly referred to as the Bitcoin Bill.

“As families in Wyoming struggle with rising inflation and our national debt reaches unprecedented levels, it’s time for us to take bold steps to create a brighter future for the next generations by establishing a strategic Bitcoin reserve. Bitcoin is transforming not just our country but the world, and becoming the first advanced nation to use Bitcoin as a savings technology secures our position as a global leader in financial innovation. This is what will help us reach the next financial frontier.”

Bitcoin Price Set to Rise

The Republican Party holds a majority in both the Senate and the House of Representatives. This bill must be approved in both chambers and signed by the president. During Biden’s term, the majority in Congress was from different parties, which delayed legislative processes. Although efforts were made for bipartisan consensus, much time was lost.

With Trump’s inauguration in January, approvals for the bill may come much more easily. Markets are likely to price in potential good news until the oath of office in January.

The proposal suggests accumulating up to 5% of the Bitcoin supply, targeting the annual accumulation of 1 million BTC.

One of the significant advantages of the Trump administration is that crypto assets held by the Justice Department will not be sold. However, there are existing sales based on court decisions that might suddenly impact the markets before January.

Türkçe

Türkçe Español

Español