The crypto analysis company LAYER.GG made a significant announcement today from the X social platform. The data shared by the company pointed to a significant rise. It is noteworthy that the last time similar data was shared was in the fourth quarter of 2020. Following this announcement, a period that whets investors’ appetite can be expected. Let’s take a closer look at the details.

Bitcoin’s Extraordinary Journey: 6 Weeks of Consecutive Green Candles

Bitcoin (BTC) investors witnessed a notable trend as the cryptocurrency recorded its sixth consecutive weekly green candle. Such a series last occurred in the fourth quarter of 2020. That period had become memorable for crypto enthusiasts due to the momentum of the rise.

Looking back, the fourth quarter of 2020 stands out as a period when Bitcoin showcased an impressive series of six green candles. Fast-forwarding to today, as Bitcoin begins its seventh weekly candle, it seems like history is on the verge of repeating itself.

Decoding the Signals and Market Dynamics

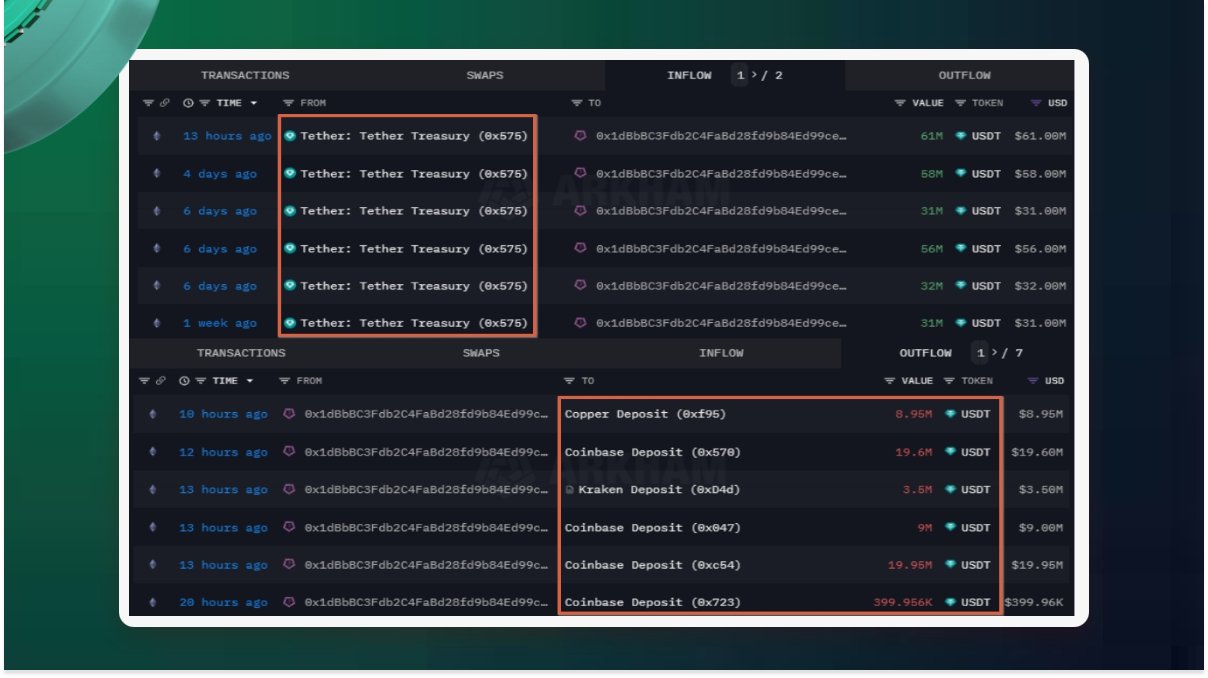

The crypto analysis company LAYER.GG highlighted several noteworthy signals during this rise period. A significant flow of 5 billion dollars in USDT (Tether), the involvement of a whale identified as “0x1dB,” and the issuance of USDT in the range of 35 to 37 thousand dollars contributed to the narrative.

Since October 2020, the consistent issuance of 1 billion USDT every 1-2 weeks has been a significant factor. During this time, a total of 5 billion dollars was printed from the Tether Treasury. In a bull market, the issuance of new stablecoins is traditionally considered a bullish signal.

Market Impact and Converging Trends

The Bitcoin price corresponding to each USDT issuance showed a recovery exemplifying the impact of stablecoin market dynamics. Notably, the market value of stablecoins rose from 119 billion dollars to 124 billion dollars. Additionally, a significant increase in stablecoin issuance was observed during the consolidation phase in the 35 to 37 thousand dollar range.

While the market value of stablecoins reflects June levels, the current Bitcoin price indicates an increase of over 40%, rising from 27 thousand dollars to 37 thousand dollars. This suggests that newly issued stablecoins are being actively distributed towards Bitcoin purchases.

Potential Involvement of BlackRock and ETF Expectations

A whale known as “0x1dB” drew attention by acquiring 1 billion 336 million USDT from the Tether Treasury and continuously depositing it into exchanges since October 20. Speculations suggest that an ETF approval may be on the horizon within two months, with traditional financial firms like BlackRock and Fidelity potentially actively participating in Bitcoin purchases.

- Bitcoin’s rise marked by green candles.

- USDT issuance suggests positive market sentiment.

- Potential traditional finance involvement looms.