In the fast-paced world of cryptocurrency trading, discerning the signs of the highest bull run while minimizing risks and optimizing gains has become crucial for investors. Among numerous charts and technical indicators, a unique yet reliable signal stands out. This is particularly true in the case of speculative assets like altcoins, where sentiment analysis becomes a focused endeavor.

Revealing a Key Sentiment Metric for Altcoin Season

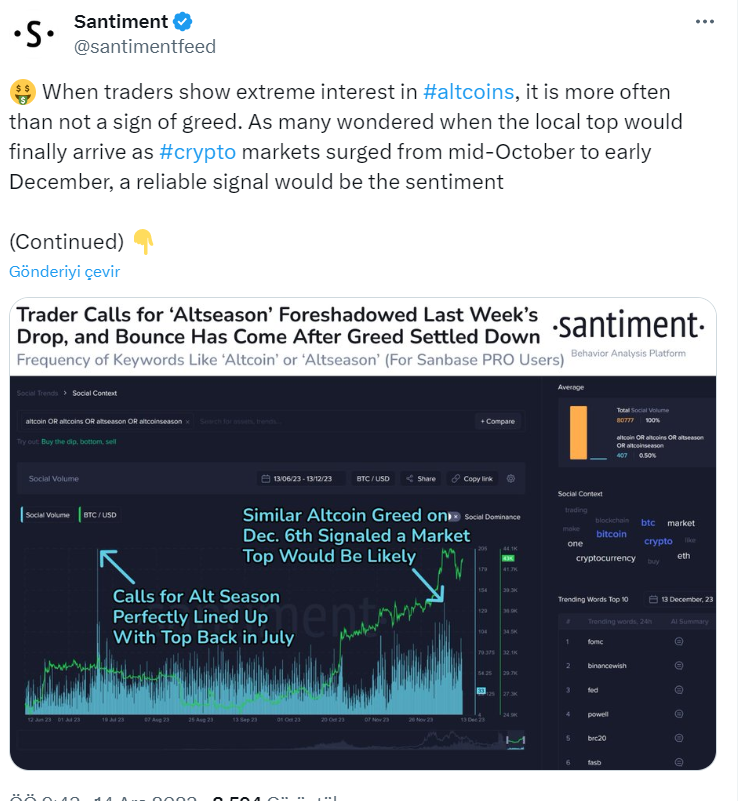

During the recent market fluctuations from mid-October to the beginning of December, there was a heightened expectation of a local peak. Investors, drawn by the allure of greed and quick profits, often shift their focus to altcoins during such periods. This behavioral change is not merely anecdotal; it is measurable and can be used as a metric to assess market peaks.

The term “Altcoin Season” permeates crypto-focused social media channels during these fluctuations, reflecting a widespread shift in investor attention towards alternative cryptocurrencies.

Santiment, a leading sentiment analysis platform, highlighted that the sudden increase in mentions of “altcoin season” and related keywords is strongly associated with upcoming market peaks.

These abrupt increases in social volume often occur before corrections and signal a market on the verge of exuberance.

Unleashing the Potential of Sentiment Analysis

While this social measurement is rare, its power as an emotional barometer for the market cannot be overstated. Rapid increases in the frequency of keywords such as “altcoin” or “altcoin season,” as demonstrated by the latest rally, serve as early indicators of an impending pullback.

This pattern suggests that when collective interest sharply turns towards altcoins, cautious investors should consider securing their profits. Utilizing tools like sentiment analysis to gauge collective mood provides investors with a strategic advantage.

Ultimately, it not only facilitates more informed decision-making but also enhances the ability to navigate the complex terrain of cryptocurrency bull runs by offering qualitative insights into market psychology.

It’s worth noting that the rise that started with the leadership of Bitcoin in the past two months has also pulled altcoins along with it. Now the question on everyone’s mind is whether this rise will continue. Yesterday’s FED decision showed that there is still a long way to go.

Türkçe

Türkçe Español

Español