According to a recent analysis of the geographical distribution of the leading cryptocurrency, the supply of Bitcoin (BTC) held by US institutions has been steadily decreasing since 2022. So what does this situation mean for Bitcoin?

Decreasing Accumulation in Bitcoin!

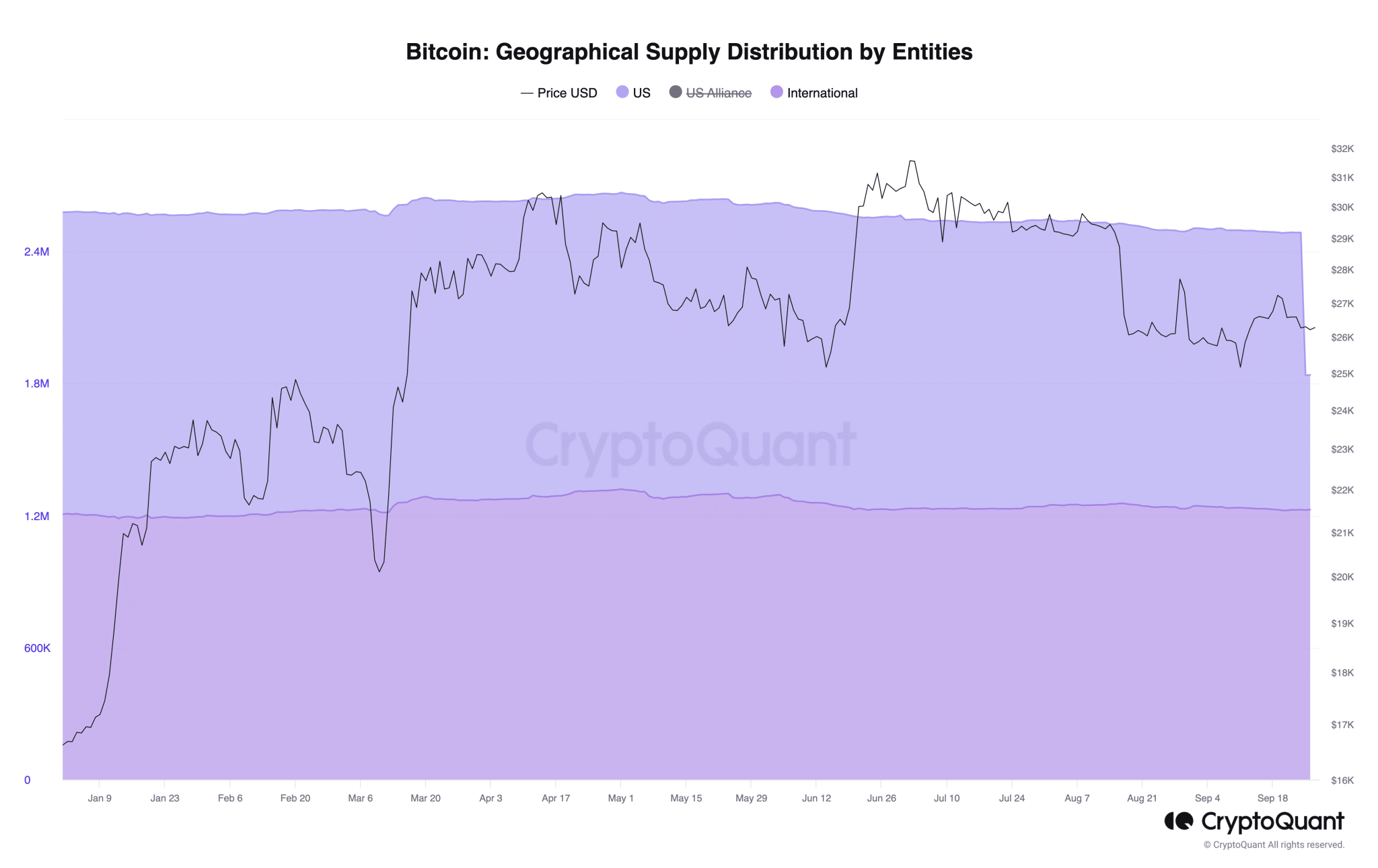

Data obtained from CryptoQuant shows that the cumulative BTC balance of US institutions has been declining since June 2022. As of September 26, the geographical supply distribution of US institutions’ BTC assets has decreased by 64% compared to last year, reaching a total of 612,472 BTC.

In a recent report published by CryptoQuant analyst SimonaD, this change can be largely attributed to the country’s increasingly uncertain regulatory environment, in addition to rising interest rates and other economic factors.

Reiterating the stance on cryptocurrencies in the region, Securities and Exchange Commission (SEC) Chairman Gary Gensler stated in his remarks before the Senate Banking Committee hearing on September 12 that cryptocurrencies are securities and should be regulated by the agency. Gensler stated:

There is nothing that shows that cryptocurrencies deserve less protection under our securities laws for investors and issuers… Given that most crypto tokens are subject to securities laws, most crypto intermediaries are therefore required to comply with securities laws.

The uncertain regulatory outlook for cryptocurrencies in the US has led to an increase in weekly outflows from digital assets as investment products. According to weekly reports published by cryptocurrency investment firm CoinShares, most of the outflows from crypto funds in the past few weeks have come from US investors.

CoinShares found that European investors have mostly responded differently. The region reported a total inflow of $16 million into crypto funds last week. According to CoinShares, European investors see the recent regulatory disappointment as an opportunity.

Macroeconomic Factors in Bitcoin!

In the first quarter of the year, BTC experienced a significant price increase. This increase occurred after the recovery of the general market following the unexpected collapse of the FTX cryptocurrency exchange (FTT) in November 2022. As of January 1, BTC was trading at $16,500. As demand increased and awareness grew, the value of the token rose above $30,000 by April and showed an increase of over 80% in just four months.

Despite this rally, a difference in sensitivity was observed from a regional perspective. While US institutions reduced their BTC holdings, data obtained from CryptoQuant showed an increase in the balance of cryptocurrencies in wallets outside the US between January and April.

Between January 1 and April 30, the distribution of BTC among US institutions decreased by 2%. During the same period, the international supply distribution of BTC increased by 9%. However, after the overall market sentiment deteriorated at the end of April, international investors adopted a more cautious approach. The international supply distribution of BTC decreased as the leading cryptocurrency’s price remained within a narrow range. According to CryptoQuant’s data, the international supply distribution of the coin, which was 1.22 million BTC at the time of writing, has decreased by 8% since May 1.