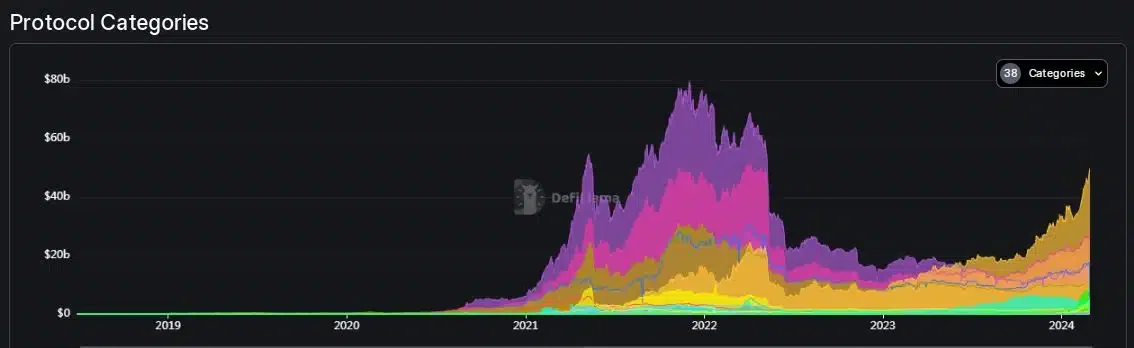

The decentralized finance (DeFi) ecosystem has recorded a significant increase in activity, leading to notable gains even during a bear market. According to an analysis of DeFiLlama data, the total value locked (TVL) in the DeFi market, a barometer of its overall health, has surpassed $137 billion. This level is less than 3% below the peak levels of May 2021.

TVL in DeFi on the Rise

Although the current value of deposits is still somewhat below the peak recorded in November 2021, the upward trend has increased the possibility of a breakthrough. The emergence of blockchain technologies, advancements in decentralization, and the historic crypto bull market of 2020-21 played a significant role in strengthening the DeFi economy. The amount of cryptocurrency locked in DeFi protocols increased a hundredfold between June 2020 and July 2020, and TVL continued to rise as the market value of cryptocurrencies reached an all-time high (ATH) by the end of 2021.

However, events such as the collapse of the stablecoin Terra USD (UST) and the fall of the FTX (FTT) exchange dragged the broader market into crisis, affecting investments in DeFi protocols. The DeFi market showed signs of recovery in 2023, with a 25% increase in TVL by the third quarter. The major surge, however, occurred from October onwards, as leading cryptocurrencies began to rise. Since that period, DeFi TVL has more than doubled at the time of writing.

Expert Views on DeFi

As leading DeFi analyst Patrick Scott pointed out, this time the growth stemmed primarily from liquid staking projects, unlike the decentralized exchanges (DEX) that catalyzed growth in 2021. DEXs, which facilitate transactions of crypto tokens in a decentralized setup, constituted 37% of the total market share in November 2021. At the time of writing, they only made up 13% of the total DeFi TVL.

As rewards from traditional ETH staking diminished over time, the promise of higher returns led users to these new staking projects. Bear markets can be challenging in terms of investment and value, but the reduction in noise has allowed developers to create products aligned with long-term growth plans. As the size of the crypto market grows, the demand for DeFi projects is inevitably set to increase.