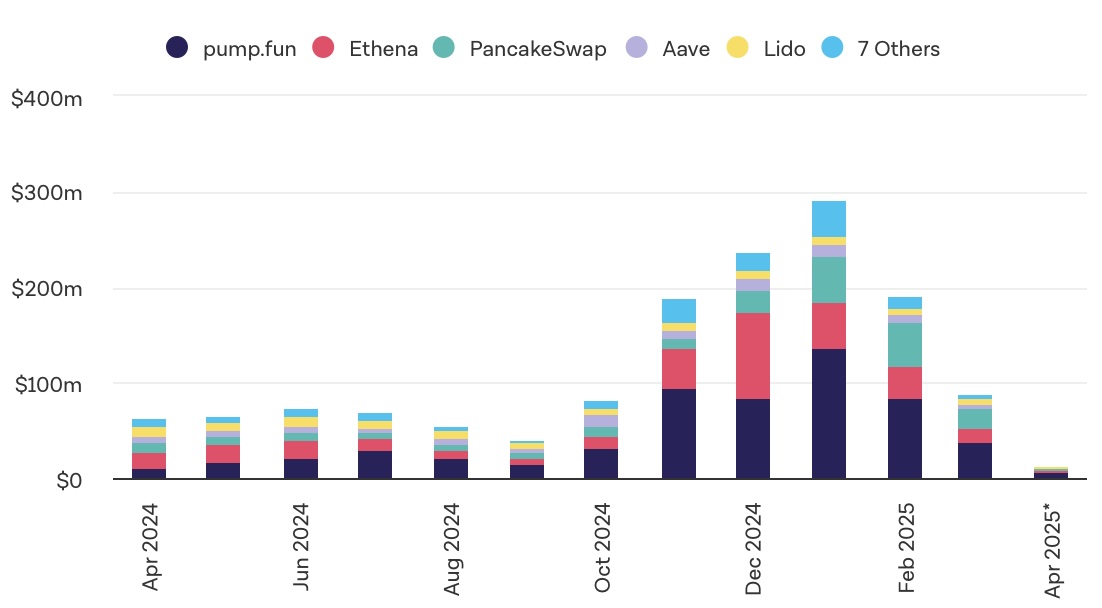

The decentralized finance (DeFi) sector, a vital arm of the cryptocurrency market, experienced substantial revenue declines in March. The drop in on-chain transaction volumes directly impacted the revenues of various protocols, while the performance of DeFi coins also suffered. The DeFi Index, which has fallen by 40% since the beginning of the year, reflects the overall weakness in the industry. Only a few protocols managed to increase their revenues in March, indicating a striking downturn across the sector.

Significant Losses in Ethereum and Solana-Based Protocols

In March, many major DeFi protocols based on Ethereum  $3,094 faced a severe revenue hit. A basket of well-known protocols such as Ethena, Lido, Aave, Curve, Compound, and Sushi collectively generated only $24.5 million in revenue. This figure marks a 52% decrease compared to February and a staggering 65% drop from January. The attempts of major players like Lido and Aave to maintain their market presence despite this decline may prompt investors to reassess their long-term expectations.

$3,094 faced a severe revenue hit. A basket of well-known protocols such as Ethena, Lido, Aave, Curve, Compound, and Sushi collectively generated only $24.5 million in revenue. This figure marks a 52% decrease compared to February and a staggering 65% drop from January. The attempts of major players like Lido and Aave to maintain their market presence despite this decline may prompt investors to reassess their long-term expectations.

A similar trend is evident among Solana  $139-based protocols. Collectively, protocols like Pump.fun, Jito, and Raydium generated about $42 million in revenue. However, this figure represents a 55% reduction from February and a 75% drop from January’s peak. The decline in transaction traffic on Solana seems to have disrupted the overall activity on the network.

$139-based protocols. Collectively, protocols like Pump.fun, Jito, and Raydium generated about $42 million in revenue. However, this figure represents a 55% reduction from February and a 75% drop from January’s peak. The decline in transaction traffic on Solana seems to have disrupted the overall activity on the network.

BNB Chain Struggles While MakerDAO Stands Out

The leading DeFi protocol on BNB Chain, PancakeSwap, also fell victim to the downturn. The protocol recorded $21 million in revenue in March, experiencing a 54% decline compared to February. The decreased transaction volumes on BNB Chain directly affected PancakeSwap’s user traffic, leading to a temporary drop in investor interest and reduced earnings for the protocol.

On the other hand, an unexpected development occurred with MakerDAO, now operating under the name Sky. The protocol generated $10 million in revenue in March, marking an 11% increase. This performance made it the only protocol among the top 11 DeFi protocols to diverge positively. Strategies for maintaining stability and innovative revenue models were cited as key factors behind this growth.

The decline in on-chain activity adversely affects not only the revenues of protocols but also the overall vitality of the ecosystem. The decreasing transaction volume indicates that users are acting more cautiously and searching for safe havens in the market. Experts emphasize the need for new strategies at both the user and protocol levels for the DeFi sector to regain momentum in the coming months.