As Bitcoin continues to trade above $50,000, the crypto community’s focus seems to have shifted to the DeFi sector, which has witnessed a significant increase indicating the end of the bearish phase for cryptocurrencies. This is largely associated with the mainstream attention DeFi has garnered amidst the recent frenzy over artificial intelligence. A rise has been observed in platforms led by Uniswap, which allow users to lend, borrow, or exchange crypto in a decentralized manner.

Strategic DeFi Gains

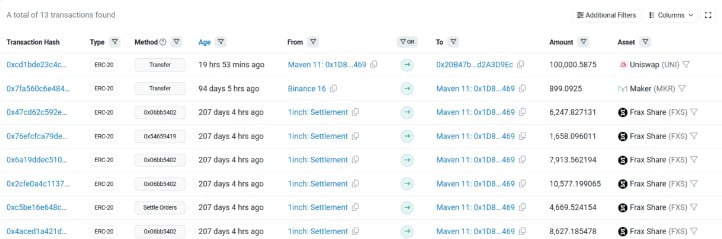

During the DeFi explosion, Maven11 Capital highlighted the potential for smart gains in crypto ventures. Maven11 Capital, which made strategic investments in DeFi tokens, announced a visible gain of 54% worth $1.43 million.

Going back to the beginning of the story, Maven11, which purchased 100,000 UNI tokens from Binance at an average cost of $5.74, later sold them at $11.2 each, achieving a 95% profit of $546,000.

Moreover, Maven11’s investments in tokens like MKR, AAVE, and FXS also yielded significant returns of 38%, 58%, and 43%, respectively, making the gains in the DeFi sector particularly noteworthy.

Many believe that the trigger for this development was none other than the latest proposal from Uniswap. The proposal involves distributing protocol fees among UNI holders who stake and delegate their tokens, which is thought to potentially strengthen the protocol’s governance.

Is It Time for Lower-Ranked Projects to Shine?

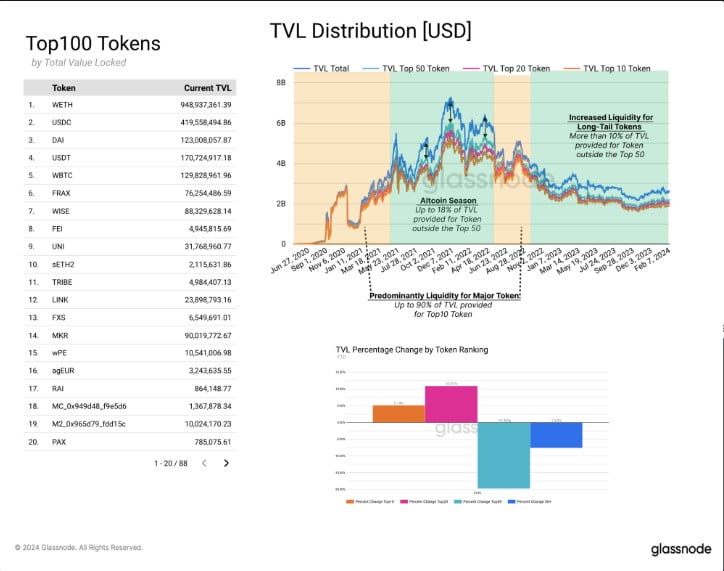

According to a recent Glassnode report, there was a structure in Uniswap’s Total Value Locked (TVL) that reflected the growing optimism in the DeFi space. During the altcoin season, a significant increase in liquidity for tokens outside the Top 50 was noted, indicating rising investor interest in lower-ranked tokens.

While liquidity during the bear market was generally concentrated in the top 50 tokens where most trading occurred, things seem to be changing. There was a 5.14% increase in liquidity for the top 10 tokens, mainly consisting of WETH, WBTC, and stablecoins, and a 10.9% increase for the top 20 tokens.

As investors move away from the bear market, their growing interest in projects ranked lower on the list is an intriguing development for market watchers.

This redistribution of liquidity could reflect a growing atmosphere of trust in the market, suggesting that expectations for investing in lower-ranked projects could increase.