Bitcoin‘s price is currently targeting $29,700 and finding buyers at $29,320. With the expected announcement in the evening, it is hoped that the market pressure will decrease. UNI Coin has been one of the notable cryptocurrencies during this period. With a price of $5.8, Uniswap (UNI) has shown an increase of over 50% since its recovery from the last local low of $3.63 on June 10.

Uniswap (UNI)

On July 20, fear gripped the Uniswap ecosystem after an attacker took control of Founder Hayden Adams’ Twitter account. The attacker then tried to trap victims by sharing a fake token request link on the page. The next day, we saw that CoinList’s account had been hacked as well. These accounts, most likely stolen through SIM cloning, have highly trusted profiles. The scammers also have an easier time due to their publication of highly professional fraudulent messages.

UNI Coin Analysis

Regarding the price, according to data compiled by Glassnode, the number of UNI tokens deposited into exchange wallets increased from 44.5 million to 44.8 million between July 21 and July 26. This represents an increase of 285,000 tokens in exchange reserves. The increase in exchange balances supports the possibility of increased selling pressure.

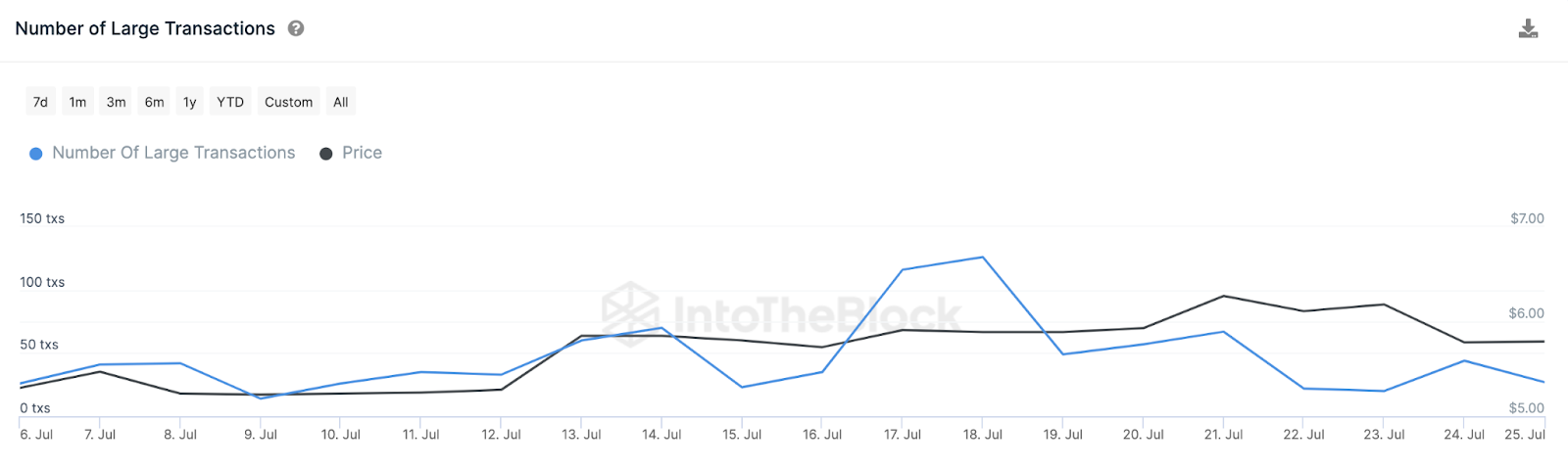

The graph below from IntoTheBlock shows how UNI Whale Transactions decreased by over 78% between July 18 and July 25. Nominaly, whales conducted 126 transactions on July 18. However, at the close of July 25, there were only 27 Large transactions involving UNI.

Due to the aforementioned negatives, if UNI Coin drops below $5.4, a prolonged correction may begin. On the other hand, if bulls continue to ignore Uniswap alerts and push for further gains, $7.5 seems to be the first major target. To realize the bullish scenario, the resistance at $6.57 will need to be overcome. The fact that Bitcoin’s price does not suffer further losses and the accumulation of short positions supports the possibility of a surprise upward movement. UNI Coin could be one of the leaders in the possible optimistic scenario.

Türkçe

Türkçe Español

Español