Today we saw the release of the last critical data of October. There is no new data that will shake the markets in the coming days. By now, the release of all important macro data may shape expectations until the November 1 meeting. The increase in inflation did not occur as feared, so what awaits us in the details? Will cryptocurrencies rise?

Details of US Inflation Data

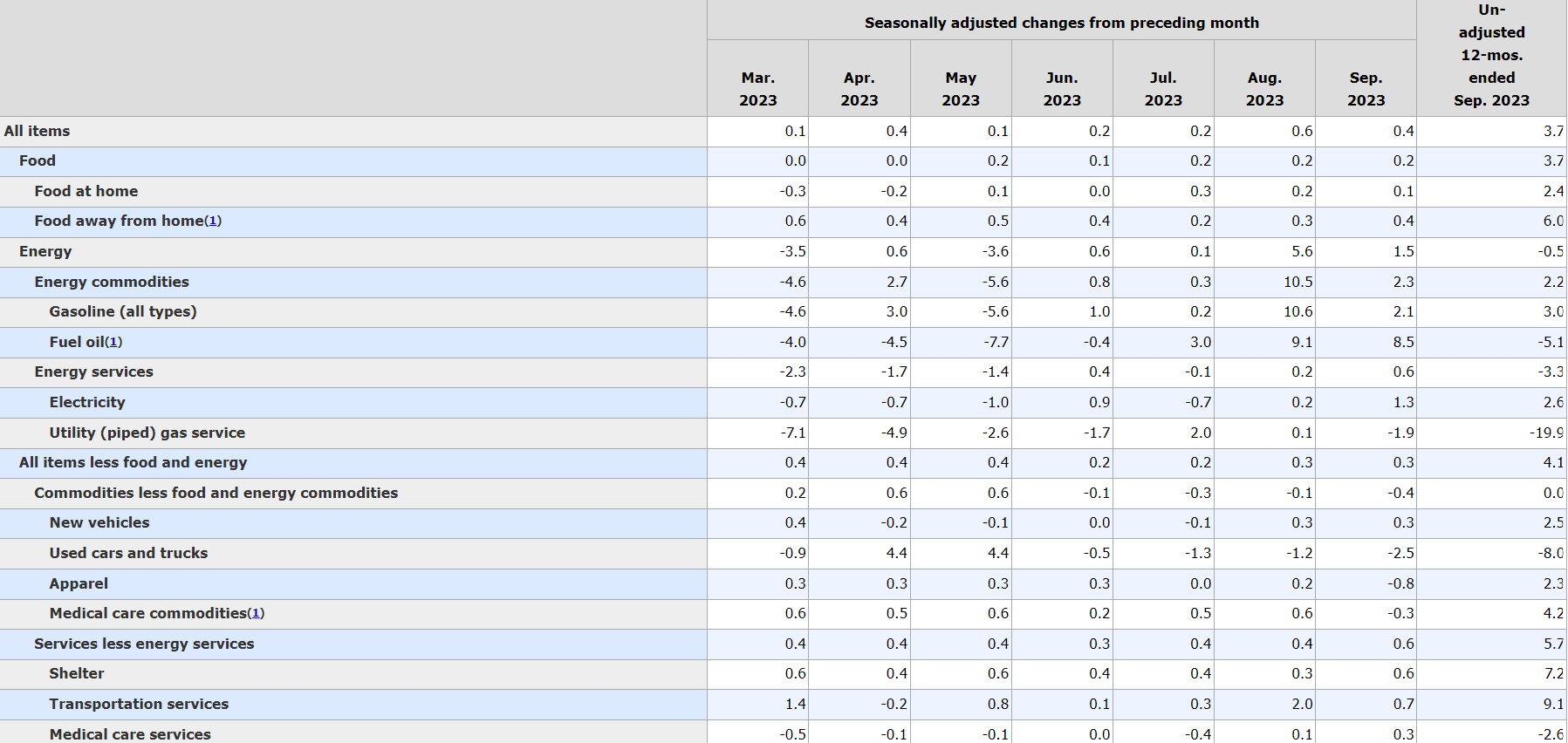

The increase in the housing index was the biggest contributor to the overall rise in all categories. The increase in fuel prices also had a negative impact on inflation. Despite mixed performance of major energy components in September, energy indices increased by 1.5% throughout the month. The food index, on the other hand, increased by 0.2%. Thus, we observed that the food index reached the peak of the previous two months.

While the food index at home increased by 0.1% compared to the previous month, the food index outside the home increased by 0.4%. Therefore, the cost of living for US citizens continues to rise. Fuel prices have been rising for three months and are around -5% annually. While this decline contributed significantly to inflation erosion, now it has the opposite effect.

The drop in the price of oil below $70 again will revive optimism regarding inflation. Yellen said they would do this, but there is not enough oil in US reserves to pump supply and lower the price. So, it will be difficult for them to do this or they will need to convince Saudi Arabia to stop the cuts. The current outlook shows that despite all the efforts of the Fed, inflation will continue to rise. Moreover, yesterday’s higher-than-expected increase in the Producer Price Index supports the ongoing rise in the Consumer Price Index.

Crypto Currencies and Dollar Forecast

After the data, the price of Bitcoin reclaimed the $26,800 support. The Core CPI decreased to 4.1%, which is the level of September 2021. After the inflation data, DXY experienced a rapid rise on the 15-minute chart but turned back from the 106 level for now. If it surpasses this region, it can make new highs while BTC can dive to deeper lows.

On the four-hour chart, there is a DXY trying to recover in a V-shaped manner from the 105.5 level. If it succeeds, the rally can continue up to the 107.2 level. This will mean an increase in the negative pressure on cryptocurrencies in the next week.

The data is now complete. Employment is strong, wage increases are normal, and the unemployment rate surprisingly came in at 3.8%. The increase in inflation is not as feared. So, what are the expectations for the November 1 Fed interest rate decision?

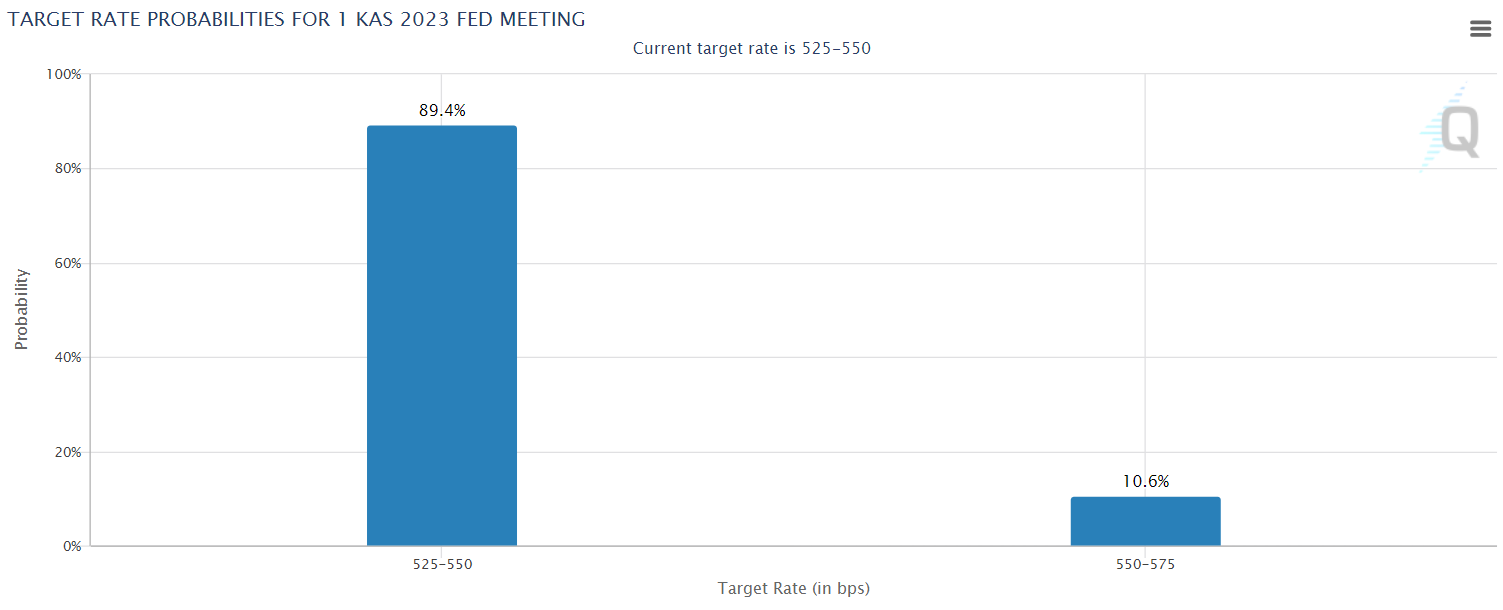

It is believed that the interest rates will remain unchanged. This rate has climbed from the 70s to the 90s. Yesterday’s “focus on the duration of tightening rather than the hike” statement and today’s inflation data may have had an impact on this. As the Fed continues to shrink its balance sheet, it maintains the tightening and it is a reasonable option to consider raising rates after monitoring the inflation situation for a while longer.

The statements that will come from Fed members in the coming days will be important in shaping the expectations for November.

Türkçe

Türkçe Español

Español