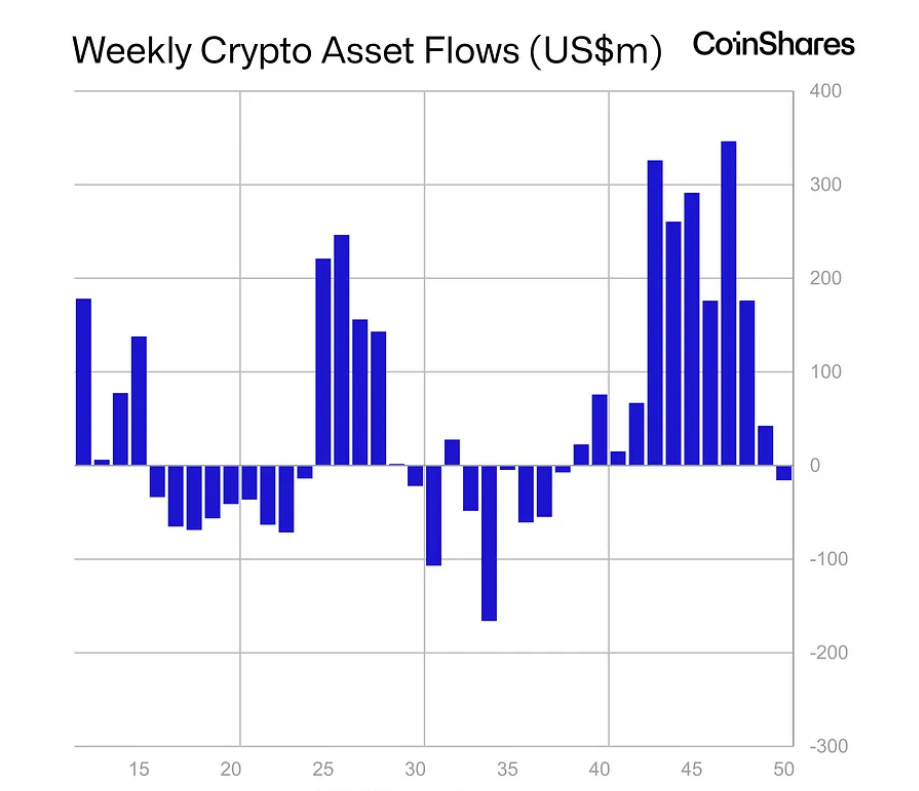

Digital asset investment products experienced small outflows of $16 million last week, ending an 11-week streak of inflows. Trading activities remained well above the year’s average, totaling $3.6 billion for the week.

Regional Analyses and Profit-Taking Dynamics

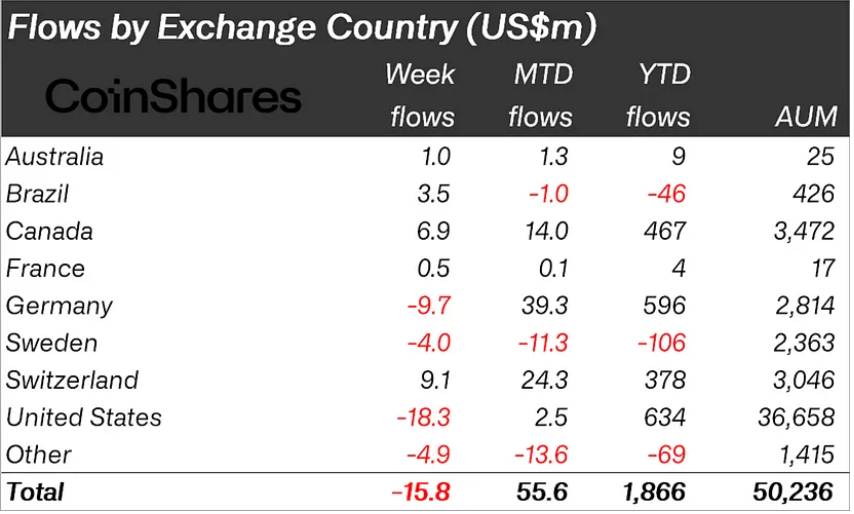

Regionally, outflows concentrated in the US with $18 million, while Germany reported minor outflows of $10 million. However, Canada and Switzerland countered this trend with inflows of $6.9 million and $9.1 million, respectively.

These mixed regional flows suggest that the recent changes are more about profit-taking rather than a fundamental shift in sentiment towards the asset class.

Bitcoin Takes a Hit, Altcoins Shine

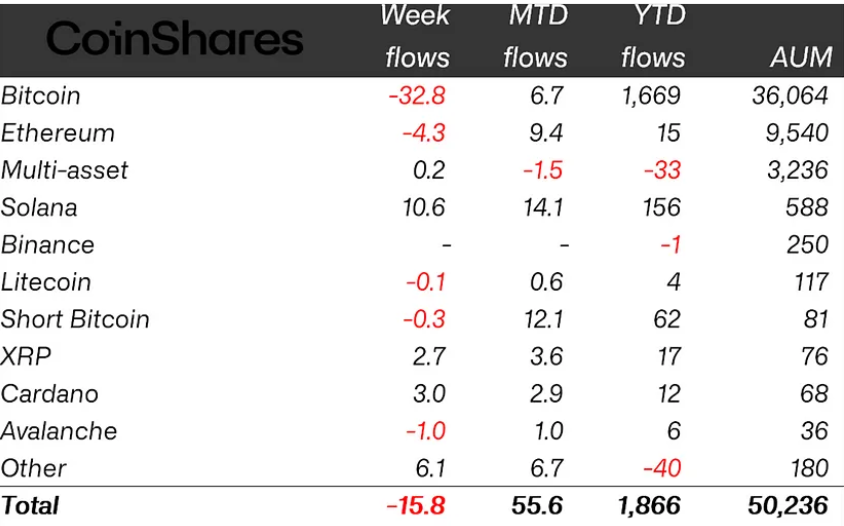

Bitcoin witnessed an outflow of $33 million, bearing the brunt of the withdrawals. Short-focused Bitcoin also experienced minor outflows totaling $300,000. In contrast, altcoins challenged this trend by securing inflows of $21 million.

Among the primary beneficiaries were Solana, Cardano, XRP, and Chainlink with inflows of $10.6 million, $3 million, $2.7 million, and $2 million, respectively. Ethereum and Avalanche faced modest outflows of $4.4 million and $1 million, respectively.

Blockchain-Focused Stocks See Robust Inflows

Blockchain-focused stocks continued a positive trend with significant inflows of $122 million last week. This marks the peak of a notable 9-week run totaling $294 million, representing the largest sustained entry on record.

While the market observed minor outflows, the resilience of blockchain-focused stocks and the ongoing appeal of certain altcoins highlight nuanced dynamics in play. Investors appear to be strategically evaluating profit-taking opportunities while maintaining active engagement with the evolving digital asset environment.