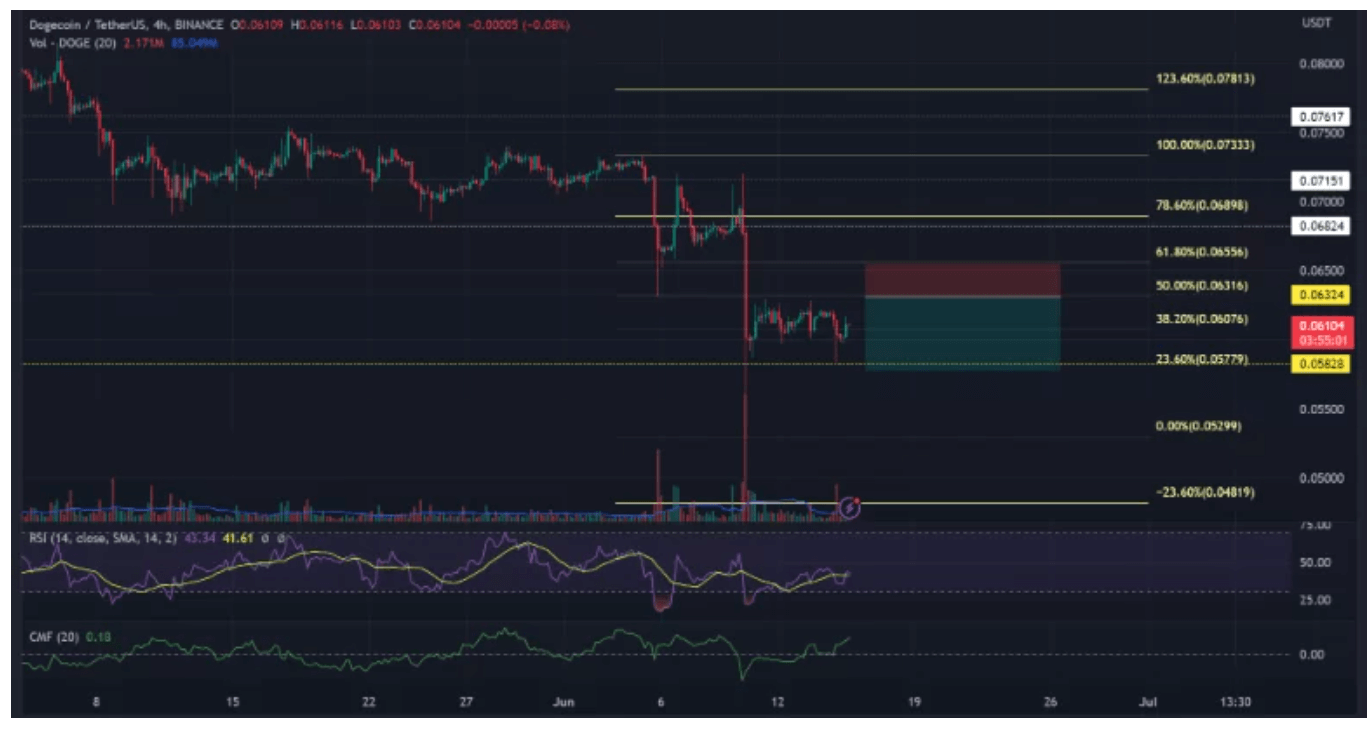

After a sharp price movement last Saturday (June 10), Dogecoin (DOGE) began to persist within a small price region on a four-hour chart. From the past weekend to the time of writing, DOGE has been oscillating between the 23.6% ($0.05779) and 50% ($0.06316) Fibonacci levels.

As a weak Bitcoin (BTC) treads below $25,000, a continuation of DOGE’s sideways action could potentially whet investors’ appetite for a short opportunity.

Dogecoin’s Target Price

The Fibonacci correction tool (yellow) was positioned between the low peak of June 5 and the low swing of June 10. According to the tool, DOGE is consolidating between the 23.6% ($0.05779) and 50% ($0.06316) Fibonacci levels.

At the time of writing, the price movement is nearing the high range and the $0.06316, 50% Fibonacci level. Also, the general four-hour market structure was in a downward trend. Thus, a possible price rejection could push DOGE to retest the low/$0.05779, 23.6% Fibonacci level.

If this is the case, such a move could provide a short position opportunity, entering at the 50% Fibonacci level ($0.06316) and targeting the 23.6% Fibonacci level ($0.05779).

A candlestick closure above the 61.8% Fibonacci level ($0.06556) could invalidate the bearish thesis. However, only a closure above the low-high level of $0.7333 could turn the four-hour structure bullish.

Meanwhile, both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) were trending. However, only the CMF crossed the zero level, indicating increased capital inflows. On the other hand, the RSI was fluctuating below the 50 level, signaling intense selling pressure.

Latest Status for DOGE

The declining Cumulative Volume Delta (CVD) confirmed the overwhelming selling pressure seen from the RSI indicator. It showed an increase in selling volumes over the last few days.

However, Open Interest (OI), tracking open contracts in the futures market, showed a slight recovery from the level of $186 million on June 14, rising to over $200 million at the time of writing. While the increase in OI may provide a glimmer of hope for the bulls, the strong decline in CVD could imply that the sellers might firmly hold control.