Dogecoin today fell by 5%, reaching an intraday low of $0.16192 on May 28. This drop outpaced the broader crypto market, which fell around 1.47% during the same period. The decline in DOGE follows Bitcoin’s 3.2% drop in the last 24 hours. DOGE has recently achieved significant gains, increasing by over 7.5% in the last 30 days.

Why is Dogecoin Dropping?

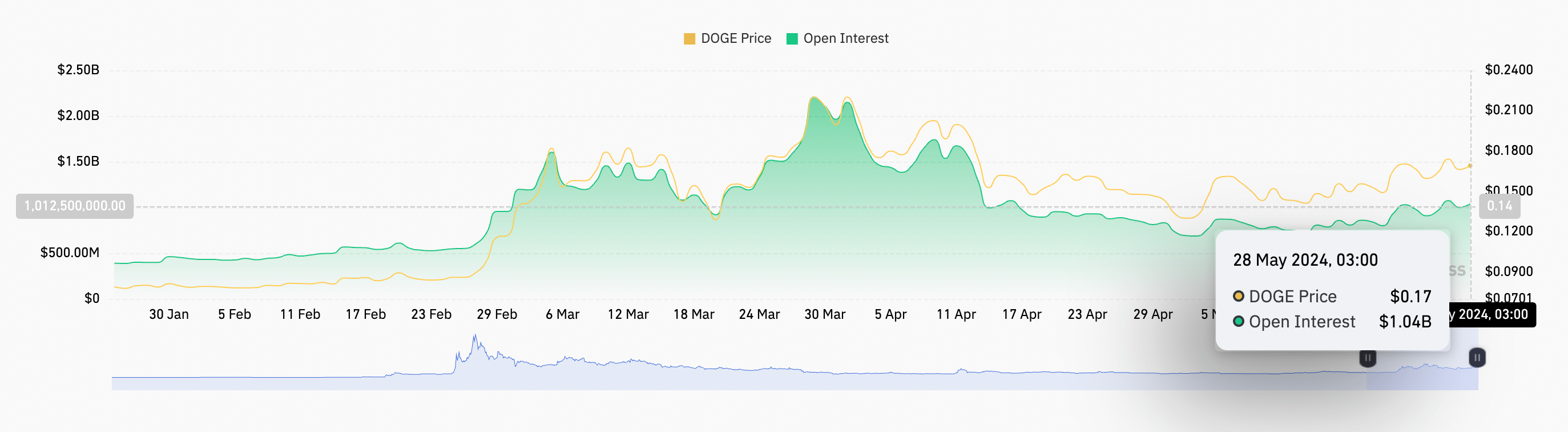

Dogecoin price started to fall between May 22 and May 26 and is currently trading 2.5% below its value from a week ago. According to blockchain data analysis platform Coinglass, this decline coincides with a 37% drop in open interest (OI) in futures contracts, from $1.67 billion in mid-April to $1.04 billion.

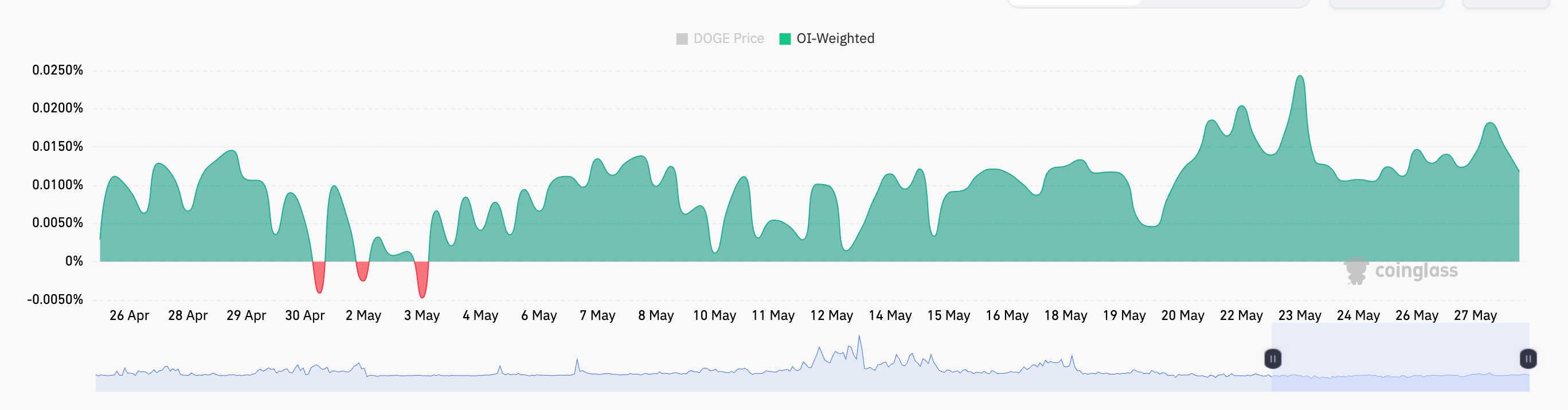

Dogecoin perpetual futures contracts’ funding rate also dropped from 0.0243% on May 23 to 0.0118% on May 28. Decreasing funding rates and OI indicate a bearish sentiment among investors, potentially increasing the selling pressure on DOGE.

What to Expect for Dogecoin?

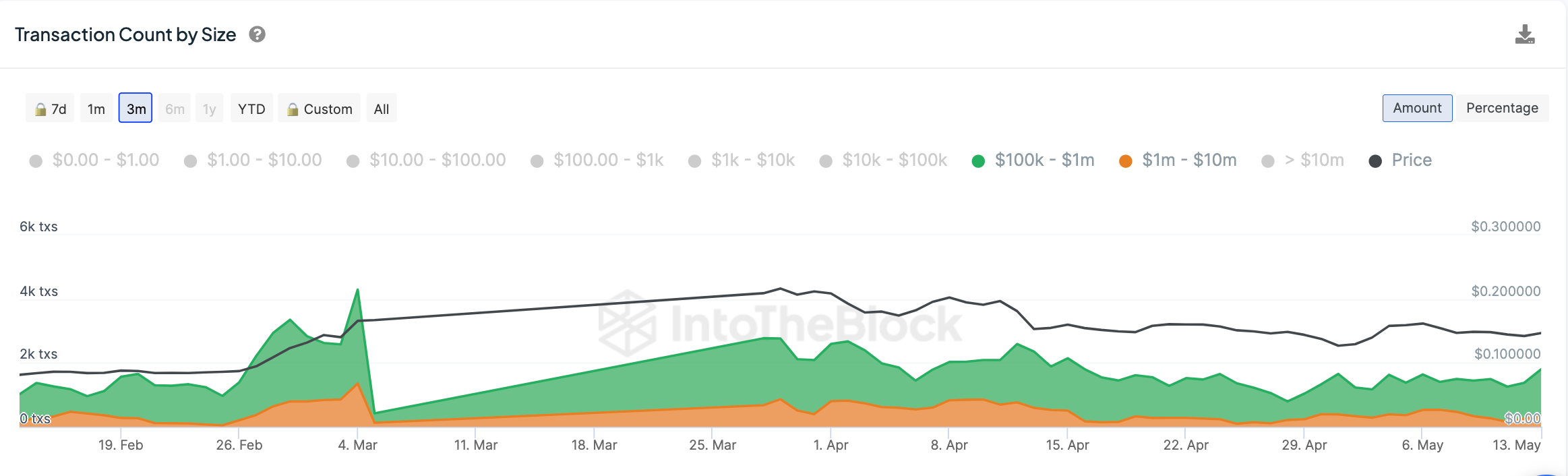

The recent market-wide correction, which saw millions of dollars liquidated, also affected DOGE, pushing its price down to $0.1512. Whale activity marked by large transactions of $100,000 or more in DOGE has increased. According to IntoTheBlock, transactions valued between $100,000 and $1 million increased by over 28% last week, while transactions over $1 million increased by more than 55% in the last 30 days. This increase indicates that institutional investors are taking profits, reinforcing the ongoing correction.

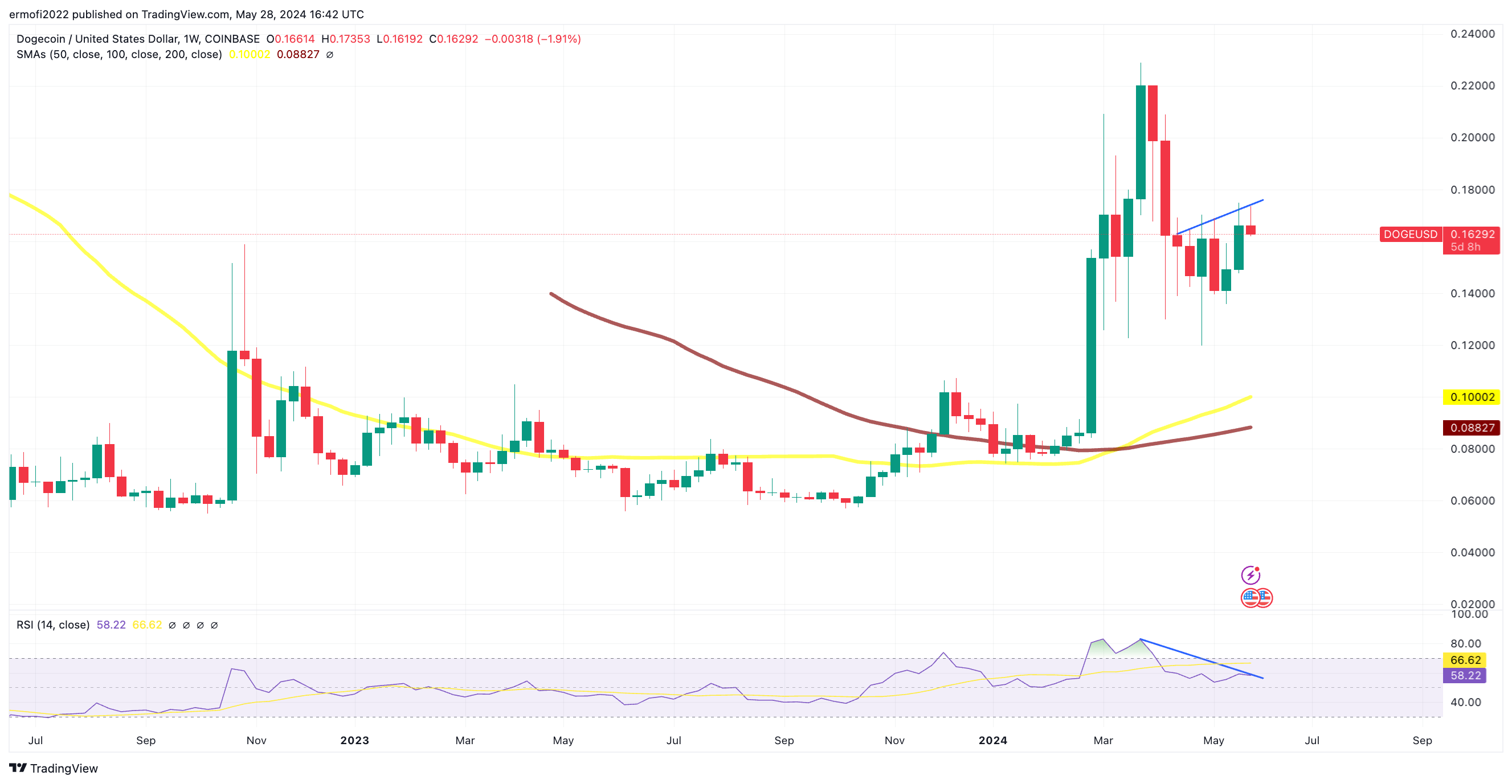

The recent price drop in DOGE followed a bearish divergence between its price and the relative strength index (RSI) on the weekly timeframe. Despite rising highs in DOGE price from April 15 to May 28, the daily RSI recorded lower levels, signaling weakness in the uptrend and encouraging traders to take profits.

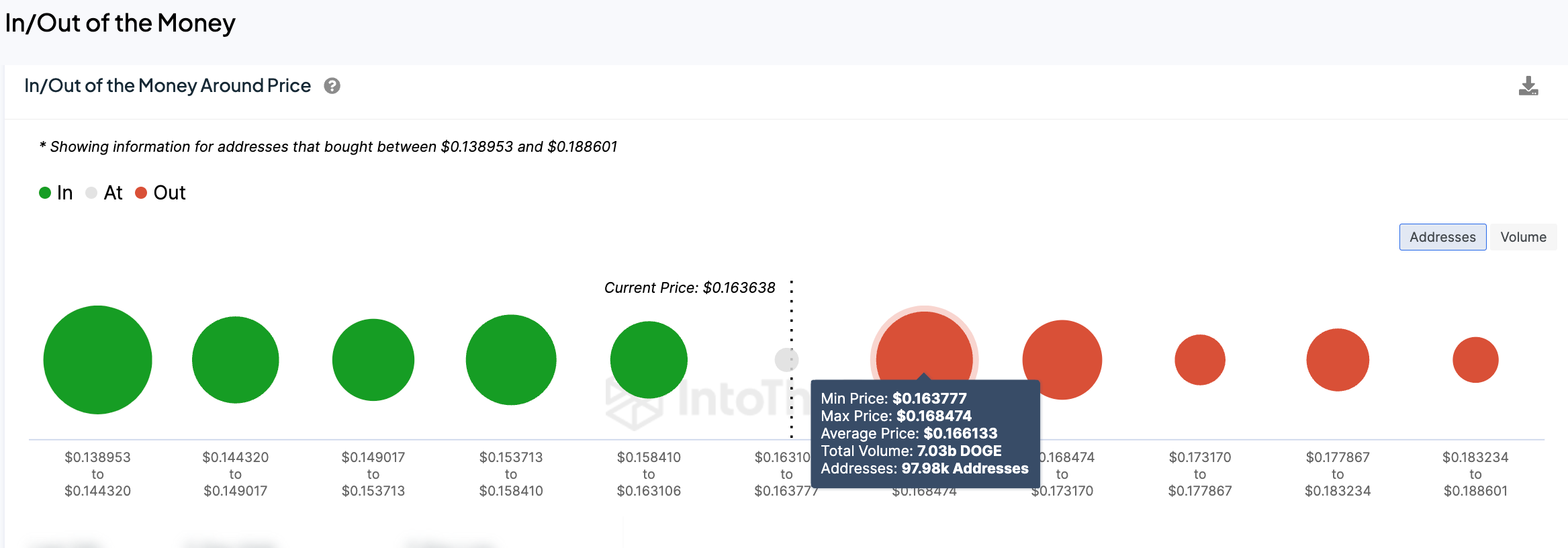

IntoTheBlock’s IOMAP model shows support for DOGE at the $0.165 region and resistance in the $0.163 to $0.168 range. Approximately 97,980 addresses purchased around 7.03 billion DOGE within this range. Increased selling from this level adds overhead pressure, potentially causing the price to fall. The 50-day simple moving average at $0.10 provides the next significant support level.

Türkçe

Türkçe Español

Español