On August 20, Dogecoin’s price recorded a 6% increase as it attempted to retest the $0.11 level. This rise also spread to a significant increase in volume. Shortly after, especially at the time of writing, the memecoin erased all these gains. While DOGE holders may hope for another rise, this analysis suggests it might be difficult.

What’s Happening with Dogecoin?

Data from Santiment shows that Dogecoin’s one-day Realized Value reached a low monthly level of $12.43 million. This data serves as the total cost basis for assets in an ecosystem. Considering this data, Realized Value is the value of all assets based on the last time they moved. An increase in this value indicates that the cryptocurrency could be priced higher as cheaper tokens are spent.

However, the decline is largely driven by capitulation because as more expensive assets are spent, crypto prices can be re-evaluated lower. Considering the above thesis, DOGE’s price may struggle to rise above $0.10 despite previous bullish signals.

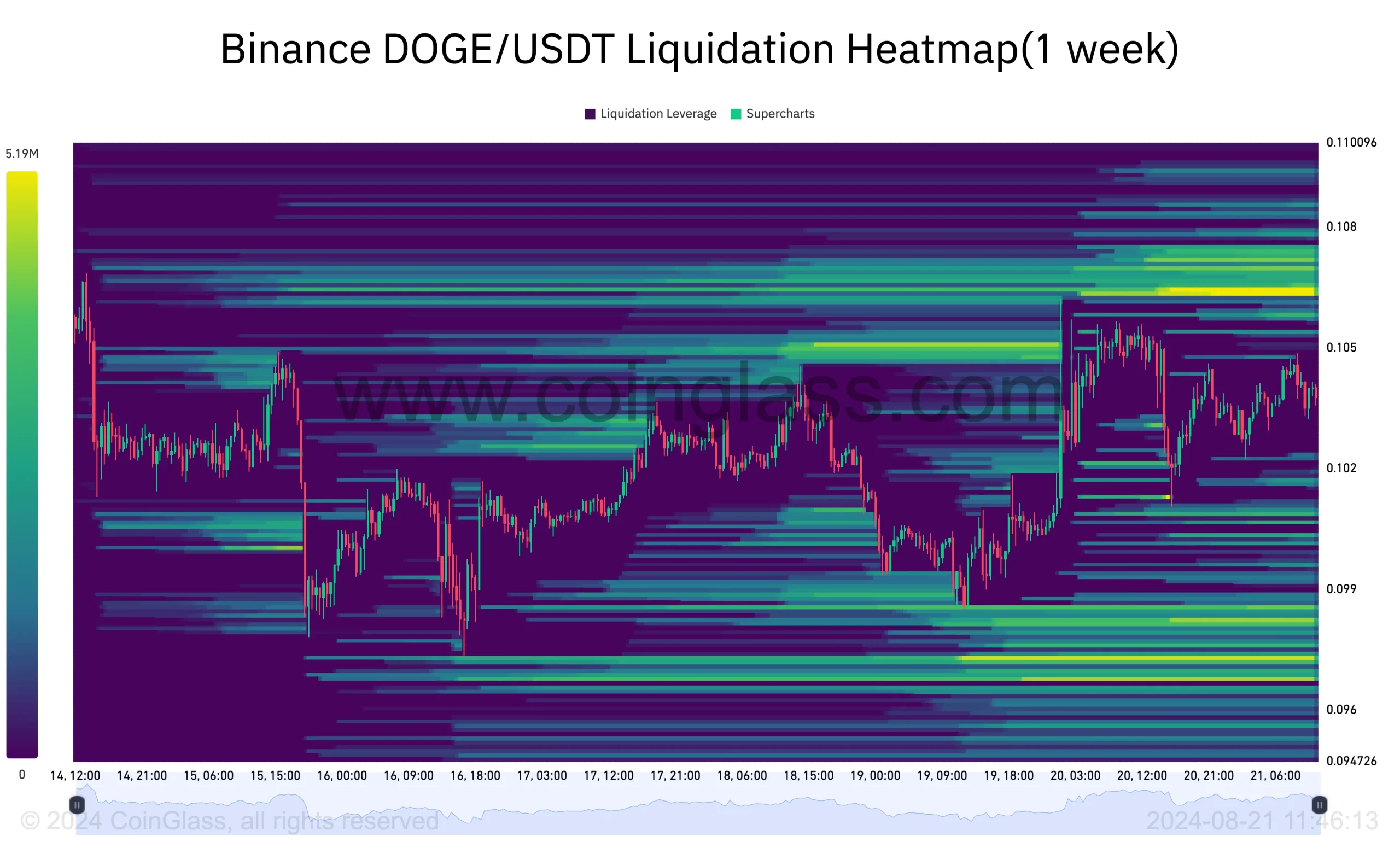

Liquidation data is another indicator showing that Dogecoin might struggle. This heatmap predicts the price levels at which large-scale liquidation could occur. For context, liquidation occurs when an exchange forcibly closes an open position due to insufficient margin balance to prevent further losses.

DOGE Chart Analysis

A technical perspective sheds more light on DOGE’s potential price movement. According to the daily chart, the Relative Strength Index (RSI) remains below the neutral 50.00 region. As a technical indicator that measures momentum, a value below the midpoint indicates that the token has not yet exited bearish dominance.

Although the RSI degree has increased, it needs to rise above the 50.00 mark to confirm a bullish trend. Therefore, unless this condition is met, it is not unreasonable to conclude that Dogecoin’s price may continue to fall below $0.09 and $0.10.

A look at Fibonacci retracement levels adds more insight to the prediction. Typically, the indicator determines the price levels a cryptocurrency can reach. At the time of writing, DOGE is hovering around the $0.10 retracement region, where the 23.6% Fib level is positioned. If market conditions remain the same, the price may not rise beyond this point.

However, an increase in buying pressure could change the situation. If this happens, DOGE’s price may attempt to reach $0.13, where the 61.8% Fib level is located. However, if the broader market crashes again as it did on August 5, Dogecoin’s price could fall back to the $0.08 level.