The price of Dogecoin has seen a slight increase this week, reaching up to $0.062 following the alleviation of initial concerns that FTX’s bankruptcy proceedings could liquidate its $42 million worth of DOGE assets. On-chain data analysis continues to explore how the confidence shown by long-term investors could contribute to further price increases in the coming days.

Last week, the price of Dogecoin went through a turbulent period after initial reports suggested that FTX exchange was preparing to sell its $42 million worth of DOGE coins as part of its ongoing bankruptcy proceedings to repay its creditors. However, in the official court filings published on Wednesday, DOGE surprisingly did not make it to the top 10 crypto assets list in FTX’s $3.4 billion property. Since then, DOGE has experienced a minor increase in price from $0.060 to $0.062.

What is the Current Price of Dogecoin in Turkish Lira?

The recent downturn in the cryptocurrency markets throughout the past month has led many leading projects in the top 100 crypto rankings, such as Litecoin (LTC), Sandbox (SAND), and Apecoin (APE), to decline to low levels on a yearly and all-time basis.

However, Dogecoin managed to stay above the $0.060 level during this challenging period, attracting attention. On-chain data suggests that the positive trend of DOGE long-term investors could be crucial in this regard.

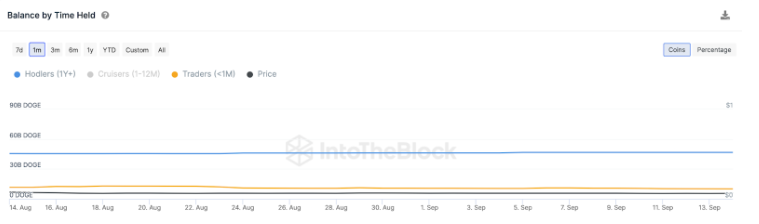

Data from IntoTheBlock reveals that so-called long-term holders increased their balances by 1.2 billion DOGE between August 14 and September 15. At the same time, short-term investors sold 1.56 billion coins.

Wallets that hold their coins for 1 year or longer are referred to as long-term holders. As seen in the graph above, these investors in Dogecoin not only hold but also actively increase their assets.

This situation can be considered as a bullish signal, especially during adverse market fluctuations. Therefore, this situation may affect new participants, and investors may also make their trades based on Dogecoin price expectations. If this assumption holds true, Dogecoin can achieve significant gains when sentiment in the memecoin markets turns bullish.

Dogecoin Analysis and Outlook

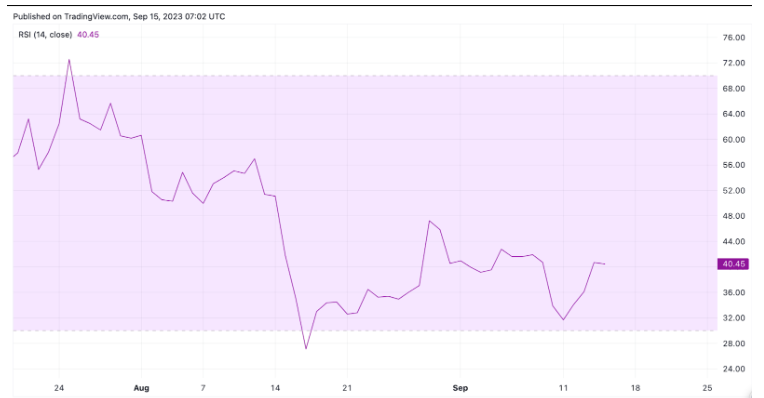

Since the official court filings revealed that DOGE is not included in FTX’s list of assets to be sold, Dogecoin bulls have gained significant momentum. The current Relative Strength Index (RSI) trends further confirm these claims. The chart below shows that DOGE’s daily RSI has been on an upward trend since September 11, reaching 40.45 on September 15.

RSI data evaluates the strength and momentum of the current price trend. As DOGE’s RSI rises towards the 40s, it indicates that the market has shifted from oversold conditions to a more balanced or neutral momentum. In summary, if long-term investors continue to HODL, the price of Dogecoin could experience higher gains in the coming weeks.

DOGE Price Prediction

Looking at the charts, Dogecoin’s price seems ready to make bigger gains when the momentum in the broader cryptocurrency markets turns bullish. However, there is a significant sell wall around the $0.07 range, which may pose a major obstacle for investors.

The Global Inflow/Outflow of Money Around Price (GIOM), which shows the distribution of entry prices among current Dogecoin holders, also confirms this prediction. GIOM vividly demonstrates that 377,570 addresses have bought an average of 35 billion DOGE at a price of $0.068. If current holders mine their cryptocurrencies at the current profitability rate, it could bring a correction in the price of Dogecoin. However, if the resistance level is surpassed, bulls can push the Dogecoin price towards $0.08.

Nevertheless, if the DOGE price makes a move below $0.055, bears could initiate a prolonged downtrend. In this case, the first support for investors could be provided by the fact that 466,770 addresses have purchased 6.45 billion DOGE at a maximum price of $0.060. Although it is not very likely, if the price fails to hold at this support level, Dogecoin could decline towards $0.055.