Analyses indicate that traders continue to maintain a positive stance on Dogecoin (DOGE) despite recent events in the market. In recent days, DOGE was seen moving towards the $0.30 level. However, within a few weeks, the price continues to trade between $0.17 and $0.22. As of the time of writing, following a more than 5% drop in Bitcoin in the last 12 hours, DOGE also experienced a 13% drop and fell to $0.17.

Current Status of Dogecoin

Looking at the Long/Short ratio data for DOGE, it appears that traders are not affected by performance. According to data provided by Coinglass, the 24-hour Long/Short ratio for Dogecoin was pointing to 1.02.

This ratio emerging on the Long/Short side is known as an important metric used to gauge the sentiments of Futures traders. A value below 1 can indicate the dominance of shorts. On the other hand, a value above 1 reflects the superiority of bulls and a positive structure.

However, relying solely on sentiments may not be enough for DOGE to break out of its narrow trading range. Therefore, looking at other indicators could be beneficial. Open Interest (OI) is another indicator that stands out.

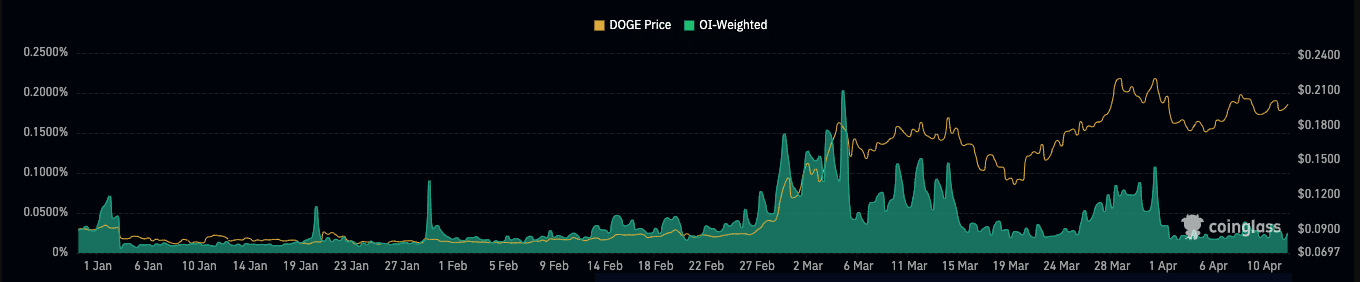

OI reflects information that indicates liquidity and interest in certain contracts in the market. This helps traders understand trends and potential movements. The rise in OI indicates an increase in market participants’ net positions.

As of the time of writing, Dogecoin’s OI value was pointing to $1.29 billion, which occurred despite the market correction. This could be interpreted as an indication that traders’ net positions are quite stable.

Consequently, the impact on price from external factors may be minimal. If OI continues to remain strong and a calm environment is established in the market, DOGE could potentially resume its upward trend and may target the $0.20 and later $0.25 levels.

What is Dogecoin’s Current Price?

In the midst of a strong market downturn, DOGE also took its share of the impact. After a 10% drop in the last 24 hours, the price has fallen to $0.17.

On the other hand, the market volume also experienced a similar decline, falling to $24.64 billion. Despite this drop, it continues to hold its 8th place in market volume ranking.

Looking at the 24-hour trading volume, DOGE saw a noticeable volume reaching $3.67 billion after an 85% increase.

Türkçe

Türkçe Español

Español