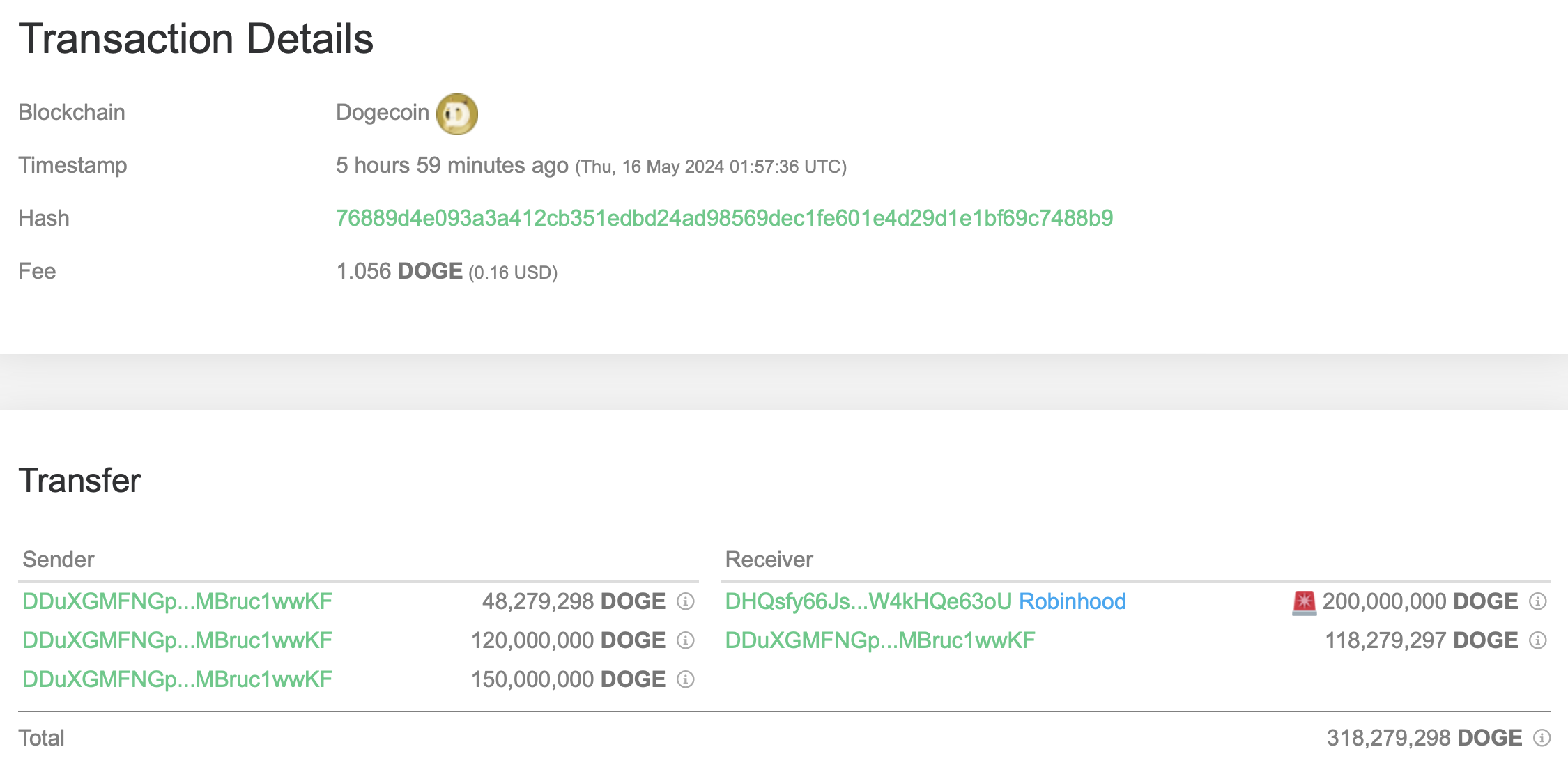

Leading altcoin Dogecoin (DOGE) has seen a notable price recovery with over 7% rise in the last 24 hours. In response to this recovery, a major investor or whale sold approximately 200 million DOGE worth $30.86 million. This transaction, conducted from an anonymous wallet to the popular trading platform Robinhood, has sparked speculation about potential selling pressure that could halt Dogecoin’s recent upward momentum in the crypto world.

Positive Data Flow for Dogecoin

This significant transfer has led to speculation that the crypto whale might be preparing to sell a substantial portion of their holdings. Such a move could create selling pressure and reverse the current rally. Nevertheless, buying pressure from other whale accumulations continues to support the DOGE price.

According to data from on-chain provider IntoTheBlock, there has been a noticeable increase in large Dogecoin transactions over the past month, peaking at 1.86 thousand transactions on May 14, 2024. This rise in network activity indicates increased participation from whales and institutional investors. Additionally, the volume of these transactions surged to 11.55 billion DOGE on the same day, signaling strategic positioning by major investors.

Currently, DOGE is trading above $0.15 and has even approached $0.16. As of today, DOGE is trading at $0.1556 with a market cap of $22.46 billion and a 24-hour trading volume of $1.96 billion, reflecting an 18.33% increase. Moreover, open interest in Dogecoin futures has risen by 11.83% to $884.94 billion, indicating growing interest among derivative investors. Additionally, short sellers dominate liquidations with $2.51 million, signaling a potential short squeeze that could sharply drive up DOGE’s price.

DOGE at a Critical Point According to Technical Analysis

On the other hand, technical indicators show that Dogecoin’s price dynamics are at a critical point. The 50-day Exponential Moving Average (EMA) around $0.1652 acts as a resistance. A breakout above this level could signal an entry into a bullish market and potentially push DOGE’s price to the next resistance levels at $0.18 and $0.20.

In a negative scenario, the 100-day EMA at $0.1434 stands out as a level providing support against significant declines. Just below this level, the 200-day EMA at $0.1237 serves as a major long-term support, and in the event of a drop, these two levels are expected to hold the price and prevent a deep decline.

Türkçe

Türkçe Español

Español