The victory of Donald Trump in the U.S. presidential elections has created a positive atmosphere for gold and Bitcoin (BTC)  $104,653. JPMorgan analysts expect these two investment assets to perform strongly in the upcoming period, particularly within the framework of the “value loss trade” strategy. This expectation involves investing in safe-haven assets to protect against the depreciation of currencies due to inflationary or expansive monetary policies.

$104,653. JPMorgan analysts expect these two investment assets to perform strongly in the upcoming period, particularly within the framework of the “value loss trade” strategy. This expectation involves investing in safe-haven assets to protect against the depreciation of currencies due to inflationary or expansive monetary policies.

Central Banks Turn to Gold

JPMorgan analysts noted that gold prices will be shaped by the purchasing pace of central banks until 2025. Following the Ukraine conflict and sanctions against Russia in 2022, gold purchases accelerated. However, the People’s Bank of China has paused its gold purchases since last April.

According to analysts, current tariffs and increasing geopolitical tensions may encourage central banks to move away from U.S. dollar reserves and shift toward gold, with countries like China expected to continue this trend.

Investment Demand for Bitcoin Is Rising

The market’s largest cryptocurrency, Bitcoin, surged to an all-time high of $76,244 following the results of the 2024 U.S. presidential elections and is currently trading around $75,100.

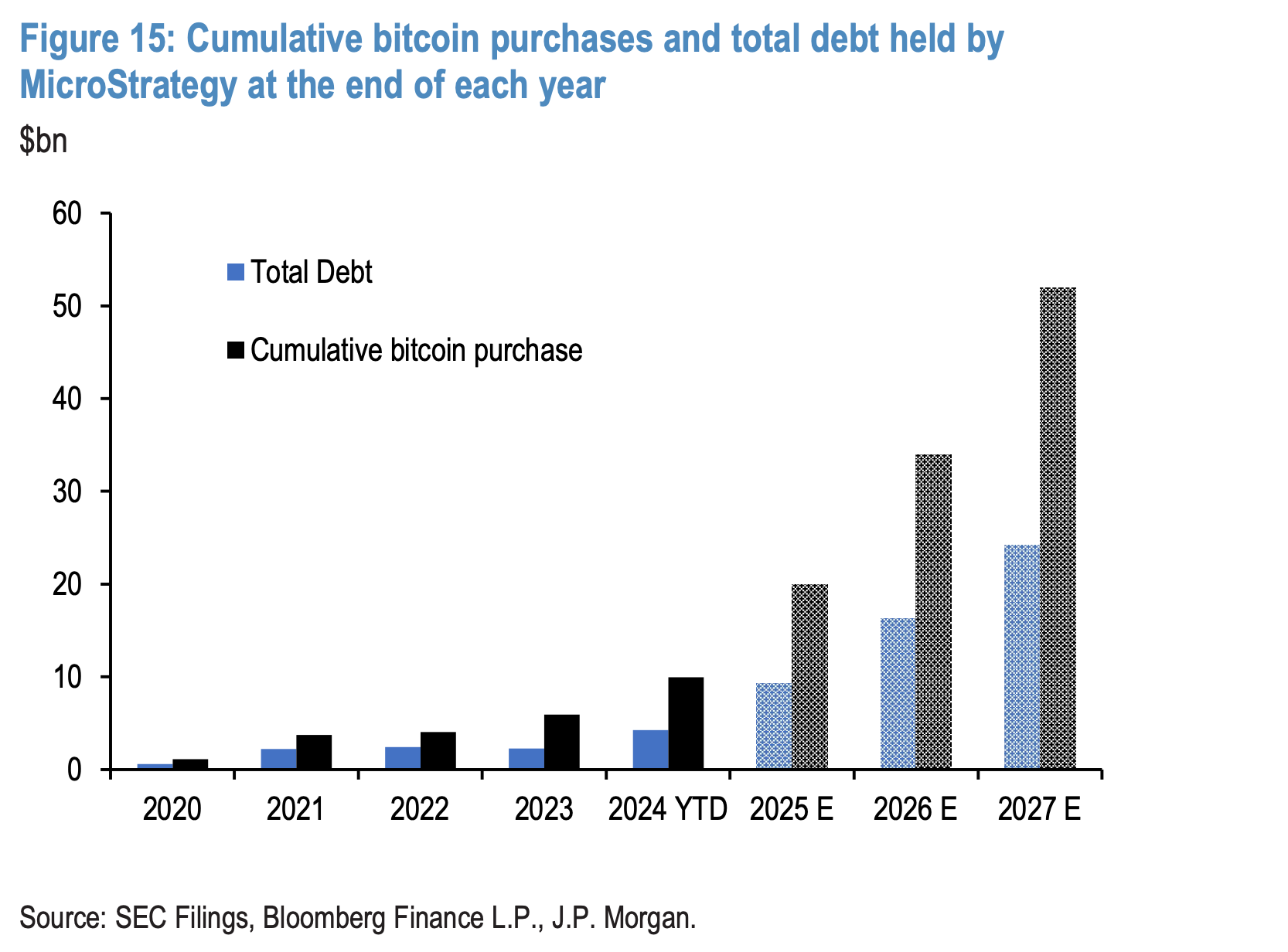

Furthermore, JPMorgan analysts predict that the largest cryptocurrency could follow a positive trajectory through 2025. Institutional investors, including MicroStrategy, are showing strong interest in Bitcoin. The company announced plans to invest $42 billion in Bitcoin over the next three years as part of its “21/21 plan.”

MicroStrategy’s plan translates to an annual investment of $10 billion, which emerges as a significant factor supporting Bitcoin’s price in 2025.

Türkçe

Türkçe Español

Español