Cryptocurrency world is witnessing continuous strategic moves by DWF Labs, especially with their recent deposit transactions to the Binance cryptocurrency exchange. This new investment move certainly has significance for both DWF Labs and the market. It not only demonstrates the famous market maker’s confidence in the market but also points to their strategic maneuvers aimed at maximizing returns.

DWF Labs Sustains Altcoin Investments

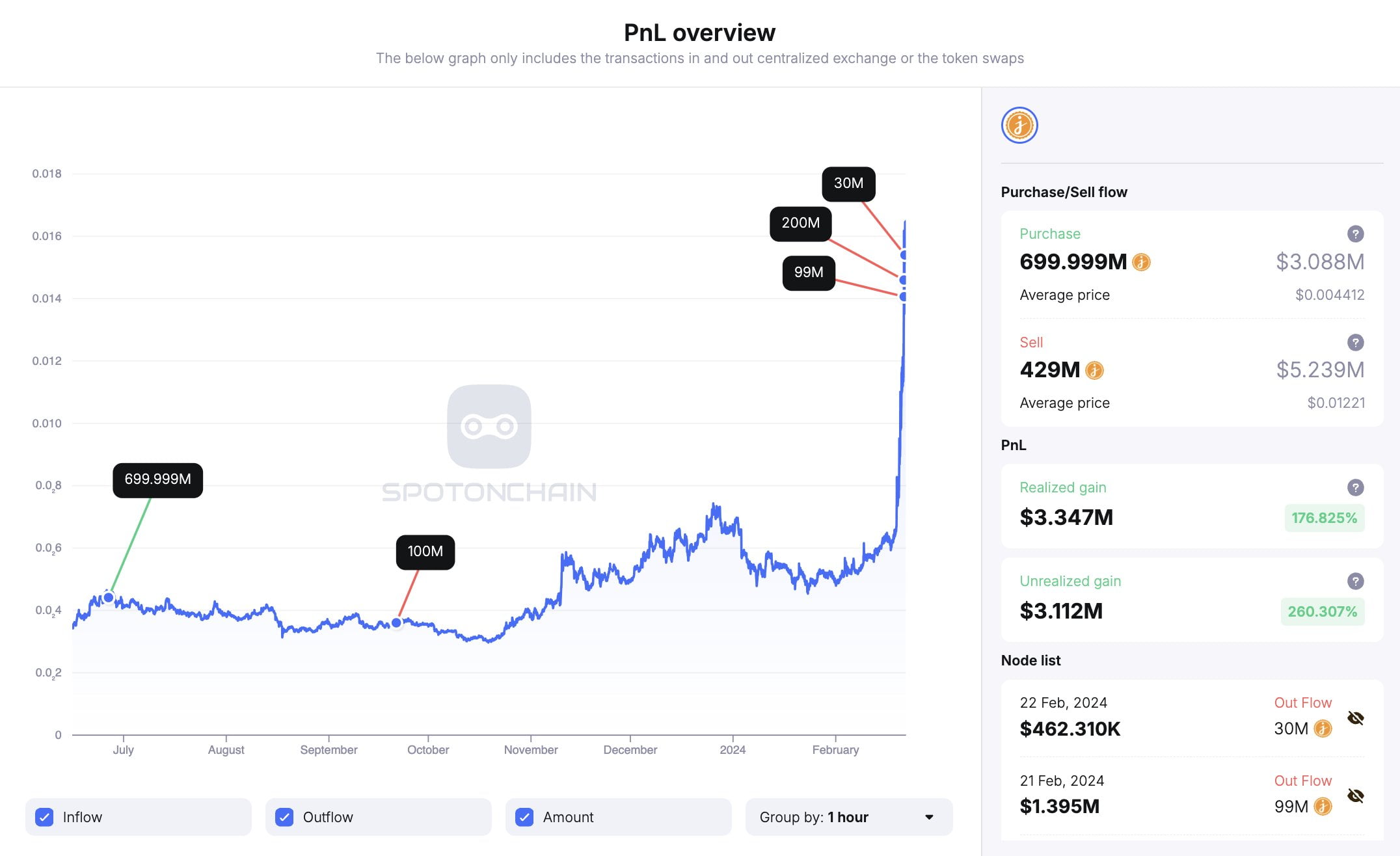

DWF Labs’s first investment move was made into the JASMY token. The market maker added 329 million JASMY tokens to its portfolio at a price of $0.01483 per token. This step increased the value of their existing 271 million JASMY tokens to $4.31 million. This impressive investment is noteworthy as it demonstrates the potential profitability of crypto ventures, with DWF Labs realizing a total profit of $6.44 million.

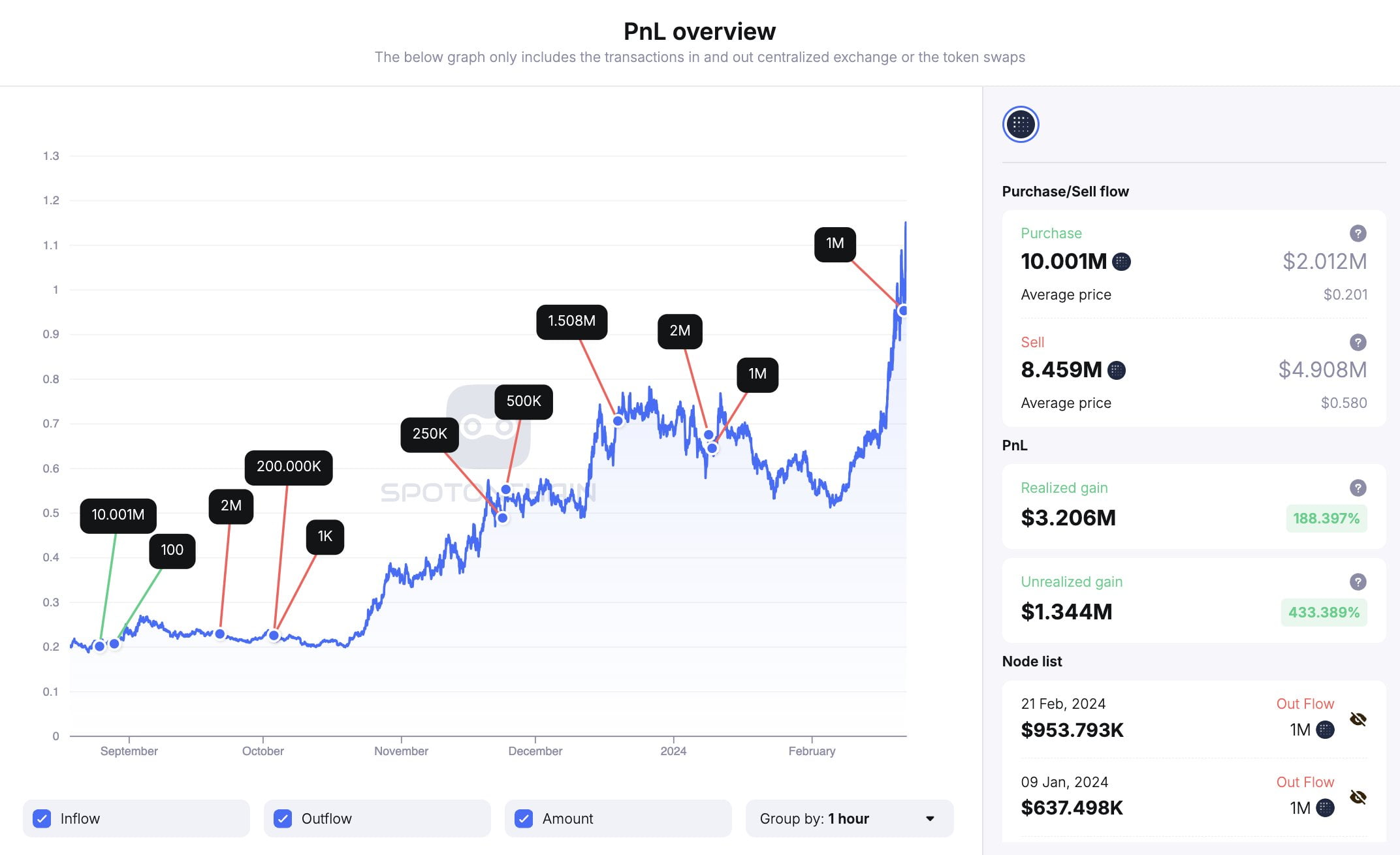

However, the renowned market maker DWF Labs did not stop there and continued its investments. Their second move was directed towards the FET token. The company made an investment of $954,000 for 1 million FET tokens at a price of $0.954 per token. This new investment raised their existing FET assets to $3.27 million. The company currently holds 3.05 million FET tokens. This strategic move also resulted in positive outcomes, bringing the company a total profit of $4.55 million.

What Does DWF Labs’ Move Signify?

The swift and impressive actions of DWF Labs in the cryptocurrency world once again highlight the sector’s dynamism and potential. The company’s investments not only contribute to its own growth but also enhance the overall health and confidence in the cryptocurrency world. Such significant investments increase confidence in the sector, attracting more investors to cryptocurrencies.

There is also a message here for investors. We often hear about rapid growth and returns. However, investors should not overlook the volatility of cryptocurrency. We are in a market with rapid ups and downs. It will be beneficial for investors to act with this reality in mind when making their moves.