One of the largest DeFi platforms, DYDX, made a fantastic start in 2021, and the airdrop was extremely satisfying. However, since only a small portion of the total supply was initially circulated, the prices around $20 have long been forgotten due to ongoing unlockings. So what does it mean for the DYDX price to exceed $3?

DYDX Commentary

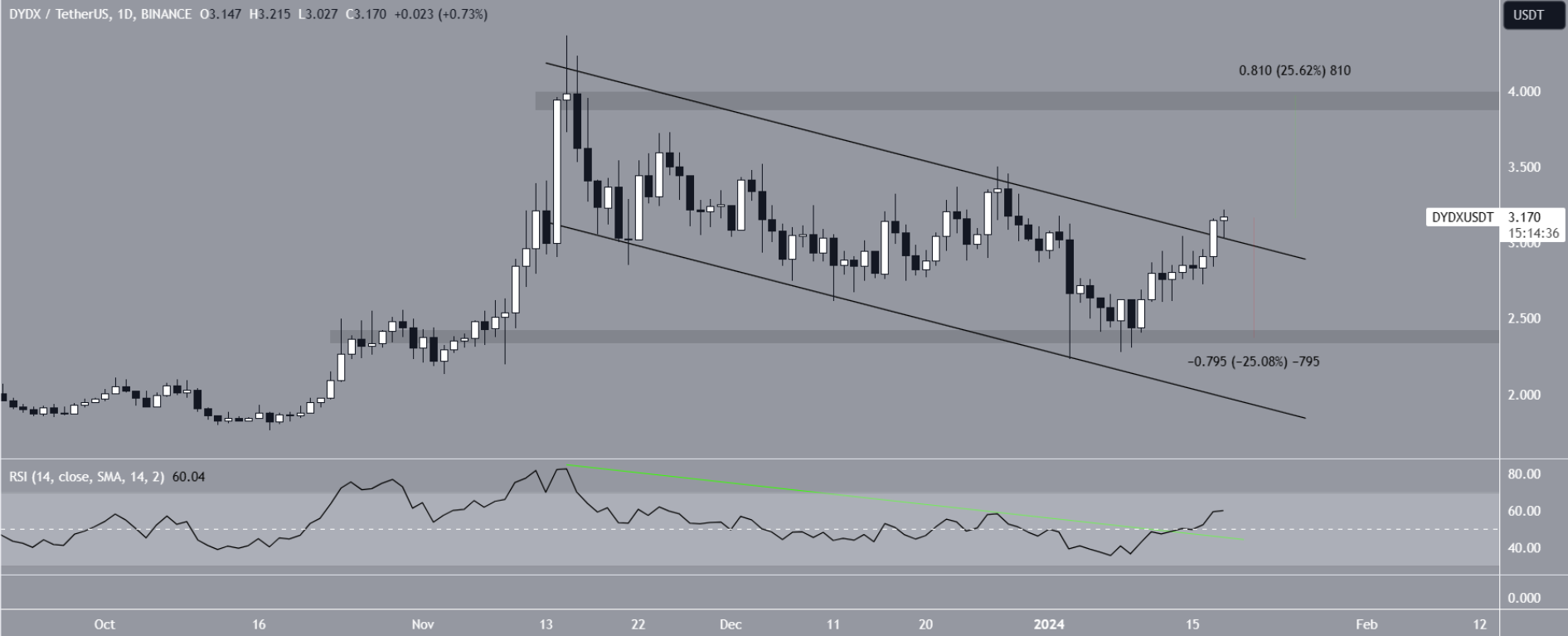

As the article is being prepared, while a significant portion of altcoins are painted red, the DYDX price continues the day with an increase of about 5 percent at $3.08. The DYDX price has been rising within an ascending parallel channel since the beginning of 2023. The cumulative value of cryptocurrencies and BTC had formed similar structures. Although BTC lost the channel’s support with the recent drop, DYDX managed to remain strong.

The channel’s support and resistance lines were last confirmed in November. DYDX, which has reclaimed the horizontal area in the last two weeks, now manages to stay strong despite the negative sentiment in the overall market. The weekly RSI supports the bullish scenario.

DYDX Price Predictions

Crypto analysts on social media also generally express the view that the rise will gain momentum. Cryptocurrency investor Nihilus wrote that the momentum would increase even more when the price breaks out from the resistance trend line. Then DYDX successfully made the breakout and exceeded $3.

CryptoDude999 emphasized his belief in the rise following the recent breakout and wrote that the target is above $4. The third analyst, KMvision, confirmed the optimism of analysts expecting a peak above $4 and agreed with this view.

In November 2023, the price, which was rejected from the channel’s resistance line, can be considered justifiably optimistic as it has surpassed this area on the daily chart. The daily RSI is above 50 and rising along with the price, indicating that the target above $4 can be achieved.

If the upward movement continues, DYDX could increase by 25% and reach the next resistance level, which is $3.9. Beyond that, there are targets at $4.36 and $7.2. The price had last exceeded $7 during the April 2022 rally.

However, closures below the channel’s resistance line will render the recent breakout unsuccessful and will start a downward journey targeting $2.4.

Türkçe

Türkçe Español

Español