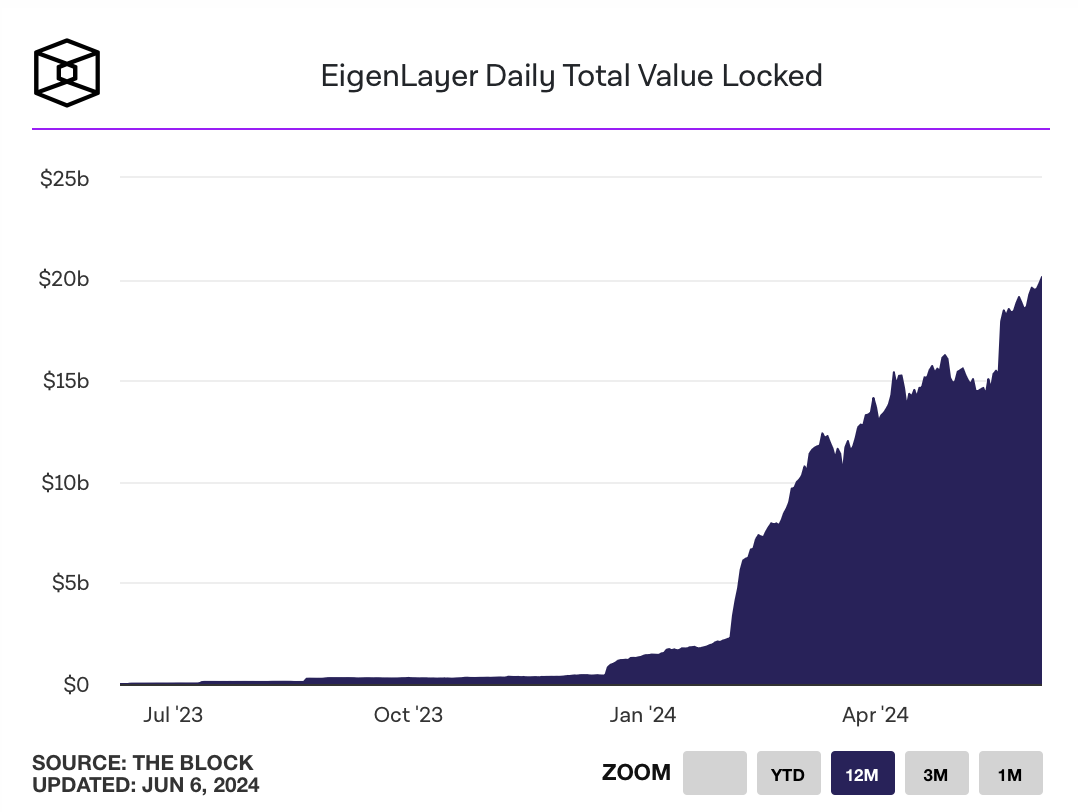

The total value locked (TVL) in the restaking protocol EigenLayer has soared to $20.09 billion, making it the second-largest DeFi protocol after Lido (LDO). According to data, this significant growth marks an important milestone for EigenLayer, which started the year with a TVL of $1.4 billion and currently holds 5.21 million Ethereum (ETH).

Rapid Growth Driven by Market Dynamics

At the beginning of March, EigenLayer’s TVL was approximately $10 billion, with 2.93 million ETH. The recent increase in TVL can be attributed to the rise in deposits and the price of ETH. EigenLayer’s mainnet launch in April and the subsequent token distribution plan were crucial in attracting more deposits to the protocol.

For those unfamiliar, EigenLayer’s unique restaking model allows users to deposit ETH and various liquid staking tokens, which are then used to secure third-party networks. This shared security model benefits third-party applications known as actively validated services, allowing them to secure themselves through a collective pool of restaked ether. This approach not only enhances security but also incentivizes users to participate in the network.

The protocol initially faced notable outflows due to community backlash over low individual AirDrop allocations and the non-transferability of tokens. The dissatisfaction was linked to the linear token distribution model, which many users found unsatisfactory. In response, the Eigen Foundation expanded AirDrop allocations for all users and clarified the timeline for token unlocks and transferability. These adjustments helped address community concerns and increased fund inflows to the protocol.

Significant Inflows Following Adjustments

EigenLayer saw a significant increase in protocol deposits following changes to AirDrop allocations. Notably, over half a billion dollars were deposited on the platform on May 31, indicating a resurgence in investor confidence. Data from The Block on daily net flows to the protocol shows a significant increase in inflows, highlighting this positive trend.

The Eigen Foundation allocated 15% of the 1.6 billion token supply for user distribution across various stakedrop seasons, with 5% already allocated as of the March 2024 snapshot. Currently in its second stakedrop season, EigenLayer continues to attract user interest with its innovative model and growth potential.

Türkçe

Türkçe Español

Español