According to a new claim, El Salvador could become a new financial center in the Americas, following in the footsteps of Singapore. Gabor Gurbacs, the strategy advisor at investment management firm VanEck, revealed in a post on October 28th that he frequently discusses this topic with portfolio managers and asset allocators. The steps taken by the country’s government are closely followed by many financial companies.

Singapore Comparison for El Salvador

Similar to Singapore’s move in the late 1990s, Gurbacs expects that new capital investments and migration policies will be the main driving forces behind El Salvador’s growing economy in the next few years. This prediction came in response to a post titled “Move to the New Country of Freedom, El Salvador,” shared by American broadcaster Max Keiser on October 28th.

Keiser, who resides in El Salvador, highlighted Bitcoin and the US dollar being the official currencies, low crime rates, and the country’s beautiful beaches and coffee as the main reasons why the Central American country is on everyone’s radar.

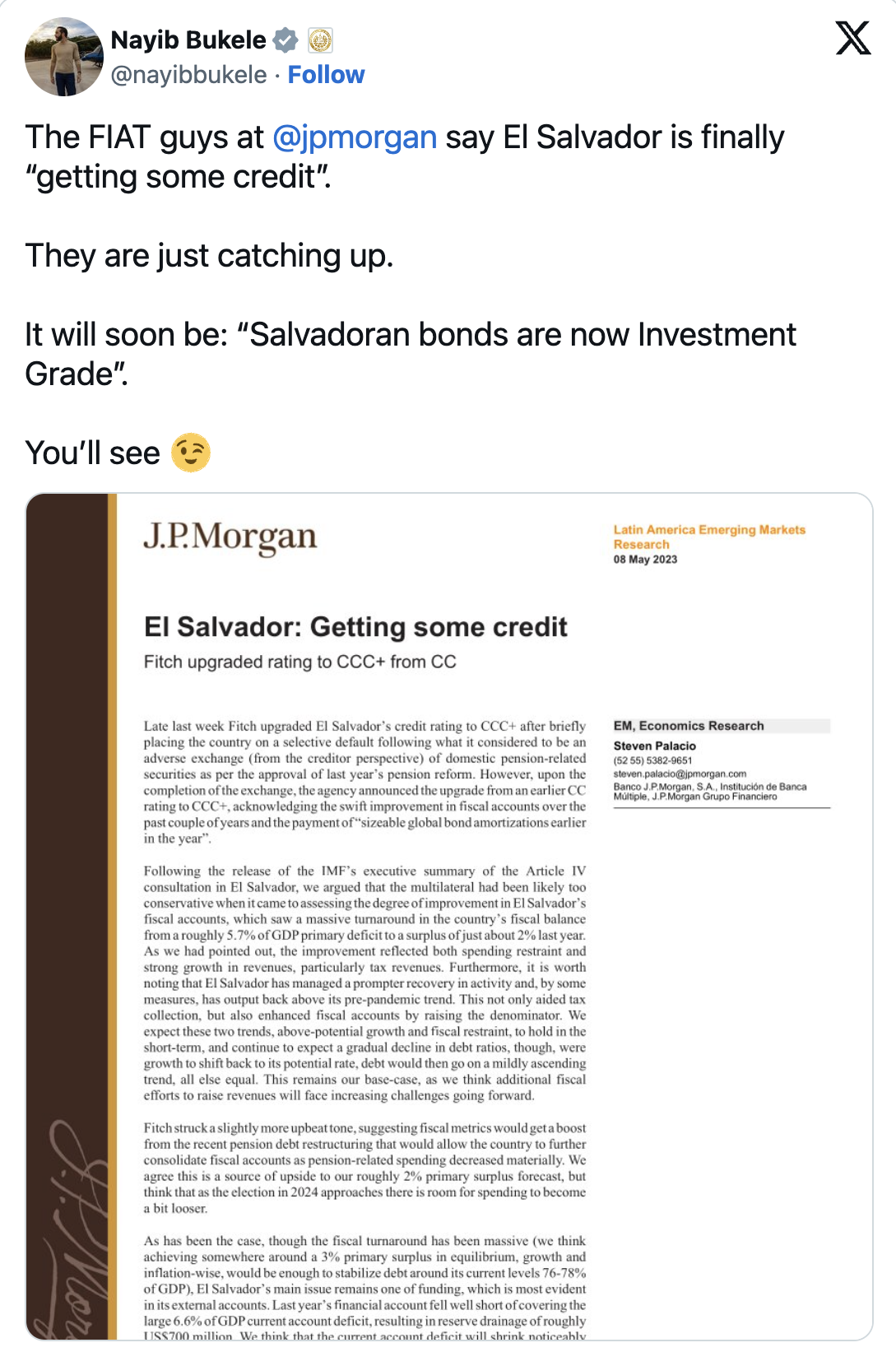

The country’s rising economic status has attracted even more attention with Nayib Bukele being elected as the country’s president in June 2019. El Salvador’s government bonds have outperformed many other emerging markets this year, delivering an impressive return of around 70% until August. This has also caught the attention of JPMorgan and other major financial companies.

The Rise of El Salvador

Under the presidency of Nayib Bukele, the government of El Salvador recognized Bitcoin as a legal tender in September 2021 and introduced Chivo Wallet, a Bitcoin storage wallet for all citizens, within the same week.

Additionally, the country utilizes its volcanic resources to support its venture, Volcano Energy, a Bitcoin mining operation that started operating in June after a $1 billion investment. In line with this, the first mining pool was launched in October following a partnership with Bitcoin miner Luxor Technology.

El Salvador appointed Saifedean Ammous, the author of “The Bitcoin Standard,” as an economic advisor to the National Bitcoin Office in May. The government plans to implement a Bitcoin accumulation strategy to clear its external debts within the next five years. Furthermore, President Nayib Bukele made a bold move in April by eliminating all taxes on technological innovations, which could be an attractive step for more entrepreneurs and foreign capital to enter the country.