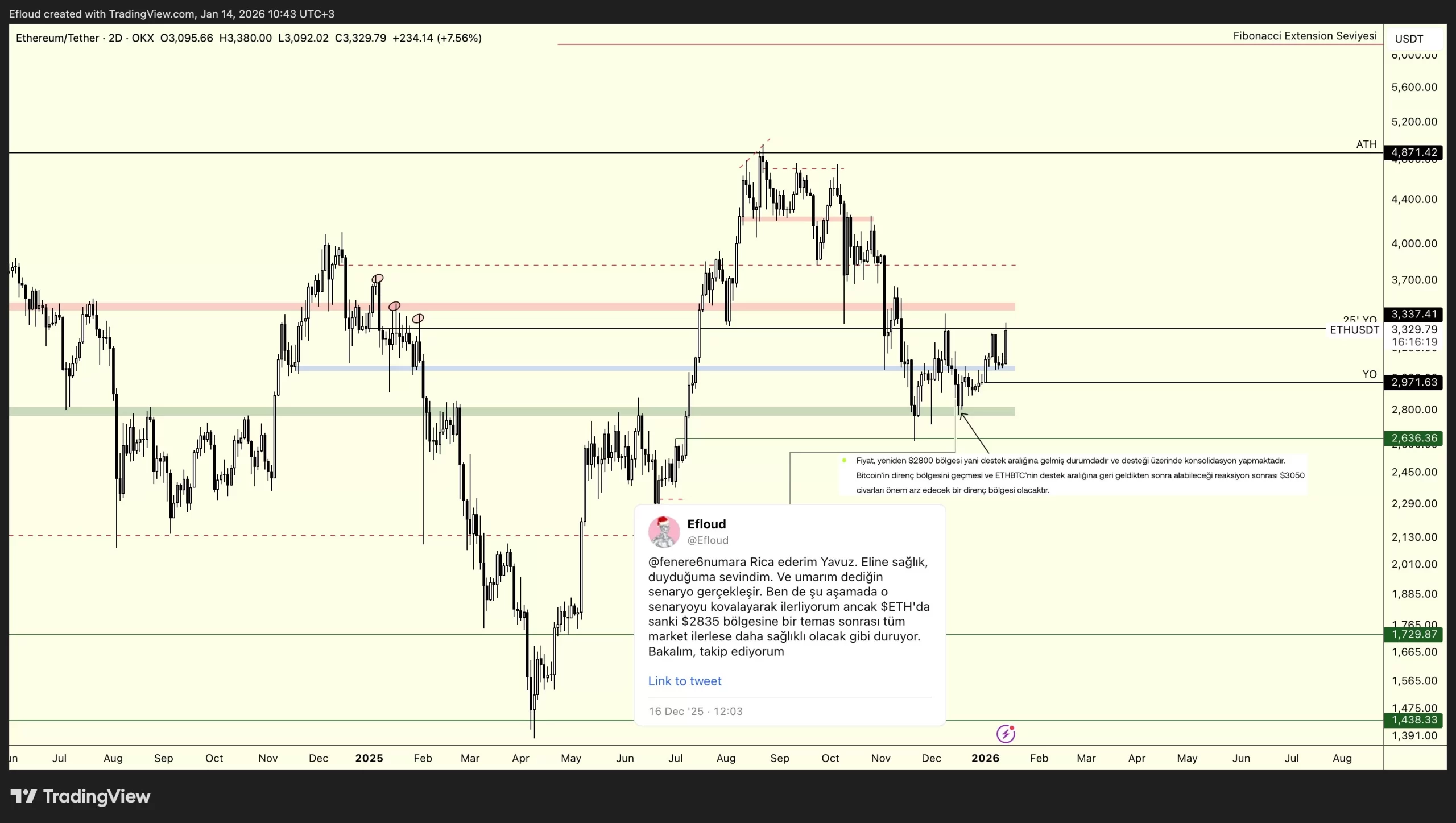

As of the latest report, Trump remains noncommittal during a signing ceremony, with Bitcoin hovering near $97,000. Meanwhile, Kashkari criticized cryptocurrencies as useless for individual investors. On the other hand, the crypto market scene is buzzing with Ethereum’s short and long-term chart analyses shared by Efloud.

Ethereum’s Price Dynamics

Ethereum (ETH) is currently trading above $3,300. Analyst Efloud expresses satisfaction with the green zone serving as a support level in the short term. In the long term, the blue zone ties in as a crucial support area. The initial target cited is $3,500, where the analyst plans to close positions at this level.

In a short-term timeframe, the $3,180 level could act as support. A breach of the red zone might lead to testing around $3,700, with the analyst emphasizing that no loss in support levels maintains bullish momentum.

Stability in ETH charts is crucial for other altcoins as well. Although the 0.0322 BTC level holds as support in the ETHBTC pair, the prior resistance point of 0.0354 BTC remains unattained. It implies that joy in altcoins may be premature. Should BTC maintain closures above $96,000, altcoin liquidity could increase as $98,000 testing begins.

Otherwise, a brief speculative spike in BTC could leave room for altcoins experiencing deeper lows. The delay in the Supreme Court decision hints at a potential pro-Trump verdict; however, certainty will come with the finalized decision this month.

Bitcoin at a Crossroads

For months, the crypto markets have been in turmoil, with early 2026’s rise associated largely with normalization. On-Chain Mind observes the current situation through BTC’s monthly active supply lens, indicating we might be in a reward phase and expecting further ascent.

“Bitcoin’s monthly Active Supply exceeding ~100,000 BTC aligns with the major turning points.

- Sudden increases during rallies denote distribution.

- Surges during sales usually indicate ultimate capitulation and significant troughs.

When activity collapses or turns negative, accumulation always profits. We are now in this final stage.”