Financial instruments tied to the US dollar are attempting to offer new opportunities for markets outside the country. Ethena Labs, a venture that received $14 million in funding for an Ethereum-based synthetic dollar, supports this claim. The Ethena team announced the fund, which is backed by venture capital firm Dragonfly among other investors, on February 16th.

Ethena Secures $6 Million Investment

In an earlier investment round in 2023 to launch decentralized finance solutions built on the Ethereum network, Ethena successfully raised $6 million from Binance Labs, Gemini, Bybit, Mirana Ventures, OKX Ventures, and Deribit.

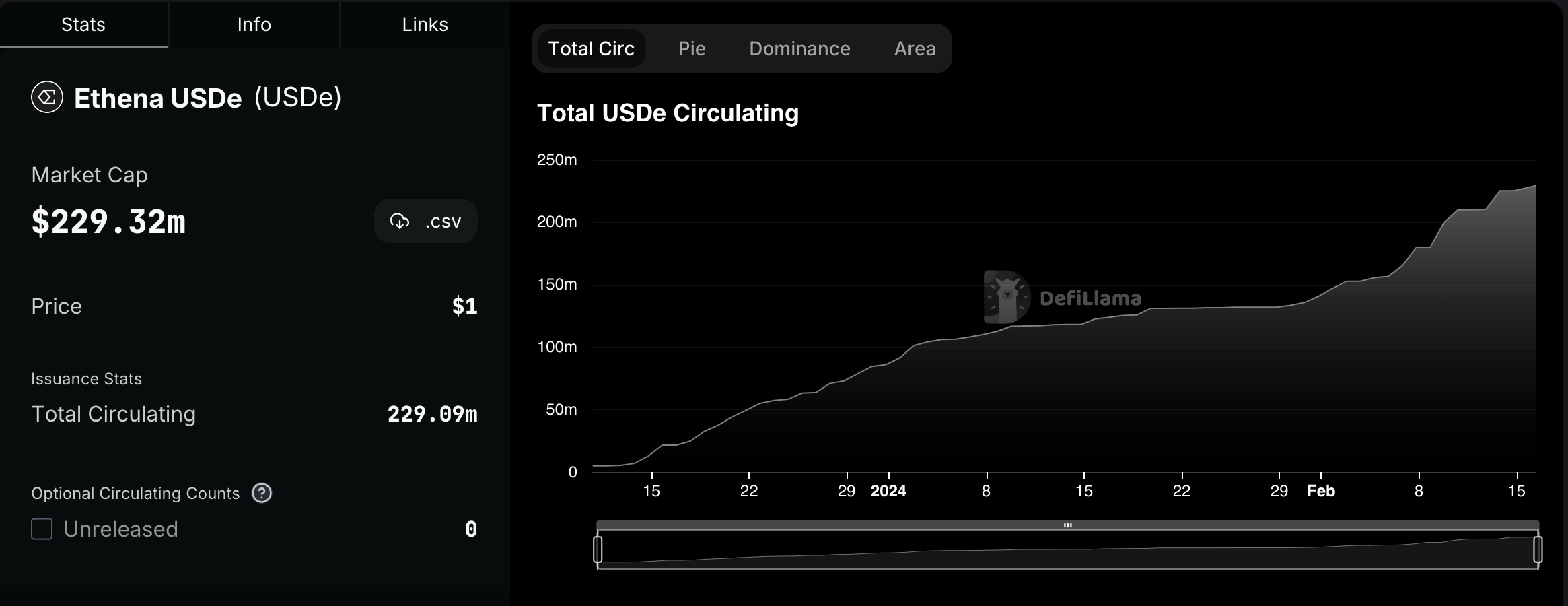

The capital will support USDe, a synthetic dollar backed by delta-hedging strategies using Ethereum as collateral. According to data from blockchain analytics platform DefiLlama, the platform has locked in a total of $200 million in assets since its launch in December. The company stated the following:

“USDe,” maintains its hard peg to the US dollar by delta-hedging the assets provided by users who mint USDe against short-term Ethereum collateral through continuous swaps to achieve delta-neutral stability.

Noteworthy Details About USDe

USDe aims to maintain its peg to the US dollar through a combination of hedging strategies. It uses financial derivatives such as arbitrage and continuous swap contracts to keep the cryptocurrency’s value stable against the dollar; this represents a different approach from typical stablecoin projects that use direct collateral or algorithmic methods to maintain their value. Guy Young, CEO of Ethena Labs, commented on the issue:

“Stablecoin projects are seen as the most important tool within crypto, and despite issuers fully internalizing the yield, they are the only idea that finds real product market fit with a global demand of over $130 billion.”

For example, leading stablecoin issuer Tether reported a significant profit of $2.85 billion in the last quarter of 2023, including approximately $1 billion in interest earned from US Treasury securities that back most of the stablecoin assets, due to the impact of returns generated from Tether reserves:

“The entire field relies on collateral-backed central stablecoin projects within the banking system. Providing a crypto-native synthetic dollar alternative is, in our view, the biggest opportunity in the space.”

Türkçe

Türkçe Español

Español