The latest on-chain data reveals that the foundational cryptocurrencies Ethereum (ETH) and Bitcoin (BTC) exhibit interesting differences in network dynamics and investor sentiment. While Bitcoin has seen a decrease in transaction fees and net outflows from exchanges, Ethereum presents the opposite scenario. The largest altcoin has witnessed a significant drop in transaction fees coupled with an increase in net inflows to centralized exchanges, experiencing the highest weekly inflow to exchanges since September 2022 amidst regulatory uncertainties in the US.

Ethereum’s Performance Amid Criticism

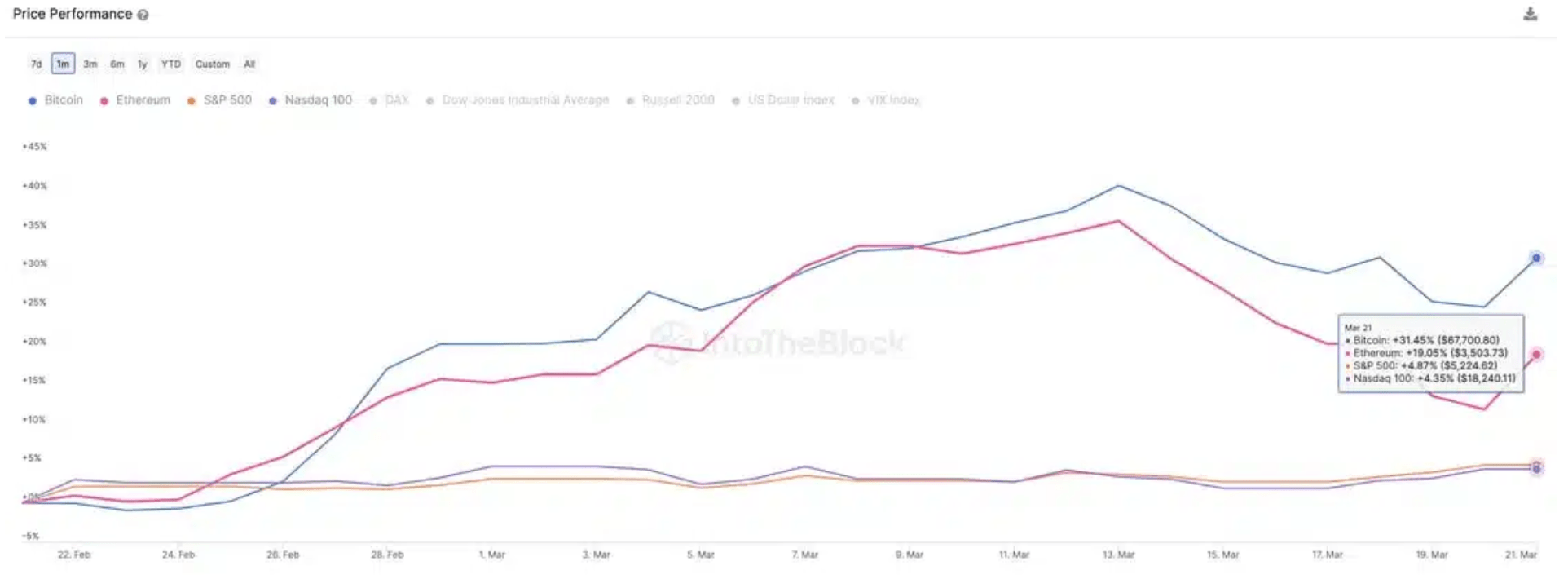

Ethereum, often criticized for underperforming compared to Bitcoin and traditional markets, reveals a complex narrative when its on-chain metrics are examined more closely. Despite all the criticism, Ethereum’s strength is becoming apparent as transaction volumes in its main network and Layer 2 scaling solutions increase.

This on-chain momentum highlights the strength of Ethereum’s network fundamentals and ongoing adoption within its ecosystem, reminiscent of previous market peaks.

Especially amidst regulatory issues in the US, Ethereum’s long-term investors have shown remarkable resilience by accumulating ETH and elevating their holdings to unprecedented levels. This accumulation trend signals unwavering confidence among Ethereum’s loyal investors, allowing the network to demonstrate strength amidst challenges.

Critical Threshold: $3,000

Technical analysis suggests that ETH has reached a critical turning point in its price trajectory as short-term EMAs fall below long-term EMAs, indicating a potential downtrend on the table.

The price of the altcoin king is navigating a complex sentiment between market sentiment and technical indicators, with the $3,000 mark serving as a psychological threshold that requires particular attention. If the price continues to stay above this level, an upward trend can be expected, but a break below could trigger a sharp decline. However, strong catalysts such as the potential approval of a spot Ethereum ETF in the US could positively impact investor sentiment and lead to strong upward movements.

With the latest data, ETH is trading at $3,420, up 2.90% in the last 24 hours. The data shows that the altcoin king has fallen 6.69% in the last 7 days, yet it has risen 15.58% in the last 30 days.

Türkçe

Türkçe Español

Español