The price of the biggest altcoin, Ethereum (ETH), started the new week with a noticeable increase after successfully resisting the selling pressure due to rising inflation in the United States. ETH, which briefly succumbed to selling pressure over the weekend, bounced back from the $1600 support and is currently trading at $1640, taking advantage of the bulls’ growing market sensitivity.

Ethereum Bulls in Action Again

Since the US Securities and Exchange Commission (SEC) filed a lawsuit against crypto exchanges Binance and Coinbase in June, accusing them of offering unregistered securities sales for various altcoins, including Cardano (ADA), Solana (SOL), and Polygon (MATIC), the negative pressure in the market has continued to support ETH’s price above $1530.

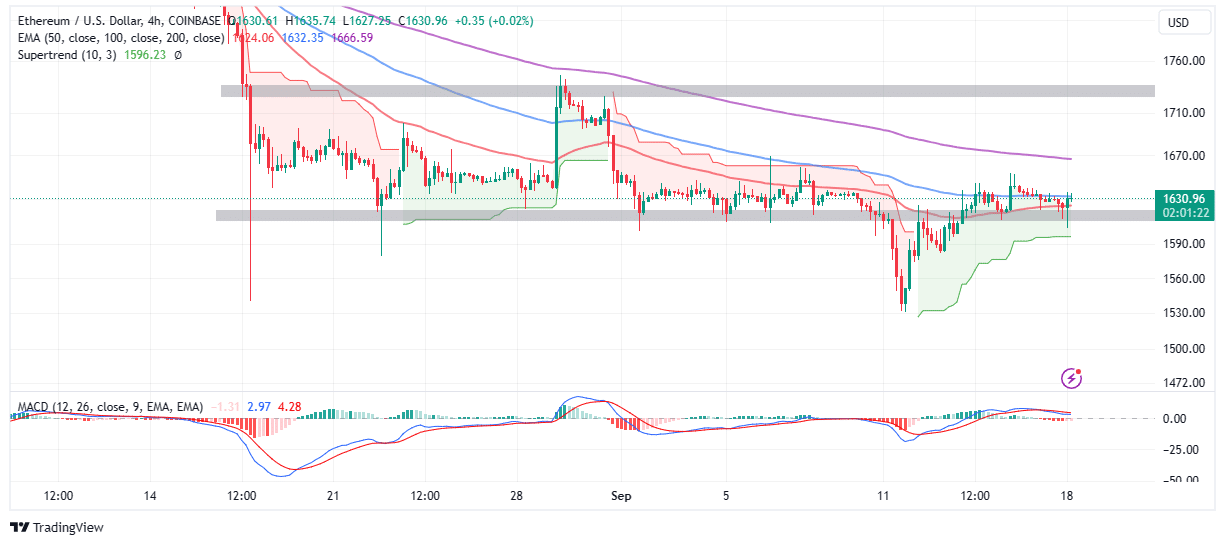

The price may consolidate around the upper limit of $1700, which is the next breakout target before aiming for the highs above $2000, by holding above the high support zone from $1600 to $1630. Based on the Moving Average Convergence Divergence (MACD) indicator, the price of ETH may move horizontally until it weakens the immediate resistance at $1632, highlighted by the 100-day Exponential Moving Average (EMA) (blue).

The 50-day EMA (red) at $1623 serves as crucial support, providing relief for the major buyer congestion zones at $1600 and $1530, respectively. Investors may wait for a buying signal from the momentum indicator. New or additional buying orders above the 100-day EMA can only be placed after the blue MACD line crosses the red signal line on the four-hour timeframe price chart.

GRAPH

The possibility of the approval of the first futures-based Ethereum exchange-traded fund (ETF) in the US requires the current technical outlook to continue developing for Ethereum to maintain the much-needed stability. Market experts and analysts believe that even though a futures-based ETF does not have a direct correlation with the Ethereum spot price, it confirms the regulatory body’s willingness to approve crypto investment products.

Bitcoin‘s price increased by more than 60% after the approval of a similar product in 2021, significantly contributing to the previous bull run. If a futures-based ETF receives a green light from the SEC, Ethereum’s live price may outperform Bitcoin.

Decreasing ETH Supply on Crypto Exchanges

Fundamental data shared by the on-chain analysis platform Santiment reveals that the supply of Bitcoin and Ethereum on crypto exchanges continues to decrease due to investors holding onto their ETH without selling. The decrease in supply on crypto exchanges tends to increase demand, creating an ideal environment for the expected price increase of ETH.

Furthermore, the largest stablecoin, Tether (USDT), is entering exchanges in large volumes, and according to Santiment analysts, this flow is currently at its highest level since March. The increase in USDT flows to crypto exchanges indicates a greater interest in future purchases.

Investors buying USDT indicate their readiness to take advantage of the opportunity to buy Ethereum if the SEC approves the futures-based ETF in October.