Ethereum continues to receive signals of a rising market. On August 14th, stake deposits reached an all-time high, with a total of 27.40 million ETH locked in, and Ethereum Name Service (ENS) collected $235,000 in fees in a single day, marking the highest value since September 11, 2022. Both of these record-breaking metrics indicate that Ethereum investors are willing to keep their funds on the Ethereum network for various reasons.

Data Sparks Excitement

According to data from Glassnode, a blockchain data analysis platform shared by Finbold, there is a total of 27,407,435 ETH locked in the ETH 2.0 deposit contract. Investors deposit these amounts to become validators of the network and are rewarded with an annual yield of approximately 3.29%. However, they cannot sell their tokens in the short term.

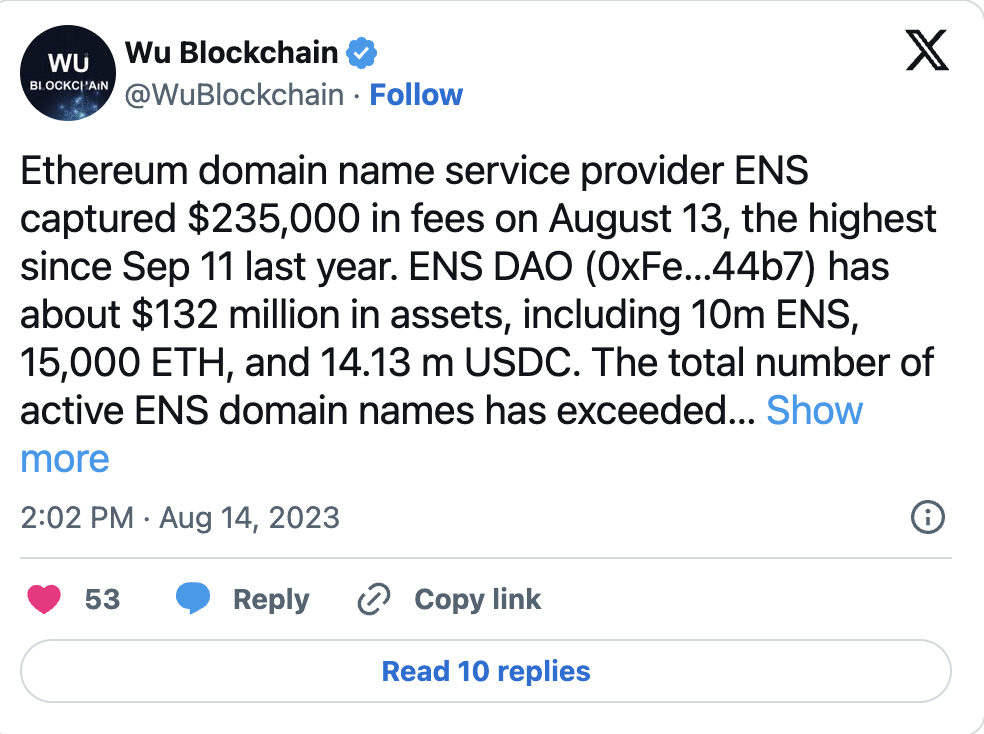

According to Ethereum Name Service data, a report prepared by renowned crypto journalist Colin Wu states that the daily fee record paid to the ENS service for buying an Ethereum address has been broken. These addresses are traded as Ethereum domain names and provide a unique domain name that can be used to receive transactions made on the Ethereum blockchain network, instead of complex wallet addresses.

The increased fees indicate a higher demand for registering new addresses by users and investors of the leading Layer-1 smart contract blockchain network in the cryptocurrency market. According to Wu, the total number of active ENS domain names has exceeded 2.6 million.

Ethereum Price Analysis

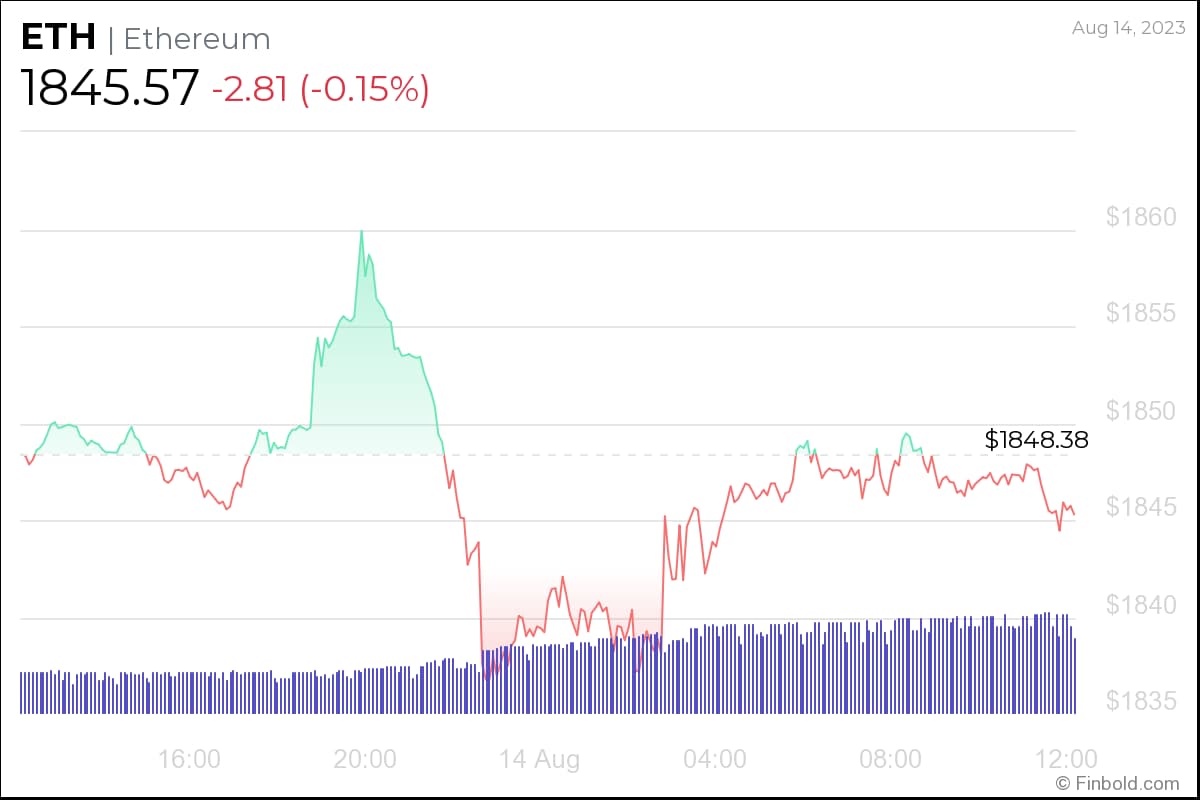

At the time of writing, the price of Ethereum was trading at $1,845. Ethereum experienced a 0.15% loss in the past 24 hours, but gained 0.84% over the past 7 days.

According to cryptocurrency asset price analysis site CoinMarketCap, Ethereum had mostly low volatility throughout the week, but the trading volume of the asset increased by 90% in the last 24 hours, with over $4.04 billion worth of ETH traded on the global spot market.