After the United States Securities and Exchange Commission (SEC) approved spot Bitcoin ETF applications earlier this year, the crypto community anticipated that it wouldn’t be long before Ethereum ETF applications would also get the green light. This expectation has led to much speculation about how it could affect Ethereum’s price.

Ethereum ETF Process Continues

Ethereum, the second-largest cryptocurrency, has continued to experience an increase in value recently. Ethereum’s price surpassed $3,000 on February 20th for the first time since April 2022. This upward trend is partly attributed to the growing optimism regarding the potential approval of a spot Ethereum ETF fund.

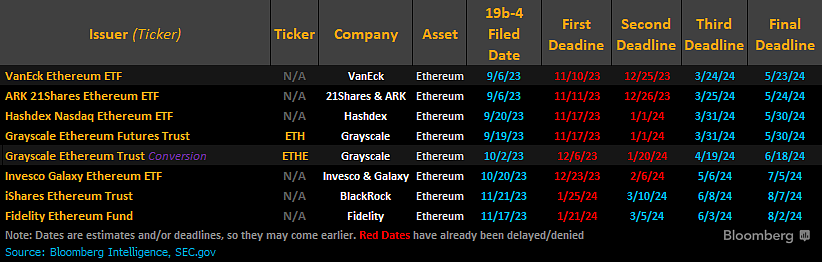

According to financial experts, the approval of such an ETF could potentially increase its value and attractiveness to investors by further integrating Ethereum into the mainstream financial system. After numerous delays, the first week of March has emerged as the next deadline for the SEC to approve, reject, or postpone the decision.

Notable Comments on the Matter

Dave LaValle, the ETF head at Grayscale, recently estimated the likelihood of the SEC approving Ethereum ETF applications at 50%. This figure is slightly lower than what Bloomberg Analyst Eric Balchunas predicted in November 2023. In an interview with The Defiant, Balchunas assessed the chances of Ethereum ETF approval at 70%, noting that this was a prediction made about two months before the approval of Bitcoin ETF applications:

“I see no reason for the SEC to reject the Ethereum ETF applications since they have approved futures ETFs. It would be illogical and technically they could be preparing themselves for another lawsuit.”

The lawsuit Balchunas referred to was when Grayscale took the SEC to court after the commission repeatedly objected to converting the firm’s GBTC fund into a spot Bitcoin ETF. The judge sided with Grayscale, stating that the SEC’s reasons for rejection were arbitrary and capricious.

The SEC has not yet explicitly classified Ethereum as a security, but continues to maintain a cautious stance. SEC Chairman Gary Gensler remains an outspoken critic of cryptocurrencies, emphasizing the need for regulatory compliance to protect against fraud and market manipulation.