Spot Bitcoin ETF funds have achieved a significant milestone, igniting hopes for similar proposals for other cryptocurrencies like Ethereum. However, crypto expert and lawyer Jake Chervinsky holds a contrary opinion. He suggests that the pending applications for an Ethereum ETF process could be rejected by the U.S. Securities and Exchange Commission (SEC).

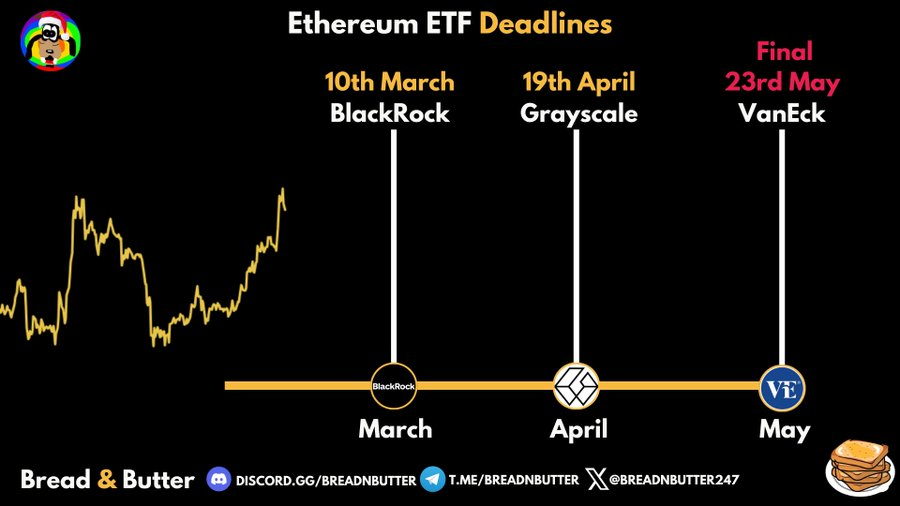

Ethereum ETF Applications

Chervinsky stated that the approval of a spot Ethereum ETF fund would intensify political pressure on the financial regulator. Despite being influenced by court decisions, he pointed out that the SEC is already facing a lot of political backlash for approving Bitcoin ETF applications. The attorney emphasized the precedent of the SEC adopting legally dubious stances to align with political agendas and suggested that the federal agency could base its rejections on similar grounds:

“The SEC has a legal argument that could justify rejecting applications, even if it’s wrong, and we know that the SEC is willing to take incorrect legal positions in court to meet political priorities.”

Chervinsky noted that the approval of Bitcoin ETFs has increased market sensitivity, with prices reacting more to investor sentiment than intrinsic value. The surge of Bitcoin’s price above $60,000 following ETF approvals is likely to reinforce this trend for Ethereum ETF applications.

In conclusion, Chervinsky anticipates that the SEC will reject Ethereum ETF applications to maintain market oversight. His arguments are consistent with recent reports indicating the SEC’s ongoing discomfort with cryptocurrencies. Additionally, industry sources expect the Commission to act cautiously due to Ethereum’s uncertain legal status.

Noteworthy Details of the Process

While many view BlackRock’s interest in an Ethereum ETF fund positively, Chervinsky warns against assuming regulatory approval is guaranteed. He suggests that the SEC could cause BlackRock and other Ethereum ETF issuers to withdraw their applications for various reasons:

“Yes, Blackrock is on the other side. However, Blackrock’s nearly perfect track record in getting ETF applications approved is as much about their ability to exert pressure as it is about their collaborative relationship with the SEC. If the SEC asks Blackrock and other Ethereum ETF sponsors to withdraw, I bet they will.”

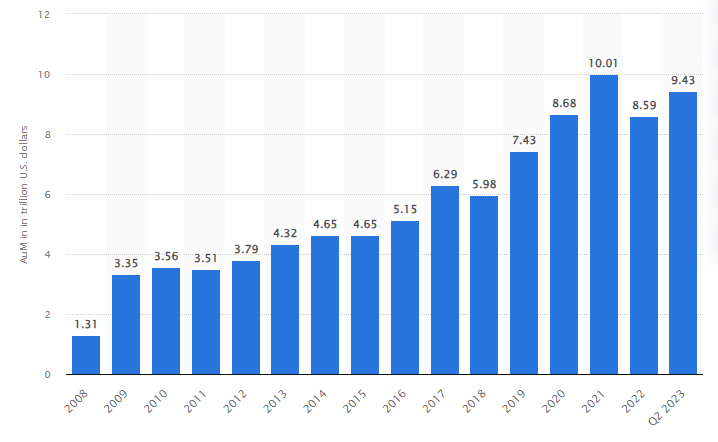

BlackRock, the world’s largest asset management firm, manages over $9 trillion in assets. Known for successful ETF applications, BlackRock recently led the way in obtaining SEC approval for a Bitcoin ETF application.