Developments in Ethereum ETF funds triggered a rise in Bitcoin and Ethereum prices, and notable developments continue to occur in this process. Accordingly, the monthly trading volumes of Chicago Exchange options related to Ethereum futures reached an all-time high this month. What can be expected for Ethereum in the upcoming period? Let’s examine it together.

New Record on the Ethereum Front

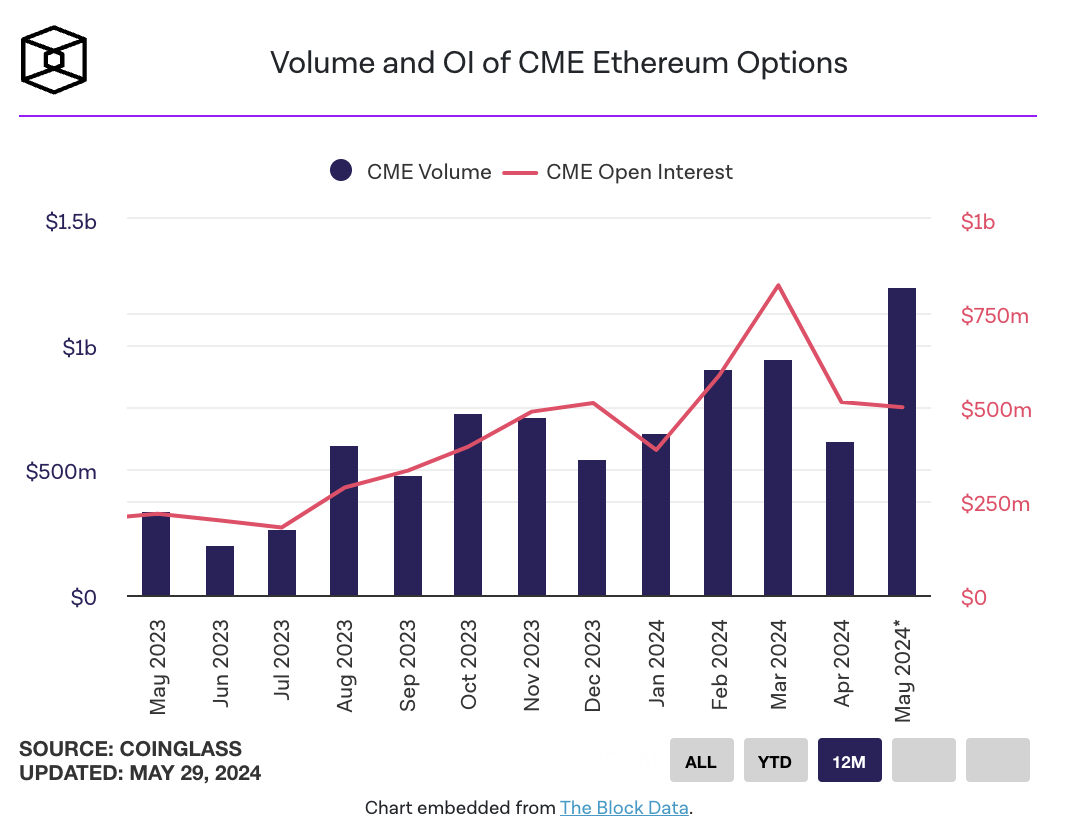

According to data from the blockchain data analysis platform The Block Data Dashboard, the trading volume of options related to Ethereum futures on CME reached $1.26 billion in May, two days before the end of the month. This development represents a significant increase compared to the $615.75 million volume in April and reaches a record level in terms of monthly trading volume.

According to the Wintermute market update on May 29, the amount of outstanding Ethereum futures contracts on CME is approaching its highest level ever. Wintermute analysts suggested that this increase in open positions indicates that institutional investors are increasingly interested in Ethereum transactions instead of Bitcoin, with the expectation that spot Ethereum ETF funds will be launched soon, and experts shared the following statements:

“Ethereum’s CME open position is approaching all-time highs, indicating institutional interest in the ETH/BTC pair ahead of S-1 filings and the final launch.”

Notable Statement from Analysts

According to Wintermute analysts, Ethereum’s implied volatility, which measures market expectations for future volatility over specific time periods based on option prices, has seen a significant increase due to rising expectations of significant price movements, and analysts shared the following statements:

“Significant increases were observed in 1-week, 1-month, 3-month, and 6-month at-the-money (ATM) implied volatilities.”

According to Tradingview data, Ethereum’s price dropped by over 2.2% in the last 24 hours and was trading at $3,794 at the time of writing. The GM 30 Index, which represents a selection of the top 30 cryptocurrencies, fell by 1% to 145.18 during the same period.

Türkçe

Türkçe Español

Español