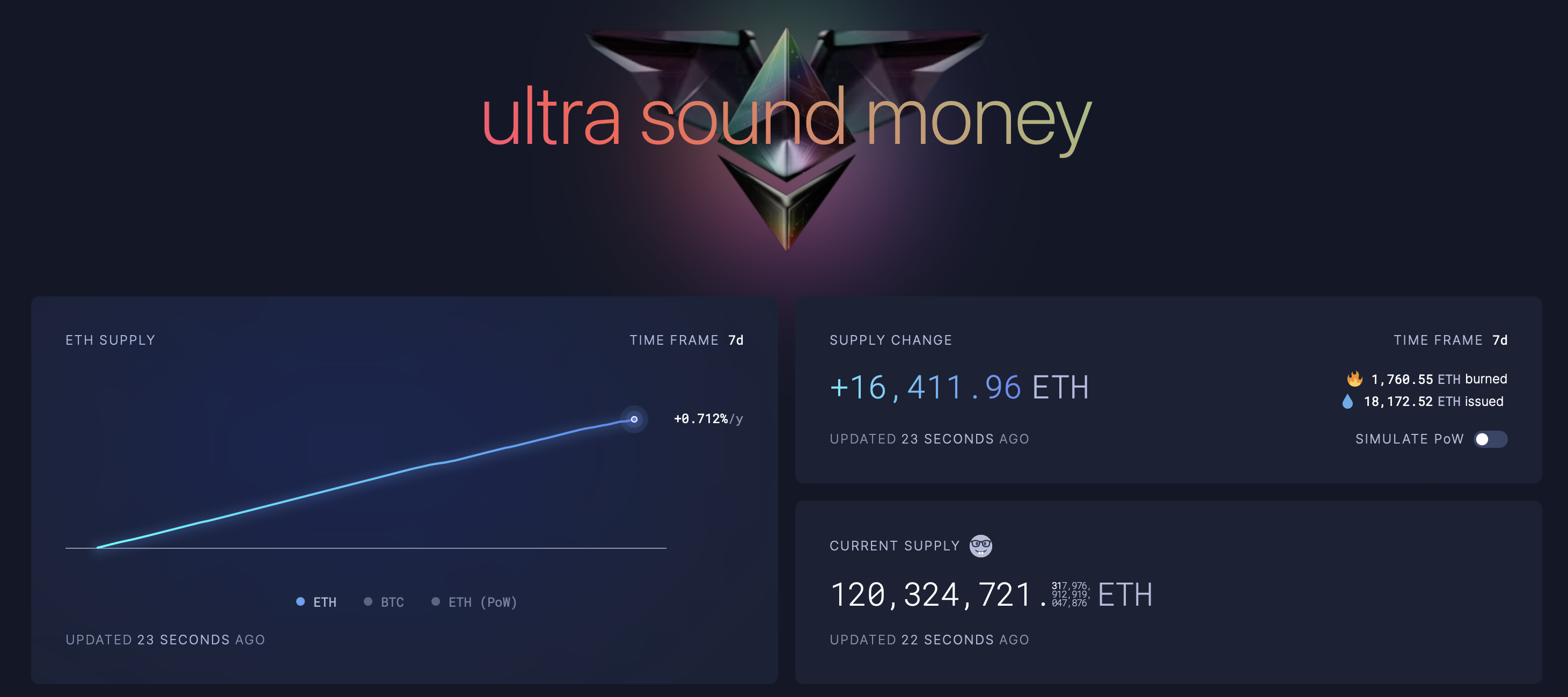

According to data provided by Ultrasound.money, the altcoin king Ethereum (ETH) is under inflation pressure. Accordingly, Ethereum’s net supply increased by 16,414 ETH in the last 7 days.

18,171 ETH Minted Against Only 1,757 ETH Burned

Data shows that Ethereum’s supply increased by 18,171 ETH in the last seven days. During this period, 1,757 ETH were burned through the coin burn mechanism designed to reduce the total supply of ETH, resulting in a net supply increase of 16,414 ETH.

The latest figures on Ultrasound.money indicate a significant net supply increase for Ethereum despite the coin burn mechanism implemented with the London update, particularly the EIP-1559 update. The mechanism, introduced in August 2021, aims to make the Ethereum network deflationary by burning a portion of transaction fees, thereby reducing the total supply. However, the current net supply increase shows that new ETH issuance currently outpaces the amount of coins being burned. For ETH burns to accelerate and the network to become deflationary again, network usage needs to increase.

As of now, Ethereum’s annual supply growth rate is 0.712%. This rate reflects the delicate balance between new ETH issuance and coin burning. The recent net supply increase could affect the price, as the inflation rate remains positive, albeit at a controlled pace.

Current State of Ethereum

At the time of writing, Ethereum’s main network asset ETH is trading at $2,412, up 0.15% in the last 24 hours. Note that the price of the altcoin king has fallen by 4.90% in the last 7 days. Market observers and analysts state that the psychological threshold of $3,000 must be surpassed for the price to enter an upward trend again.

On the other hand, Ethereum’s supply dynamics are extremely important for the trajectory of ETH’s price. Ongoing changes in supply and the coin burn rate are among the key factors that can affect ETH’s scarcity and consequently its market price.

Türkçe

Türkçe Español

Español