Kripto para market fluctuations continue to affect Ethereum (ETH), which draws attention as the second-largest cryptocurrency by market value. However, uncertainties about how these fluctuations will affect Ethereum‘s future trajectory persist. Data reveals critical outcomes that will determine the fate of the cryptocurrency Ethereum.

Expectations of a Rise Dominate for Ethereum

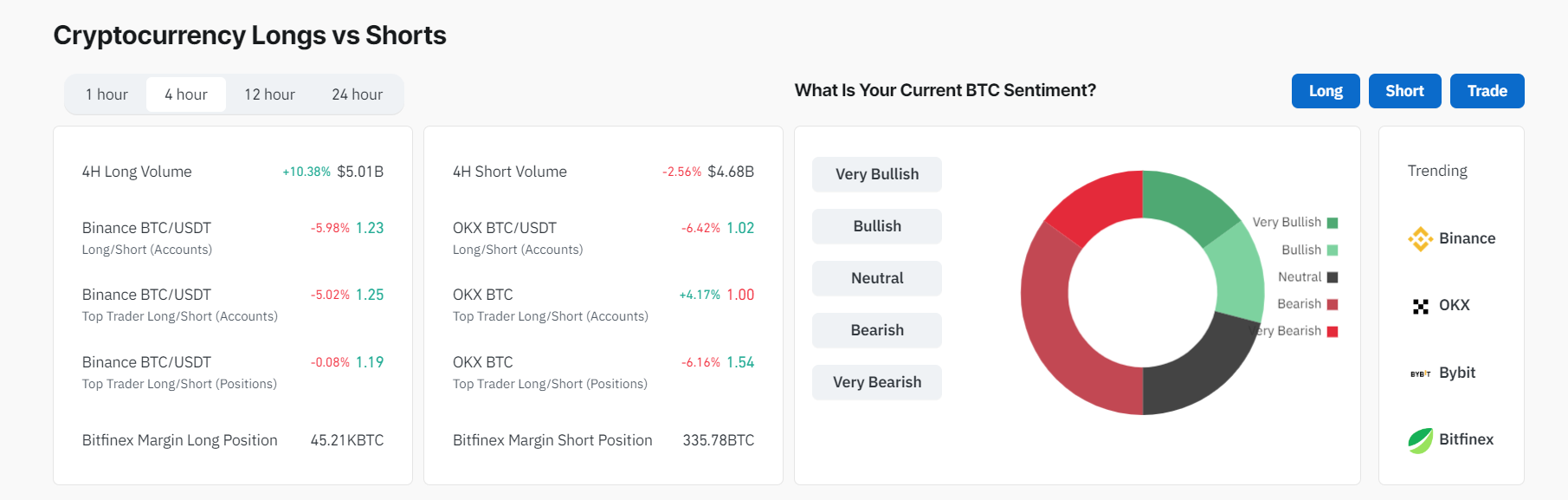

According to recent data from Coinglass, despite ongoing market fluctuations, the majority of Ethereum investors and traders still expect the cryptocurrency ETH to rise. Particularly, investors focusing on long positions maintain their belief in Ethereum’s long-term value increase.

This upward trend is so strong that even a trader who lost $4.5 million increased his Ethereum position by taking a significant loan from Compound. This move can be considered an indicator of confidence in Ethereum.

Many Ethereum Owners Are Not Yet Profitable

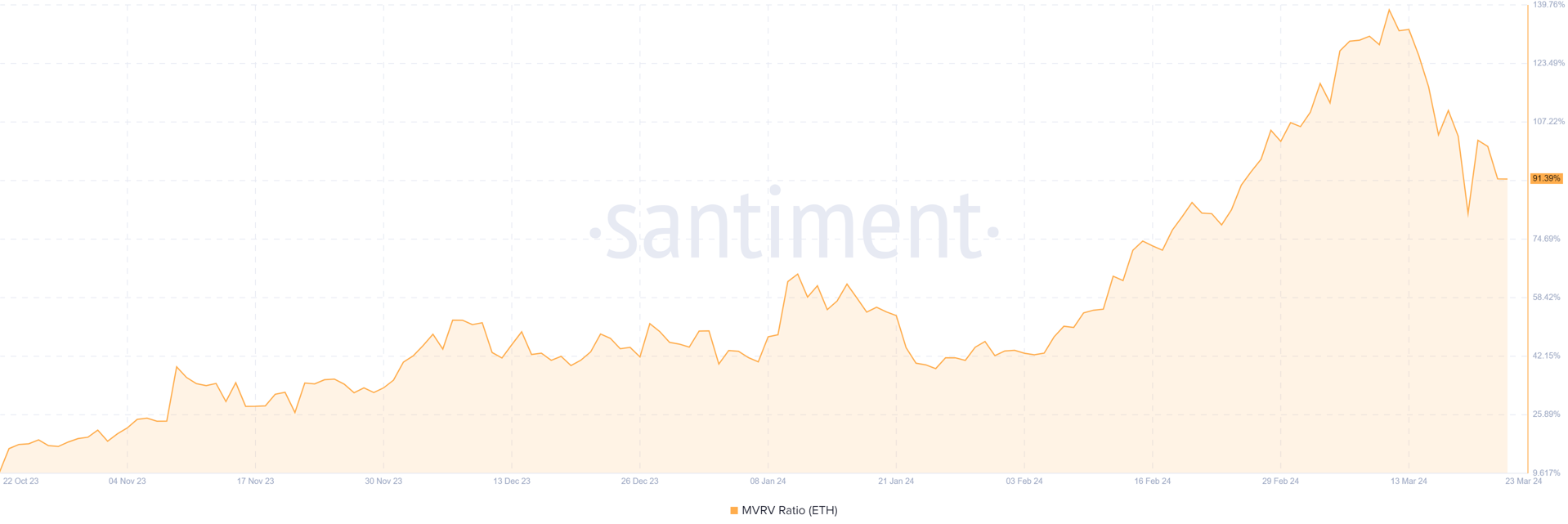

Santiment data shows that the Market Value to Realized Value (MVRV) ratio of Ethereum has dropped and many Ethereum owners are not yet profitable.

This situation signals a potential rise in the price of the cryptocurrency ETH, as investors likely continue to hold their assets expecting further increases.

Decrease in Network Growth

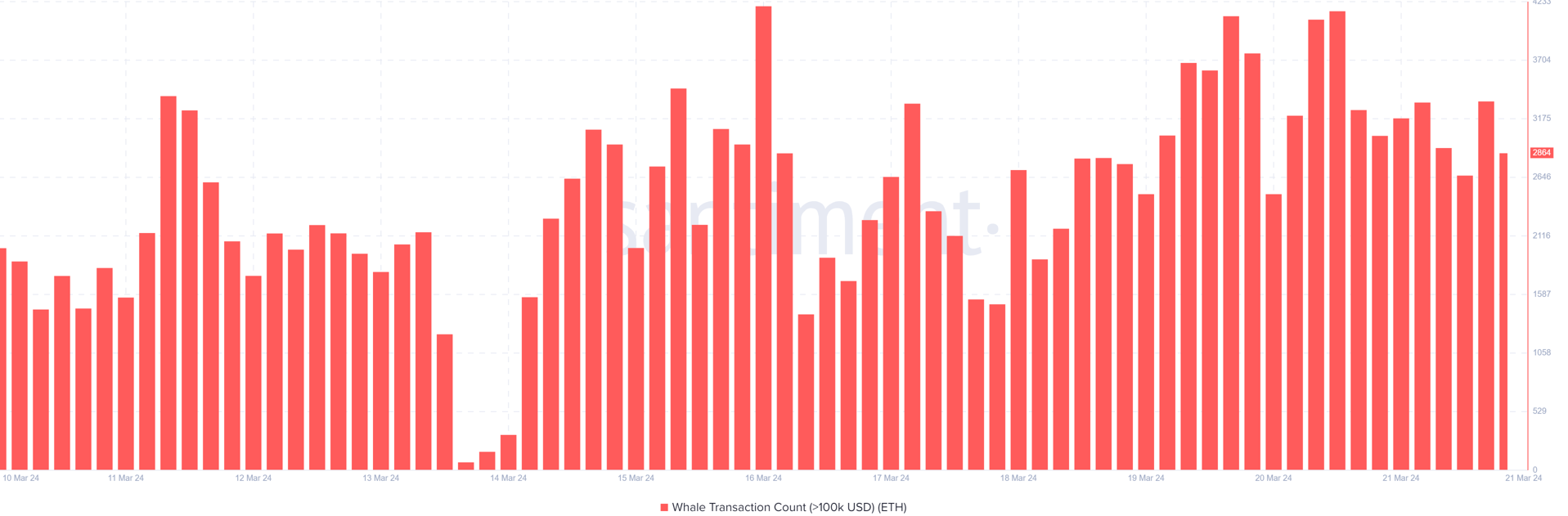

Despite a decrease in network growth, Ethereum’s price potential seems to be increasing. According to Santiment, the influx of new users into the Ethereum ecosystem is slowing down.

Despite increased activities on the network, Ethereum fees have reached their lowest level since January. Normally, as network activities increase, Ethereum fees would rise rapidly. However, currently low fees indicate fewer new users and even that they are holding onto their ETH tokens.

However, Santiment’s data also shows that current users are active and providing liquidity to the Ethereum ecosystem. This points to potential price increases for the ETH token. As the leader of altcoins in the crypto world, ETH is currently trading at approximately $3,190 and has recorded an increase in the last 24 hours. This situation indicates a short-term improvement in Ethereum’s price, but the decrease in network growth raises concerns for long-term price performance.