The world’s second-largest cryptocurrency, Ethereum (ETH), witnessed strong selling pressure and attracted attention following the successful implementation of the Dencun upgrade. As of the time of writing, the price of Ethereum (ETH) had fallen by 5.3% to a level of $3,700, and its market value appeared to be just under $450 billion. Additionally, the daily trading volume on Ethereum experienced a 45% increase and was at $32.29 billion.

Ethereum (ETH) Price Outlook

Despite spending some time above the $4,000 level, Ethereum’s price retreated from the resistance zone and underwent a downward correction, following the trend set by Bitcoin. ETH quickly lost key support levels at $3,920 and $3,850, signaling a potential decline.

ETH briefly fell below the support level of $3,680 but failed to maintain stability there and dropped to $3,625 before consolidating its losses. The first significant resistance level is currently around $3,850, according to the time of writing.

If the Ethereum (ETH) price successfully surpasses the resistance level of $3,880, it could resume its upward trajectory towards the $4,000 target. Conversely, if the price fails to break above $3,850, a sharper downward movement could occur.

The first support level is at $3,680. On the other hand, the second level is considered a significant support zone around $3,600, and finally, a potential downward support level at $3,500 is also noteworthy.

Popular crypto analyst CrediBULL Crypto suggests that the $3,600 to $3,700 range could create significant buying pressure in the short term for Ethereum.

Ethereum’s Status Post Attack

Furthermore, important information was revealed by blockchain analysis firm Elliptic. A significant transaction involving $12 million worth of Ethereum, targeted by the Lazarus Group, was identified. This transfer was facilitated through a cryptocurrency mixer, Tornado Cash, which continues to be used by the North Korean hacker group despite sanctions.

It has been discovered that the funds were stolen, and the incident dates back to an attack on the HTX and Heco Bridge by the Lazarus group in November, resulting in losses exceeding $100 million.

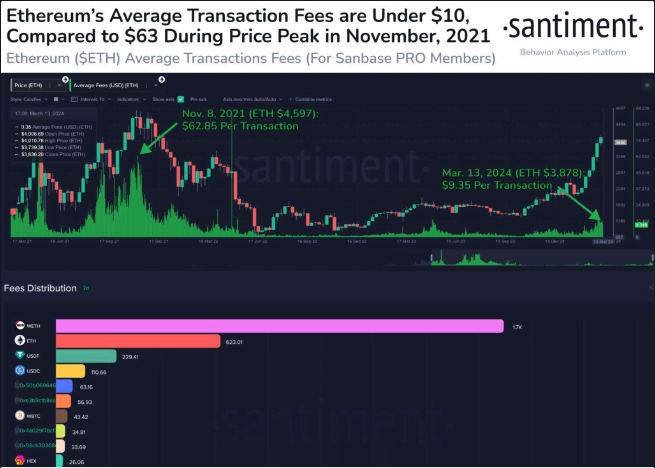

According to on-chain data provider Santiment, the period when Ethereum surpassed a $4,000 market value differs from October and November 2021.

Today, a noticeable decrease in network transaction costs is observed, and it is known that the level is less than 1/6th of that period. With average gas fees at $9.35, it can be said that the improvements made to network fees following the transition to Ethereum 2.0 are visibly significant.

Türkçe

Türkçe Español

Español