Ethereum (ETH), the second-largest cryptocurrency by market value, is dangerously poised on the edge of a significant correction phase that has caused noticeable concern among market observers.

Ethereum ETF Application Submitted

The situation worsened when ARK recently applied to the U.S. Securities and Exchange Commission (SEC) for an Ethereum Spot Exchange Traded Fund (ETF). This move added an additional layer of uncertainty to the price movement of ETH, particularly in light of a potential synergistic effect with a Bitcoin ETF that could potentially impact the value of decentralized finance (DeFi) assets.

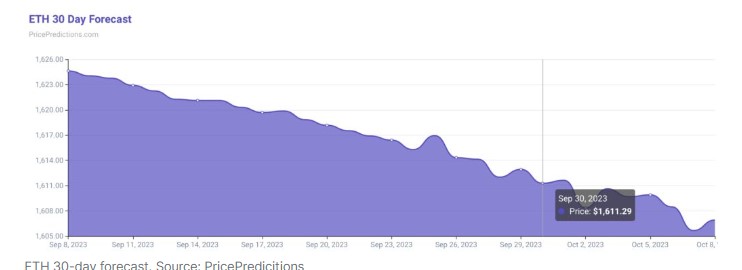

Amidst this increasing uncertainty surrounding Ethereum’s price dynamics, machine learning algorithms’ predictions were questioned through PricePredictions, a cryptocurrency monitoring and forecasting platform, on September 7th.

The primary objective was to distinguish a reasonable price projection for ETH as September draws to a close, considering the latest developments in the crypto arena. According to the detailed analysis, the forecast for ETH indicates a potential drop to $1,611 by the end of September.

Ethereum Price Prediction

When we focus on the technical aspects of ETH, we see that the current trading price is $1,627, with a solid support level at $1,560 and a challenging resistance level at $1,702. Throughout the day, ETH experienced a slight decline of 0.18%, and over the past week, it experienced a more significant drop of 4.65%, reaching a cumulative market value of $195 billion.

A tweet shared by crypto analyst Ali Martinez on September 6th highlights the underlying concerns surrounding Ethereum’s price trajectory. Martinez emphasized the significance of Ethereum surpassing the $1,680 threshold, as it could potentially serve as a gateway to a significant corrective phase, ultimately causing the price to drop to $1,200.

Martinez also shared enlightening analyses from IntoTheBlock, a center for crypto analytic power, which shed light on the scarcity of addresses making Ethereum purchases within the price range of $1,285 to $1,681. The stagnation in activity at these price levels supports the possibility of a price retreat to $1,200, as Martinez suggests.