Ethereum price has increased by 6.2% in the last two days, but it continues to struggle with the $1,900 resistance. Despite the current upward movement, Ethereum’s 17% return in the last 30 days lags behind Bitcoin‘s notable 27% gain during the same period. Analysts attribute this to the uncertainty surrounding Consensys, a key player in the Ethereum ecosystem, which partially explains Ethereum’s underperformance.

Ethereum Falls Behind During the Bull Run

Legal challenges continue to hinder the growth of the Ethereum ecosystem. The latest uncertainty revolves around PayPal’s stablecoin, PYUSD, which operates on the Ethereum network. This token is designed for crypto payments and Web3 applications, and on November 2nd, PayPal publicly disclosed a court subpoena it received from the US Securities and Exchange Commission (SEC).

In the last 30 days, Solana has outperformed Ethereum with a 75.5% gain, followed by Ripple with 37% and Cardano with 35%. This situation clearly indicates that the factors holding Ethereum back are not solely related to legal pressures or decreasing demand in the DeFi and NFT markets. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Notable Data in the Ethereum Ecosystem

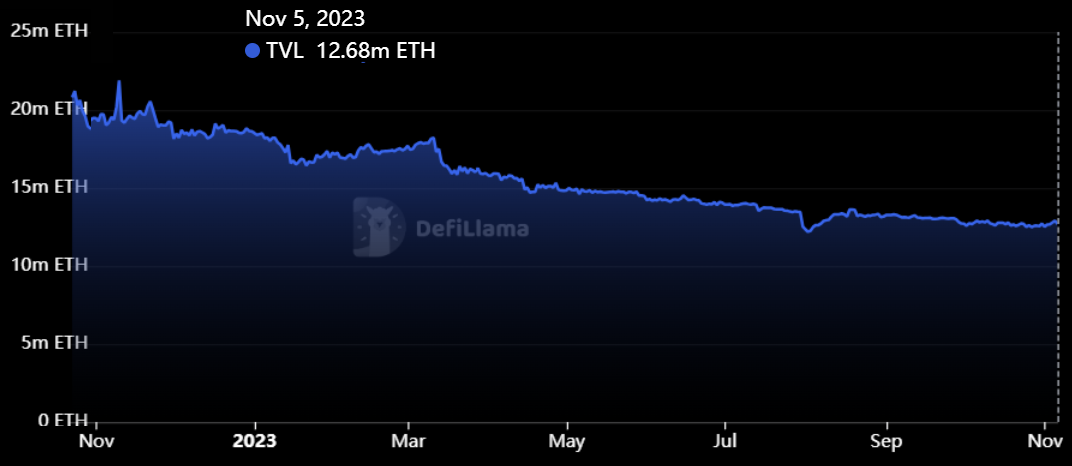

One notable issue for the Ethereum network is the high transaction fees, including those performed by smart contracts, which negatively affect the usage of decentralized applications (DApps). The latest seven-day average transaction fee was calculated at $4.90, further impacting the adoption of DApps. Additionally, the total deposits measured in Ethereum on the Ethereum network have reached their lowest levels since August 2020.

According to blockchain data analysis firm DefiLlama, the total value locked (TVL) in Ethereum DApps decreased by 4% on November 5th, reaching 12.7 million Ethereum compared to the 13.2 million Ethereum two months ago. In contrast, the TVL on the Tron network increased by 13% during the same period, while the locked asset value on Arbitrum remained at 1 million Ethereum. These data on DApp activities in the Ethereum ecosystem indicate a decrease in activity.

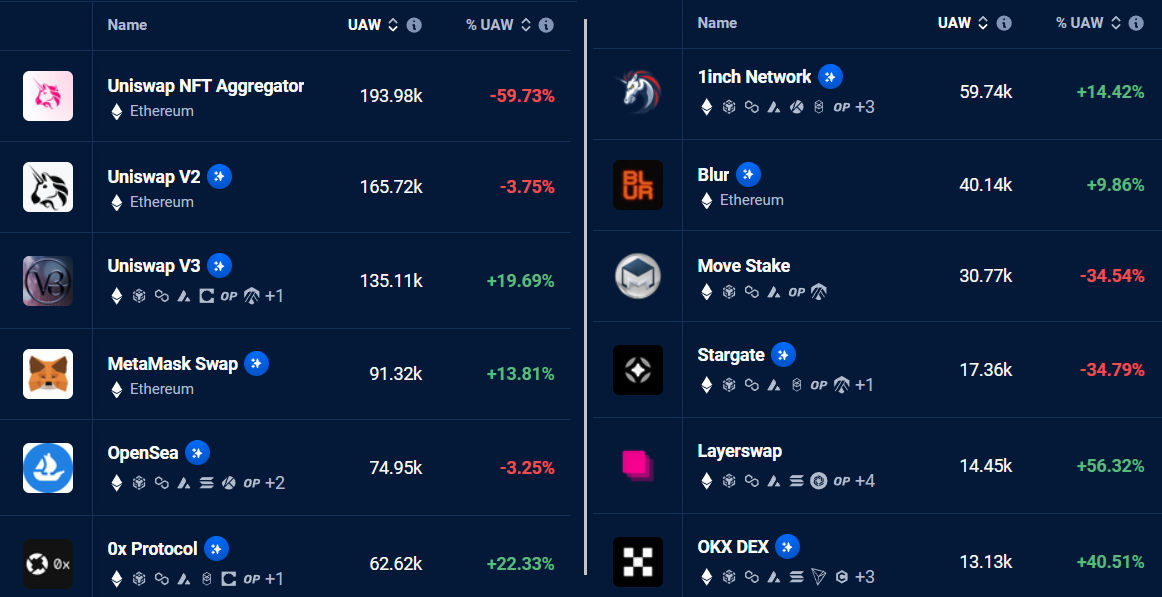

Uniswap NFT Aggregator experienced a significant 60% drop, but even without considering this, the average number of active addresses in the top Ethereum DApps decreased by 3% compared to the previous month. Conversely, according to DappRadar data, the top applications in the Solana ecosystem experienced an average 18% increase in active users during the same period.

Türkçe

Türkçe Español

Español