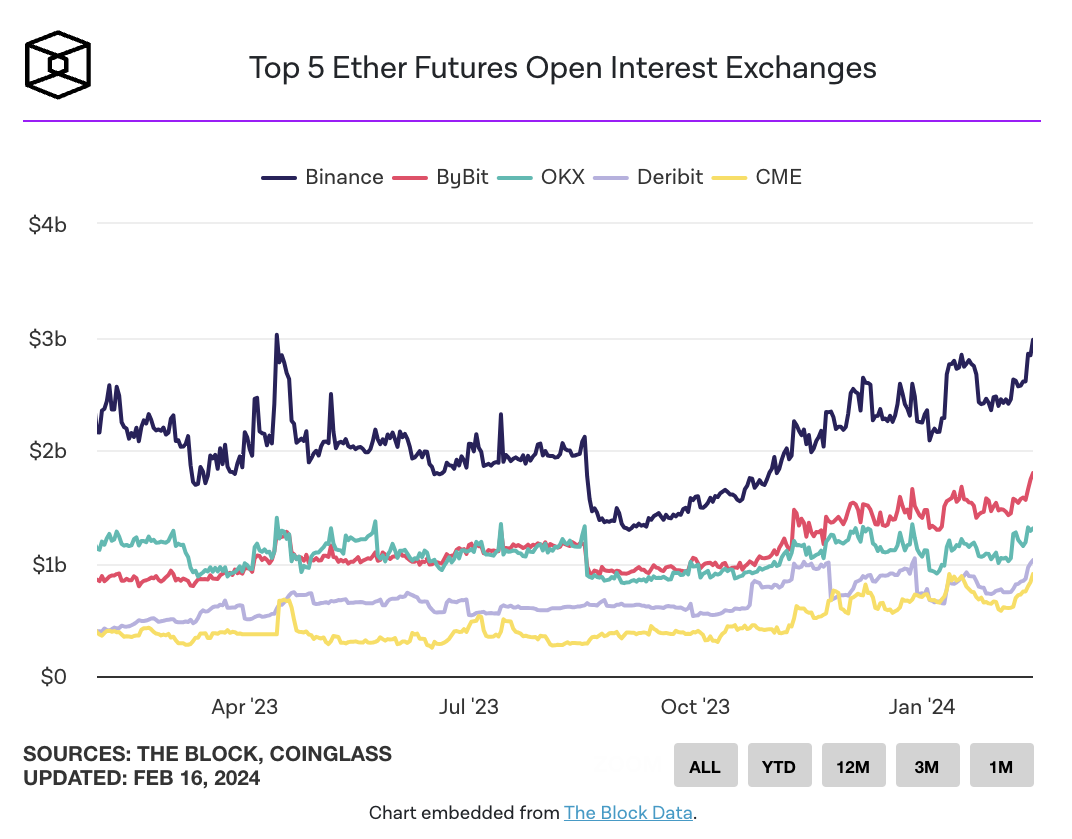

Ethereum futures open interest (OI), a notable data point, has shown an increase since the beginning of February on major centralized cryptocurrency futures exchanges. According to blockchain data analytics platform Coinglass, open interest in Ethereum futures across different exchanges is currently over $10.1 billion.

Why Is Ethereum Rising?

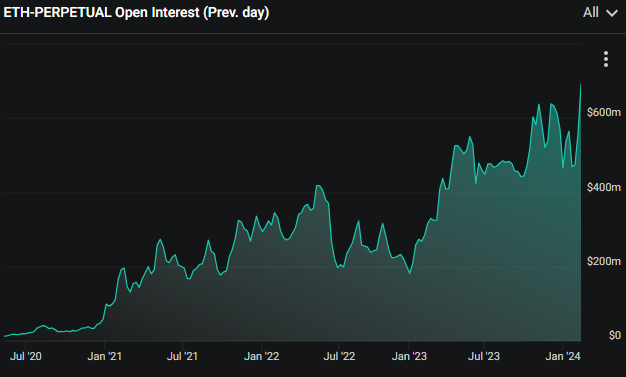

The total number of pending Ethereum futures contracts on the Deribit cryptocurrency futures exchange has reached an all-time high. The data indicates that open interest on Deribit is now over $690 million. A perpetual contract is known as a type of futures contract without an expiration date, allowing investors to hold their positions indefinitely.

The increase in open interest suggests a rise in trading activities and interest in Ethereum derivatives. This situation may indicate a potential increase in market interest, speculation, or hedging activities related to Ethereum, especially with the expectation of upcoming potential price factors.

One such factor could be the potential approval of a spot Ethereum ETF application by the US Securities and Exchange Commission in the coming months. For instance, investment firm Franklin Templeton joined other asset managers by submitting an S-1 registration statement to the SEC on February 12, taking the first step towards launching a potential spot Ethereum ETF fund.

According to The Block’s Data Dashboard, daily Ethereum futures open interest on Binance, ByBit, OKX, and CME has also increased. The data shows that Ethereum futures open interest on Binance has reached nearly $3 billion, the highest level in recent months.

Noteworthy Data on the Ethereum Front

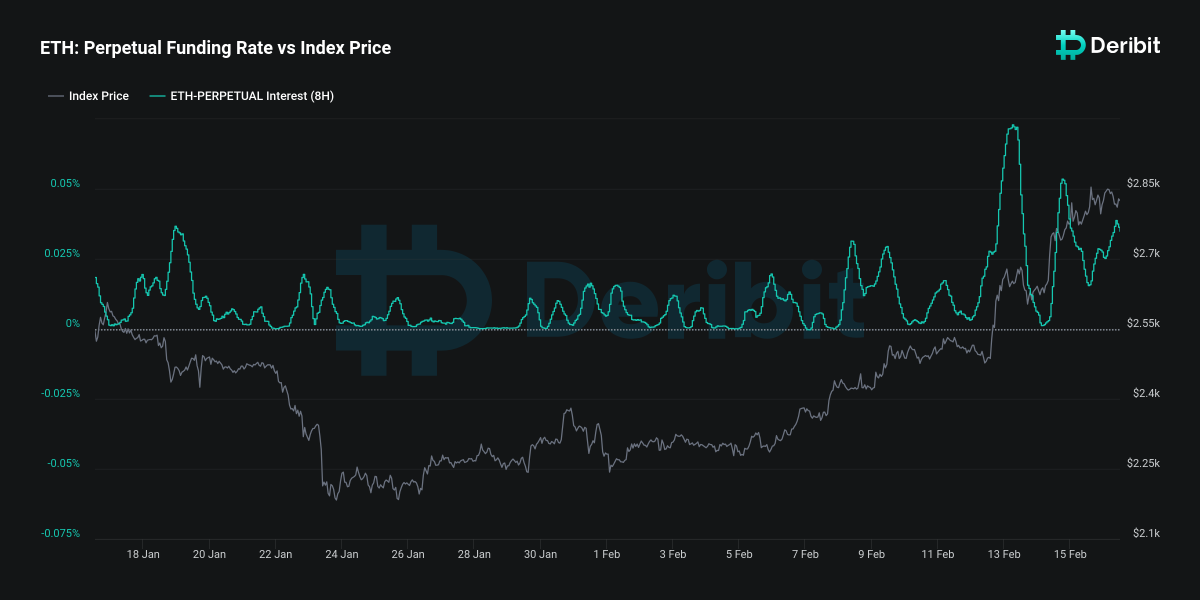

Since the beginning of February, the funding rate for Ethereum perpetual futures contracts on the Deribit central futures exchange has risen from 0.00045% to its current value of 0.035%. When the funding rate increases, it means that long positions (buyers) are paying more to short positions (sellers).

This situation indicates an increased demand for long-term positions in the Ethereum futures market. The rise can reflect a stronger bullish sentiment towards the crypto asset and may imply that more investors expect an upward movement in Ethereum prices in the coming months.

Türkçe

Türkçe Español

Español