According to a statement by leading brokerage firm Bernstein, there has recently been a noticeable rise in optimism towards Ethereum (ETH). This perspective seems to align with the actions of a notable crypto whale wallet, identified as 0x7a9, which purchased approximately $66 million worth of Ethereum.

Whales Accumulating ETH

As the positive momentum continues for Ethereum, attention shifts to its potential for institutional adoption and the likelihood of the U.S. Securities and Exchange Commission (SEC) approving a spot Ethereum ETF.

The report published by Bernstein views Ethereum as close to the light at the end of the tunnel regarding SEC-approved spot ETFs. Moreover, analysts believe there is a 50% chance of an Ethereum ETF approval by May, with near certainty over a one-year period.

Traditional finance giants like Blackrock and Fidelity, often heard in the context of the Bitcoin spot ETF, are also leading the race to launch Ethereum ETFs in the U.S., indicating high expectations and potential from major firms for Ethereum.

Despite this, it would be incorrect to assume that interest in Ethereum is limited to ETFs. There are expectations that institutions will use the Ethereum network to create transparent, tokenized financial markets, aiming far beyond simple asset accumulation.

Bernstein analysts Gautam Chhugani and Mahika Sapra shared the following:

Ethereum is well-positioned for mainstream institutional adoption due to its staking yield dynamics, eco-friendly design, and utility in creating new financial markets.

BlackRock CEO Larry Fink also provided support during this process, reiterating his approach to an Ethereum ETF. Fink’s support suggests that Ethereum could be part of a shift in the investment giant’s strategies towards blockchain technologies.

Another significant development is the anticipated Denizen upgrade, which aims to reduce transaction costs by 50-90% and is seen as central to Ethereum’s appeal.

While all these developments are taking place, the purchase of 22,719 ETH at an average price of $2,893 by the whale wallet 0x7a9 seems to underscore the growing investor interest in Ethereum.

How Much Is ETH Now?

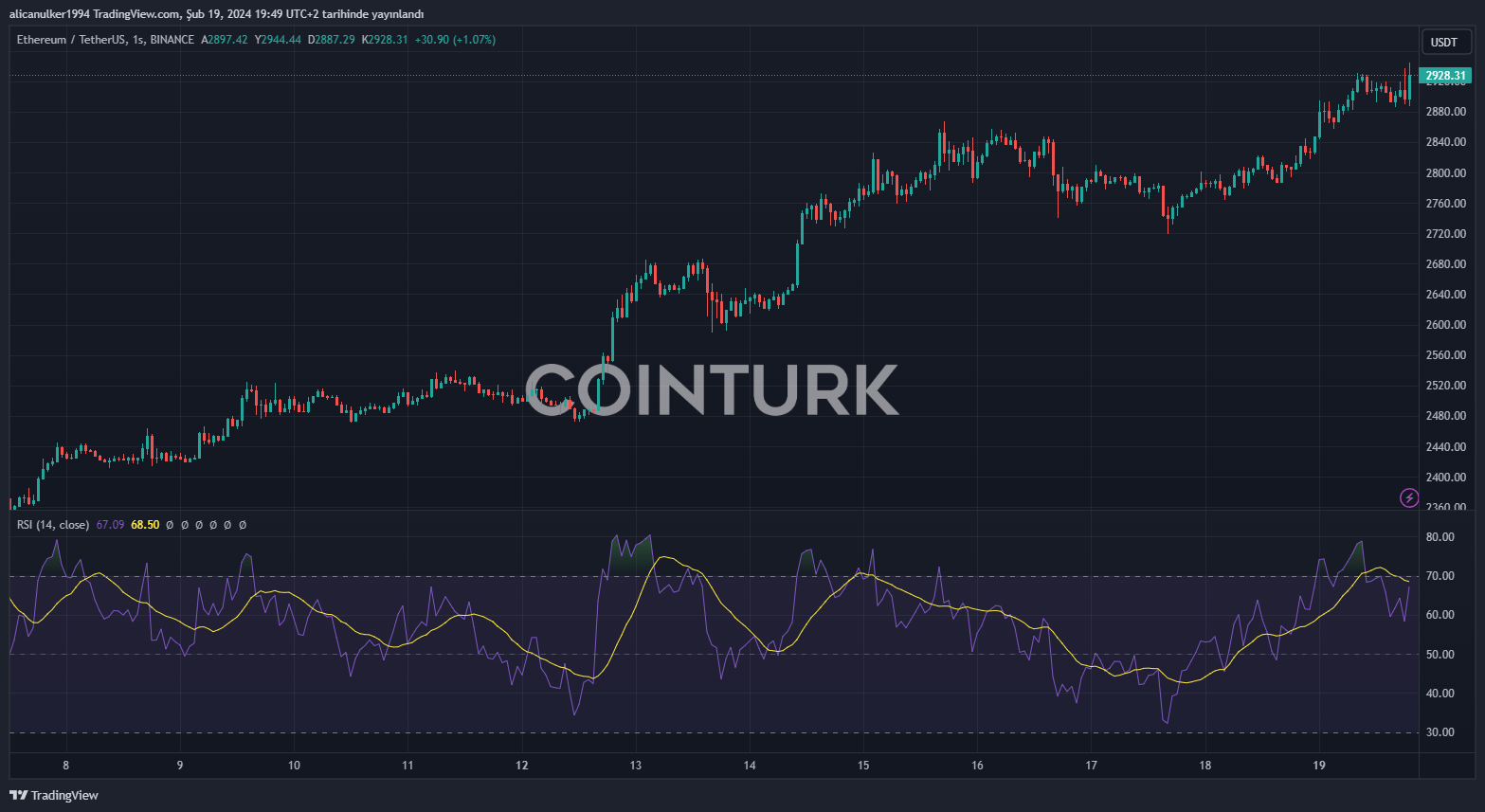

Amidst these events, ETH has seen an increase of over 4% in the 24-hour charts. The price is currently at $2,928, inching closer to the $3,000 mark.

On the other hand, ETH’s overall market cap has surpassed $350 billion with a 4% increase, while the 24-hour trading volume has decreased by 20% to $14.8 billion. The RSI value, at 67, could indicate overbuying, but this seems inconsistent when compared to the trading volume.