Ethereum investors may be disappointed due to the 12.5% decline experienced in the last three weeks. Part of the recent correction can be attributed to macroeconomic processes; the market no longer expects a decrease in interest rates by the US Federal Reserve until March. Nevertheless, the premium on Ethereum futures has retreated to its lowest level in three months, leading to speculation among investors that something else is exerting pressure on the price of Ethereum.

Excitement Persists on the Ethereum Network

High gas fees on the Ethereum network continue to be a constant source of complaint for users and investors, creating significant pressure to compete with blockchain networks focused on scalability such as BNB Chain, Solana, and Avalanche. Despite differences in decentralization among these networks, the user experience for Layer-1 solutions is often more favorable. Therefore, the cost of scalability solutions for Ethereum carries great importance among users.

On February 1st, Ethereum core developer Tim Beiko announced the success of the latest Ethereum network upgrade tests. The Denoun hard fork will introduce proto-danksharding, aiming to reduce the costs of rollup scalability solutions. Analysts expect the main network to become active by March, even though the Ethereum Foundation has not announced an official deadline. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

According to blockchain data analysis platform DefiLlama, to highlight the importance of Layer-2 solutions, the top four networks—Arbitrum, Optimism, Manta, and Base—have a total locked-in value (TVL) of $4.2 billion, surpassing BNB Chain’s $3.5 billion in smart contract deposits. More importantly, as reported by L2Beat, Ethereum rollups continue to process transactions at a rate 4.2 times higher per day compared to the main network last week.

Ethereum in the Futures Market

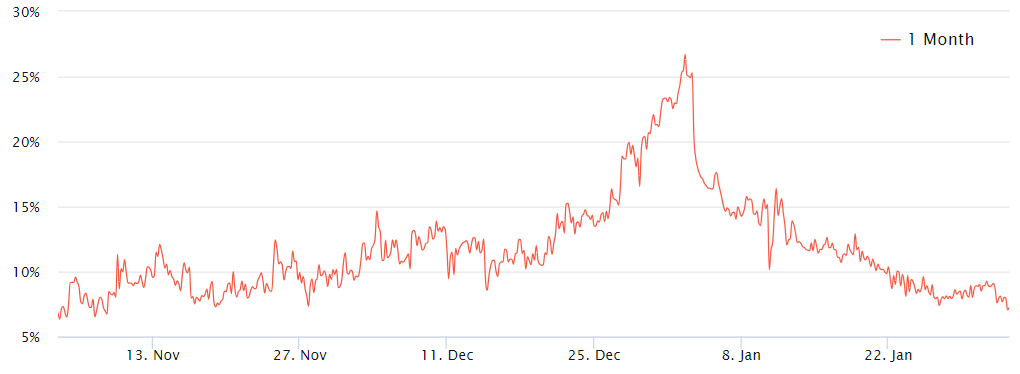

Professional investors prefer monthly futures contracts due to the lack of funding rates. In neutral markets, these instruments trade at a premium of 5% to 10% to account for extended settlement periods.

Data reveals that the Ethereum futures premium has been on a downward trend since January 2nd, but remained above the 10% threshold until January 23rd. Interestingly, despite Ethereum’s price reaching $2,715 on January 12th due to FOMO from the launch of a spot Bitcoin exchange-traded fund, it showed a 2.2% decrease between January 2nd and February 2nd. In fact, the current neutral 7% premium in ETH futures can be linked to market price expectations.

As a point of comparison, the last time Ethereum futures reached a 7% premium was on November 4, 2023, when the Ethereum price was $1,860. Historical data shows that trading occurred below the $1,900 resistance for 110 days, which justifies the lack of confidence at that time. However, those who were bold enough to make bullish predictions in November 2023 saw Ethereum’s price increase by 21.5% from $1,850 to $2,250 within 30 days. Therefore, the lack of excitement in the futures market does not necessarily indicate an impending negative price volatility.

Türkçe

Türkçe Español

Español