Blockchain data analysis platform L2Beat has caught the attention of many Web3 users with new data. According to the data, Ethereum Layer-2 networks reached a new milestone on November 10th, with a total locked value (TVL) of $13 billion in smart contracts. Despite some challenges in user experience and security, industry analysts expect this significant interest in Layer-2 networks to continue.

Record-Breaking in Layer-2 Ecosystems

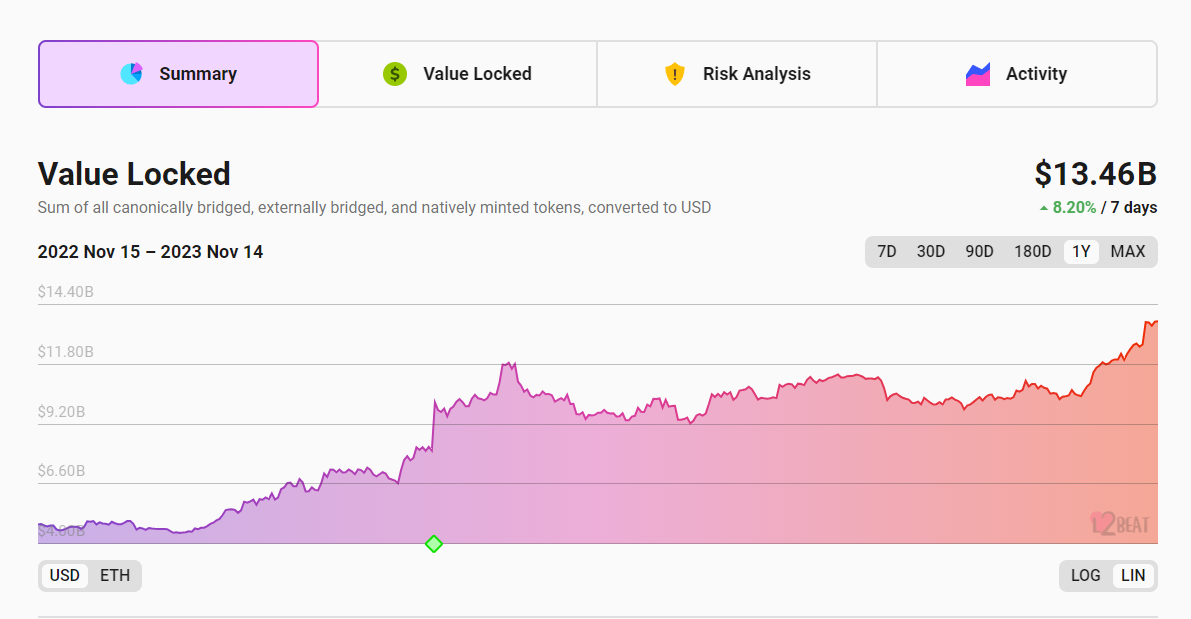

According to L2Beat data, there are 32 different networks classified as Ethereum Layer 2, including Arbitrum One, Optimism, Base, Polygon zkEVM, Metis, and others. Before June 15th, the total TVL value of these networks was less than $10 billion, and the combined TVL had been declining since reaching its highest level of $11.8 billion in April.

However, starting from June 15th, TVL growth in Layer-2 networks turned positive, and as of October 31st, these networks reached a new peak with approximately $12 billion worth of TVL. Investments in Layer-2 platforms have continued to increase since then, surpassing the $13 billion TVL level on November 10th and reaching around $13.5 billion.

This increase in TVL is at much lower levels compared to the current general crypto investment during the 2021 bull market. When the crypto market cap reached an all-time high of $2.82 trillion on November 12, 2021, there was less than $6 billion locked in Layer-2 smart contracts. According to Coinmarketcap, although the total crypto market cap is now at a lower level of $1.4 trillion, the TVL value of Layer-2 networks is greater than ever.

Attention-Grabbing Theory from a Prominent Figure

Elena Sinelnikova, CEO of Metis, shared a theory in an interview about why Layer-2 networks have grown despite the ongoing bear market. According to the prominent figure, the high gas fees of Ethereum during the bull market had an impact on users and created a desire for alternatives in the market when demand started to return:

“During the bull market, scaling Ethereum was very difficult during peak times, making transactions slow and very expensive. Hundreds of dollars were being paid for a single transaction, making it an unsustainable structure.”

According to Sinelnikova, another reason for the success of Layer-2 networks in the bear market is the successful marketing methods of development teams, which have led to high user activity and consequently high returns:

“They use capital to attract new users and bring new projects to DeFi. DeFi operators from all ecosystems always go where there are high returns, and this happens naturally.”