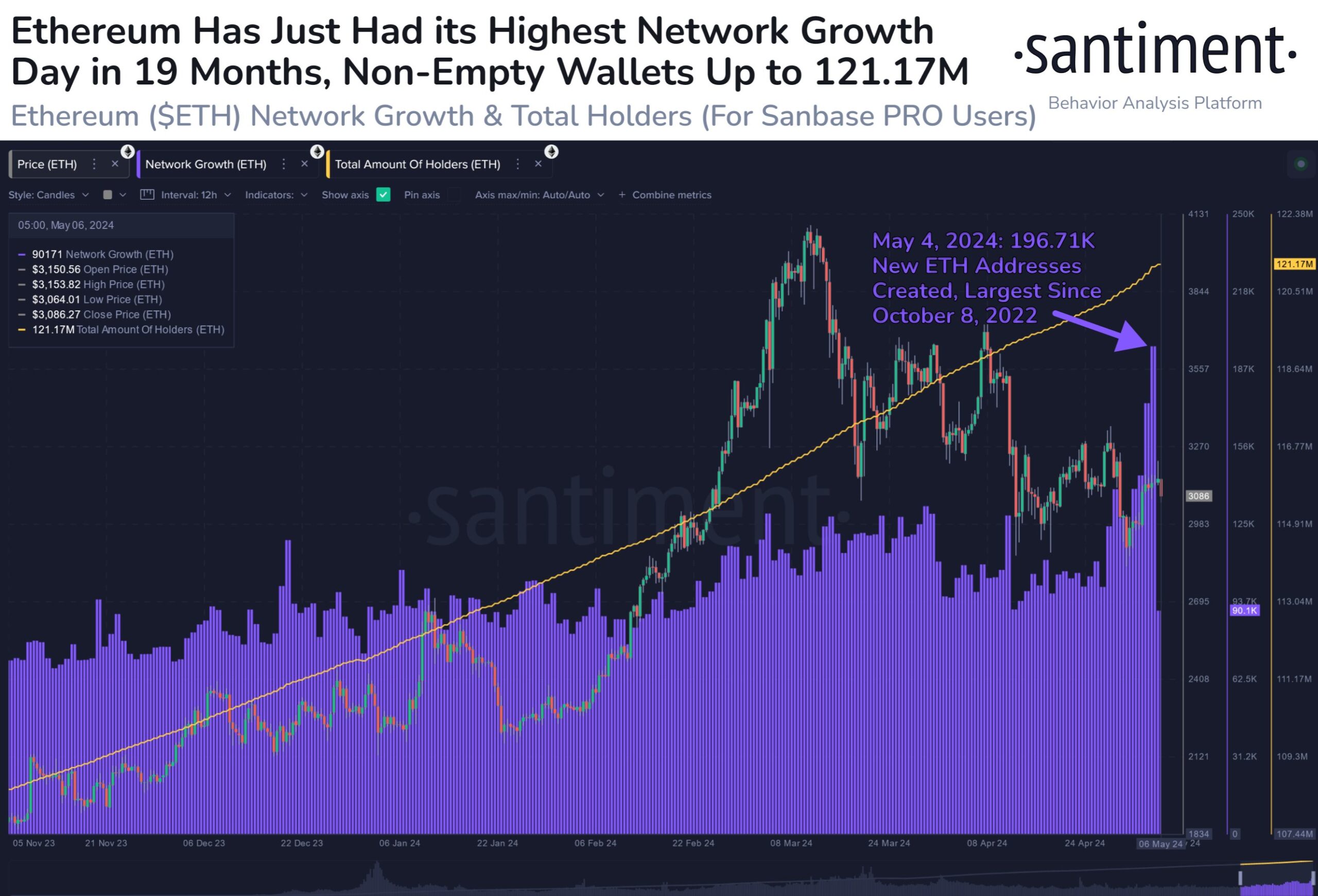

Altcoin king Ethereum (ETH) surpassed the $3,200 level last weekend, experiencing a significant increase in network activity. According to on-chain data, the Ethereum network reached its highest single-day network growth in the last 19 months.

Interest in the Altcoin King Rises

On May 4, 2024, 196,000 new Ethereum wallet addresses were created, marking the largest daily increase in wallet addresses since October 8, 2022. This surge in newly created wallet addresses indicates strong and growing interest in Ethereum, signaling a bullish trend.

Despite the price hovering below the $3,200 threshold, the Ethereum network maintains its strength. The creation of so many new wallet addresses within 24 hours points to an influx of new participants or increased interest from existing ones, which could provide a strong foundation for future price increases.

From a technical analysis perspective, ETH is currently facing a critical level. The altcoin king is on the verge of falling below its 200-day Exponential Moving Average (EMA). A drop below this level could indicate a potential short-term decline.

Transaction Volume Decreases

On the other hand, the decrease in ETH’s transaction volume accompanying the price drop could signal a possible reversal of the trend. Typically, a decrease in volume during a downtrend might mean that selling pressure is exhausting, and if other conditions align positively, it could set the stage for a potential rise.

The combination of strong network growth and technical analysis indicators presents a confusing scenario for Ethereum. While the price is currently under slight downward pressure, the increase in new wallet addresses and the decrease in volume could indicate that hidden bullish potential is on the table. At this point, a rise above the 200-day EMA level could directly trigger an uptrend.

According to CoinMarketCap, ETH was trading at $3,106, down 2.98% in the last 24 hours at the time this article was prepared. The data points to a 2% increase in the altcoin king’s price over the last 7 days, against a deep loss of 8.18% over the last 30 days.

Türkçe

Türkçe Español

Español