Altcoin king Ethereum network’s daily ETH burn rate has dropped to its lowest level in years, directly linked to the decrease in gas fees on the network. Currently, gas fees range between 1 and 2 gwei, which significantly impacts the amount of ETH issuance.

ETH Burn Rate at Lowest Level of the Year

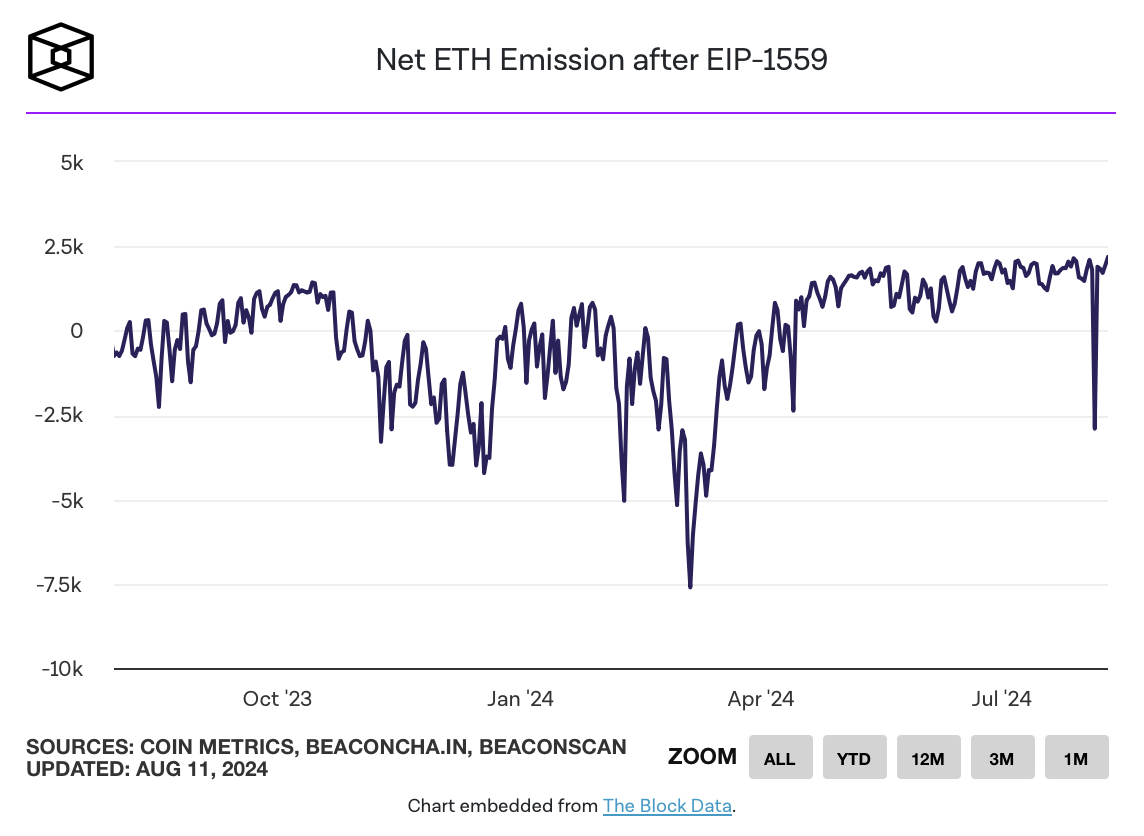

Recently, especially last Saturday, with only 210 ETH burned, Ethereum’s token burn rate dropped to its lowest level of the year. In contrast, due to low gas fees, the net ETH issuance exceeded 2,000 ETH. On August 5th, when gas fees surged to 100 gwei, the daily burn amount rose to 5,000 ETH.

This situation led to an increase in the inflation rate of the Ethereum network. Gnosis founder Martin Köppelmann evaluated the current situation and suggested a temporary increase in the gas limit. Köppelmann stated, “The base fee is at a multi-year low of approximately 0.8 GWEI. To balance staking rewards, 23.9 GWEI is required. Ethereum needs to increase its Layer-1 (L1) activity again, and raising the gas limit even at such low fees could be part of a strategy.”

Relationship Between ETH Burn and Base Fee

Implemented in August 2021, EIP-1559, also known as the London hard fork, introduced the base fee that is burned and the priority fee that serves as a tip for validators. The base fee is directly related to network activity, and higher fees lead to more ETH burn, thereby reducing supply.

The decline in gas fees is thought to be due to the increasing shift of users to Layer-2 (L2) scaling solutions and the adoption of blob transactions introduced with the Dencun update in March. All these innovations have reduced costs on L2 networks, decreasing demand on the main network.

The largest altcoin ETH is trading at $2,540 at the time of writing and has risen by approximately 10% since the beginning of the year. Its market value is around $305 billion.

Türkçe

Türkçe Español

Español