Ethereum price increased by 77% to reach $2,715, the highest level of the year, following the approval of spot Bitcoin exchange-traded funds in the United States. However, in the weeks since then, the Ethereum price has been facing selling pressure along with the rest of the market. The latest data from blockchain data analytics firm Glassnode reveals that despite the current decline, Ethereum has outperformed Bitcoin in many areas.

Ethereum Leaves Bitcoin Behind

Glassnode’s latest The Week Onchain report draws attention to Ethereum’s performance against Bitcoin on a three-month, monthly, and weekly basis. Analyst Alice Kohn pointed to a significant increase of over 20% in Ethereum’s value against Bitcoin, a trend consistent with similar activities in the Ethereum derivatives market.

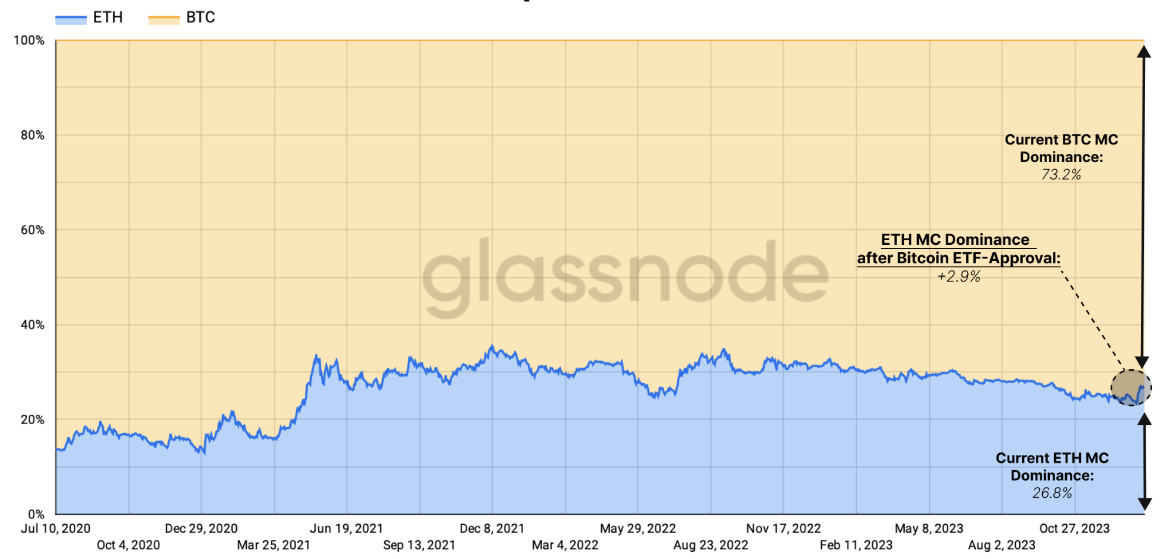

Glassnode notes that this performance coincides with a recovery in Ethereum’s market dominance. According to the graph below, Ethereum has gained 2.9% in market value dominance compared to Bitcoin since the approval of the spot Bitcoin ETF.

Noteworthy Data for Ethereum

Ethereum may be trading 14% lower compared to last week, but market sentiment for the altcoin king continues to be positive. This is evidenced by the net profit volume locked in by Ethereum investors reaching the highest level of the year, indicating significant changes in investor profitability:

“Since mid-October, the rate of profit-taking has increased, and the peak on January 13th reached over $900 million/day, aligning with investors taking advantage of the ‘sell the news‘ method.”

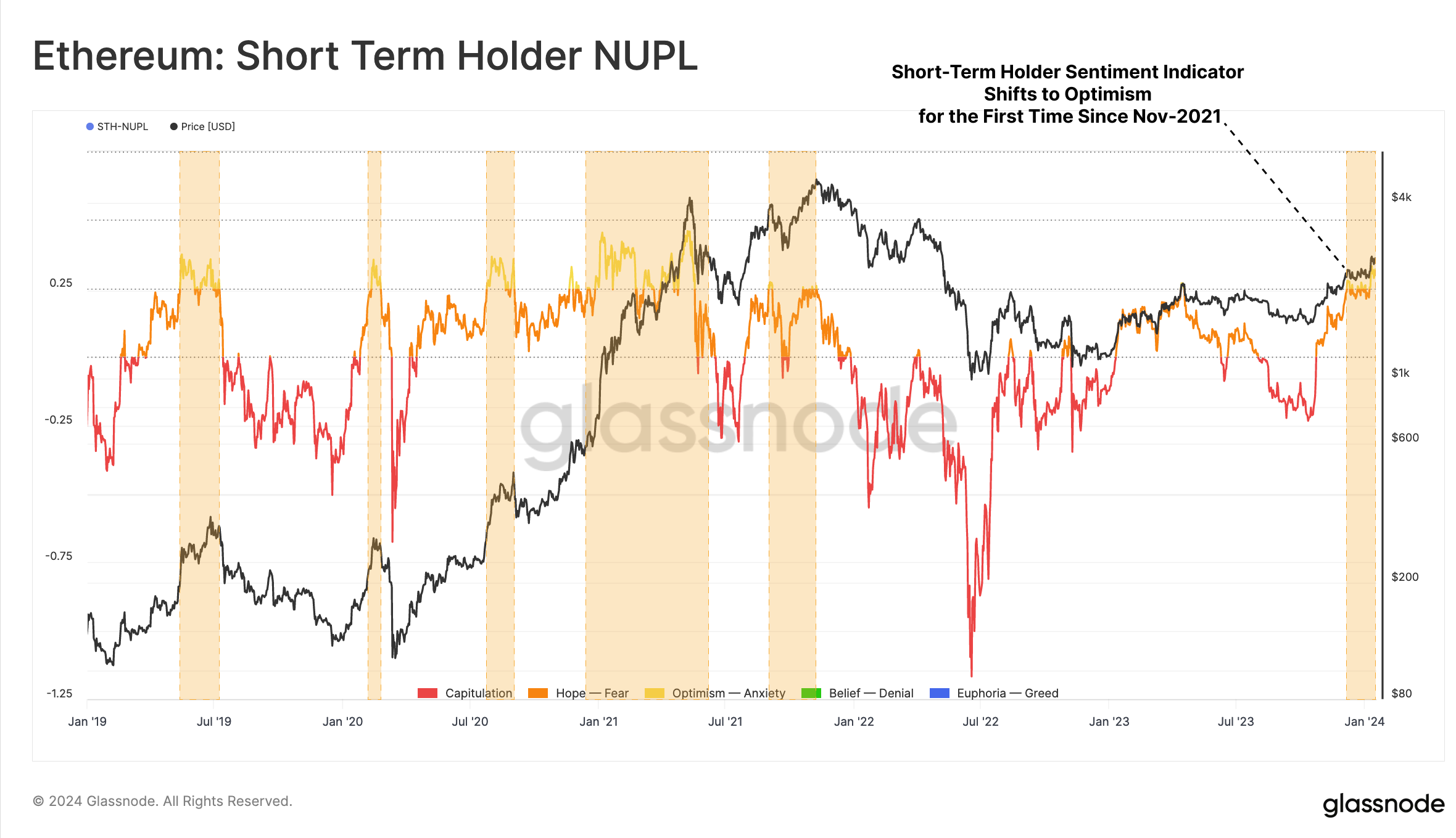

Perhaps the most important data supporting the positive sentiment for Ethereum is the net unrealized profit/loss (NUPL) metric for short-term asset holders. NUPL measures the potential profit or loss of investors holding an asset, based on the price at which they purchased the assets. This metric has risen above 0.25 for the first time since the all-time high in November 2021, indicating increased optimism among holders.

According to Kohn, this could mean either a positive market sentiment is beginning to form for Ethereum or that the markets are in a phase of digestion and distribution of profit-taking pressure. Expressing this optimism, investor Ken identified a support level, suggesting that Ethereum’s price in the ETH/BTC pair is nearing a breakout with a rise above $2,240.

Türkçe

Türkçe Español

Español