Ethereum’s (ETH) successful navigation of a significant regulatory challenge has boosted buyer confidence in ETH. This positive development occurred during a period when Bitcoin (BTC) faced downward pressure. The increase in Ethereum’s on-chain data indicates potential for further upward movement in the near future.

SEC Closes Ethereum Investigation

Ethereum developer Consensys announced that the SEC’s Enforcement Division has closed its investigation related to Ethereum 2.0. This closure means the SEC will not charge ETH sales as securities transactions, marking a significant victory for Ethereum developers and the community.

This decision followed the SEC’s approval of spot Ethereum exchange-traded funds (ETFs) in May, categorizing ETH as a commodity, and the request to end the investigation dated June 7, 2024.

Increase in On-Chain Metrics

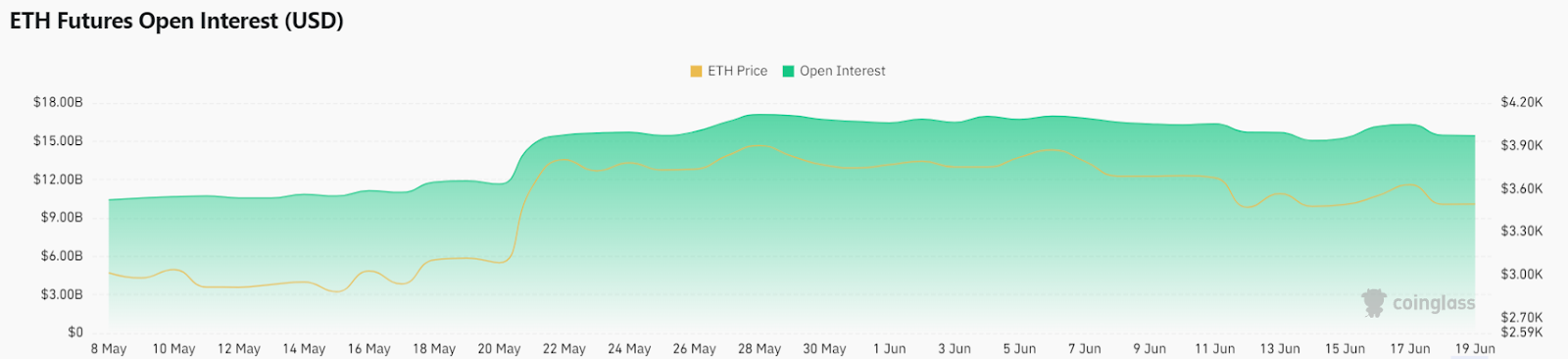

News of the SEC’s decision has led to increased buying interest in Ethereum. According to Coinglass data, Ethereum’s open interest rose by 4% in the last 24 hours, reaching $15.8 billion. During this period, the total liquidation amount exceeded $33 million, with liquidations evenly split between both sides of the market. This rise in trading activity reflects the market’s positive response to regulatory news.

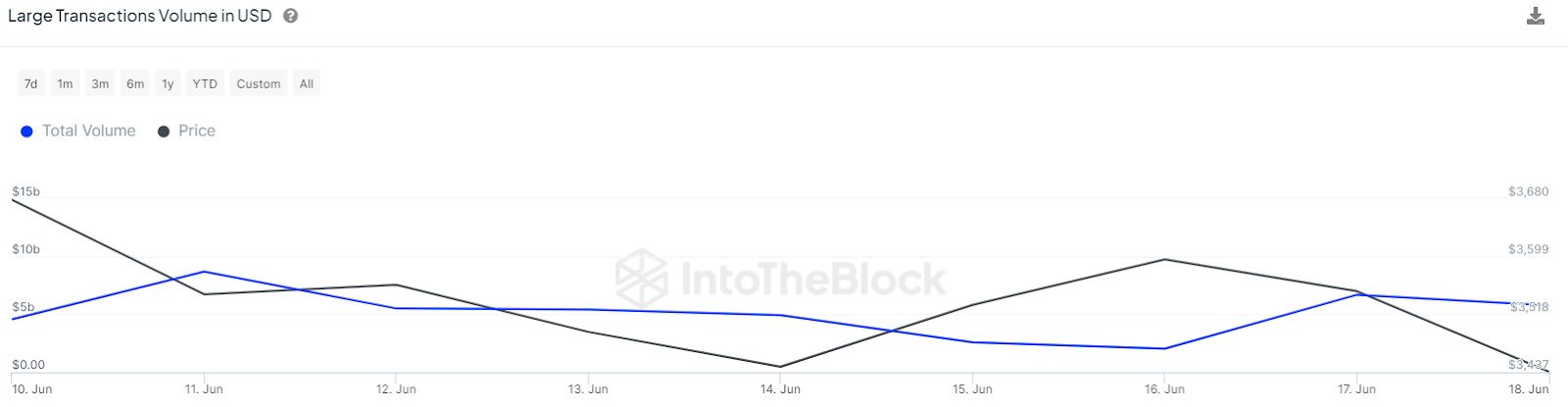

Data from IntoTheBlock shows a sharp recovery in large transaction volume, rising from $2.05 billion to $5.8 billion. This indicates increased interest from large-scale investors in the altcoin king and further increases Ethereum’s volatility. Additionally, Lookonchain reported that a leading Ethereum whale accumulated 5,603 ETH worth $19.6 million, highlighting significant buying activity.

The current long/short ratio for Ethereum has risen above 1, reaching 1.206, indicating increasing bullish dominance in the market. Approximately 55% of total positions predict the continuation of the bullish trend, reflecting strong market confidence.

Ethereum’s price has recovered from a low of $3,350 due to intense buying activity. The price has risen above critical Fibonacci channels, testing buyers’ patience at $3,600. However, bears are strongly defending against a rise above higher EMA trend lines. Currently, ETH is trading at $3,524, up over 3.5% in the last 24 hours.

Sellers are defending the EMA100 trend line, and a drop below the 50-day SMA at $3,379 could give bears an advantage. This could lead to a decline towards the significant support level of $3,172. If bulls fail to maintain this level, the price could drop to $2,850, where strong buying interest is expected. Conversely, if the price recovers from current levels or the 50-day SMA, the bullish trend may continue, potentially rallying above the 100-day EMA and targeting $3,740.