The price of Ethereum (ETH), the largest altcoin in terms of market value, is trading at $1,832 with a 1.38% decrease in the last 24 hours. The king of altcoins briefly dropped below the support level of $1,830 and fell below $1,825, but it quickly climbed back above this support. Let’s take a closer look at what’s next for ETH.

Ethereum Price Analysis

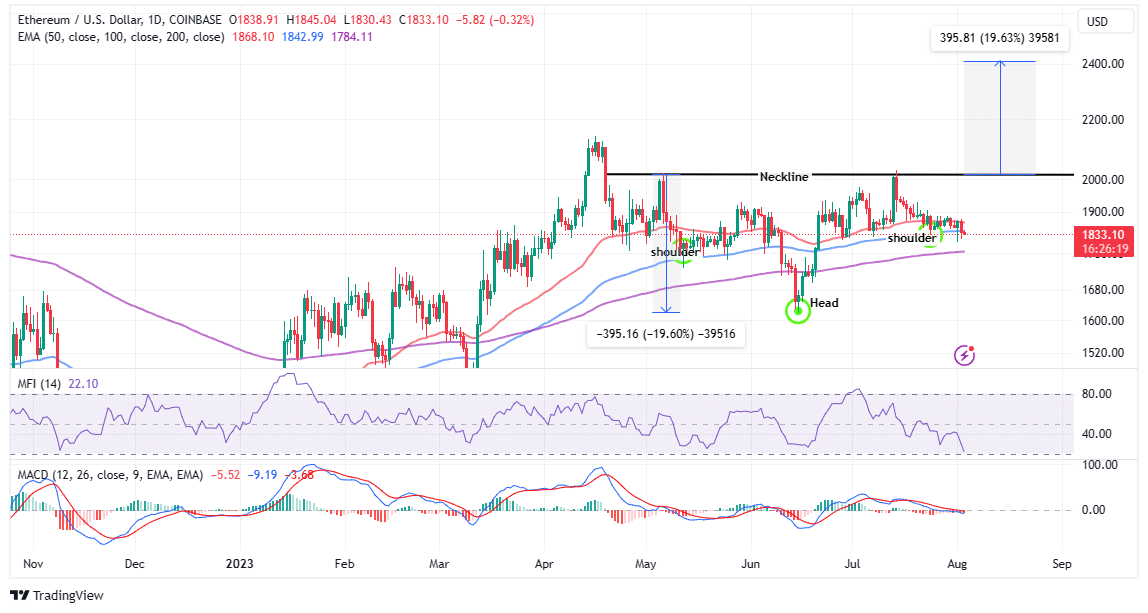

Since mid-June, the relatively stagnant price of ETH has barely surpassed $2,000 and appears uncertain around the critical support level of $1,800. If the price does not quickly rise above $1,900, it is likely that selling pressure will increase as investors reassess their positions. In particular, Ethereum is currently trading below two important moving averages, the 50-day and 100-day EMAs, indicating selling pressure.

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that a reversal of the uptrend is not imminent. This indicates that investors should be prepared for the possibility of Ethereum falling below $1,800 and potentially dropping to the support level of $785, which is the 200-day EMA, before any trend reversal towards $2,000. In the worst-case scenario, the price could drop to $1,600, offering investors an opportunity to buy ETH at a lower cost and potentially creating momentum for a larger trend reversal.

A closer look at the daily Ethereum chart reveals a bullish reversal formation called the Head and Shoulders (H&S) pattern, indicating the end of the downtrend and the beginning of an uptrend. The formation consists of three lows, with the middle low being the lowest and the other two approximately the same height. When the price surpasses the resistance level at $2,000, which connects the peaks of the two shoulders, the formation will be confirmed. Investors should carefully observe this formation for a potential trend change and consider opening long positions when the price confirms a break above $2,000. The target price is calculated by adding the height of the formation to the neckline, indicating a target level of $2,412 for ETH.

DeFi Trend Supporting the Rise in ETH Price

One of the factors supporting Ethereum’s potential rally is the gradual increase in the Total Value Locked (TVL) in DeFi. This indicates a rapid decrease in Ethereum supply on crypto exchanges. This decrease reduces selling pressure on the king of altcoins and creates a favorable environment for price rallies.

Since mid-June, the value of cryptocurrencies locked in Ethereum-based smart contracts has been on the rise, reversing the downtrend since mid-April.

Türkçe

Türkçe Español

Español

Nice