Ethereum (ETH) has experienced a significant increase in value, gaining nearly 25% in the past three weeks, supported by the news of Bitcoin ETFs. The news from Hong Kong, considering allowing ETFs, has sparked the interest of investors, shifting their focus to ETH.

During this period, the movements of a whale address drew attention, as a large amount of ETH was withdrawn from the Binance exchange. According to investors and analysts, such situations generally continue with a bullish market movement.

Ethereum Price Increase?

In the daily chart analysis, a strong upward structure was observed in ETH. The RSI was at 74, indicating a strong buying level, and the On-Balance Volume showed an upward trend since mid-October. Considering this, it can be assumed that the buying volume has been significantly higher than the selling volume in the past three weeks.

The notable resistance levels in the upper range were 2039 and 2141 dollars, which were the highest levels in July and April. When examining the weekly ETH price chart, a strong resistance zone was found between $1940 and $2140. This resistance zone has been present since May 2022.

The Future of Ethereum Price

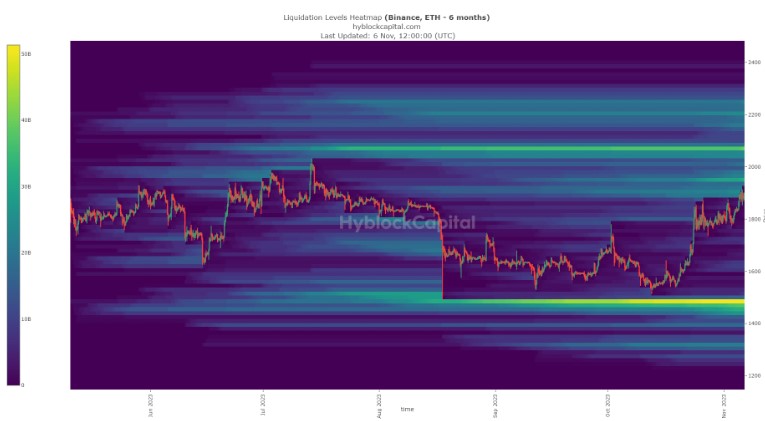

The liquidation levels heatmap provided by Hyblock drew the attention of long-term investors to two points. The first one was the $2070 level, which many analysts have previously highlighted.

Transactions can be made to put these positions into circulation, and a price retracement may occur after surpassing $2070. The next major liquidation level was below $1485. Therefore, a price movement towards the $1500 region can be seen as a buying opportunity for investors.

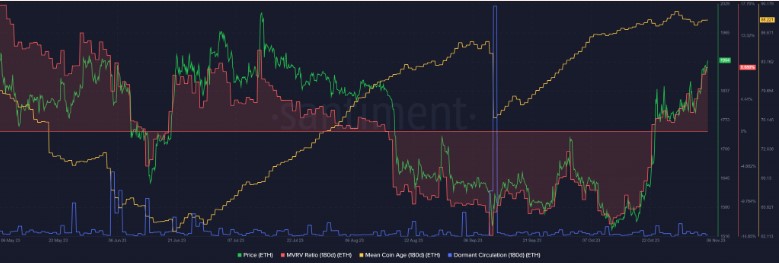

The increase in ETH prices also continued the upward trend in the average coin age measurement of 180 days. This indicates that ETH investors have not started mass selling their coins.

On the other hand, the MVRV ratio revealed by the Santiment chart has reached unprecedented levels since July, indicating that investors may start seeking profits in the near future. Such situations can trigger a price retracement.