Ethereum‘s (ETH) price has once again dropped below the $1600 level after a recent price correction. Despite the overall market rally last night, altcoins failed to perform as expected and remained below $1600. However, investors are still hopeful for a new bull rally.

On the ETH/BTC side, the price tested the long-term trendline support area. It reached the target of 0.055. If the price can stay above this line, investors may expect a price increase in ETH.

How Much is Ethereum Worth?

After the rise following the ETF news on October 16th, Ethereum’s price witnessed a correction. According to 21milyon.com, despite a 1.02% increase in the price of ETH in the last 24 hours, it continues to trade below $1600. After the rise, the market value of ETH reached $186 billion, with a price of $1583. Despite the price drop, popular crypto trader and analyst Maga believes that the price is still at a critical level.

According to Mag’s post, the price of ETH/BTC was on a long-term support trendline. If the price can stay above this line, investors may expect a positive movement and an increase in ETH’s price.

Metrics for ETH also continue to shed light on its future. According to CryptoQuant, ETH’s net deposits on exchanges appear higher compared to the 7-day average. Generally, this indicates selling pressure on the token.

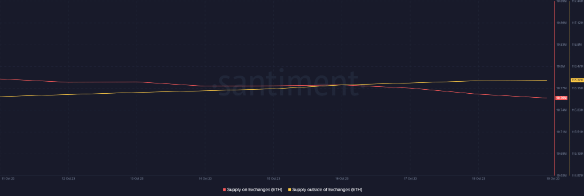

On the other hand, Santiment’s data indicated a different situation. The balance between Ethereum’s supply outside exchanges and supply on exchanges shifted, suggesting that investors were increasing their accumulation of the token.

Ethereum Analysis and Future

Data provided by CryptoQuant also indicated a rise in ETH’s exchange net flow. There was also a positive movement in Coinbase premium. Considering these factors, it may indicate increased buying by US ETH investors on Coinbase.

The Relative Strength Index (RSI) value appeared near the neutral level of 50, which can be interpreted as an indicator of uncertainty in the market. Ethereum’s Money Flow Index (MFI) showed signs of a recent rise, which can be seen as a promising development for investors.