The price of Ethereum (ETH) is on the verge of a significant market movement. After turbulent weeks, Ethereum has risen above $3,000, showing signs of recovery, but market conditions indicate caution is necessary. The decline in whale addresses and opportunities in the MVRV ratio stand out as key indicators investors should pay attention to.

What Does the Decline in Whale Addresses Mean for Ethereum?

Ethereum’s price movement has been quite volatile in recent weeks. The reduction in whale addresses, in particular, stands out as a significant bearish signal. The number of whale addresses holding more than $100,000 worth of ETH has decreased by 14% in the last five days, dropping from 150,000 to 130,000. This indicates a lack of confidence among major ETH holders and shows a weakening belief in Ethereum’s short-term potential.

This decline in whale addresses is not only related to holding or selling Ethereum but also to exiting the network directly. This trend emphasizes that investors should act more cautiously in the current market conditions. The loss of confidence among large investors can also affect the general market trend and lead to fluctuations in price movements.

Fibonacci Retracement Level and MVRV Ratio

The 23.6% Fibonacci Retracement level at $3,011 plays a critical role in determining Ethereum’s future price movement. This level stands out as a potential point where Ethereum can find support and move upwards steadily. If Ethereum can maintain this level as support, it can create a more favorable accumulation environment for investors and increase future profit possibilities.

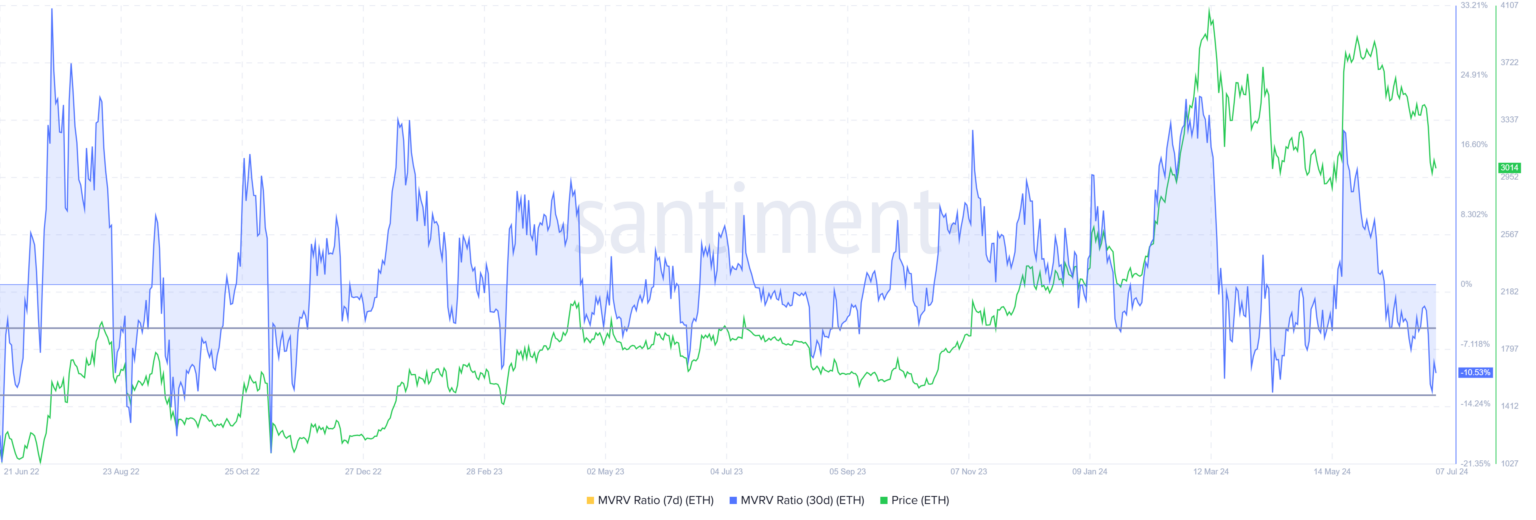

Additionally, Ethereum’s Market Value to Realized Value (MVRV) ratio is also considered an important indicator. The MVRV ratio helps measure the average profit or loss of investors, and currently, the 30-day MVRV ratio for Ethereum is at -10.4%.

This indicates that the cryptocurrency is currently undervalued and at an attractive point for accumulation. Historical data reveals that significant corrections in Ethereum’s price occur within the -5% to -13% MVRV range, presenting potential buying opportunities at these levels.

There are several risks to be cautious of in the current market conditions for Ethereum. If Ethereum’s price falls below the $3,000 level, it could quickly drop to $2,800. This situation could lead to a consolidation period and invalidate the current bullish outlook.

Türkçe

Türkçe Español

Español